Fortress Biotech Preferred $FBIOP

– Resumed dividends can create significant value for shareholders in the form of accumulated dividends and significantly increasing in share price

Disclaimer

This analysis represents only my personal opinions and is based on information that was current at the time of publication. The information is not intended as an investment recommendation or as advice from a certified financial advisor. All content in this analysis should only be used as a basis for further study and not as the sole basis for investment decisions. Investments in stocks and other securities always involve risk, including the possibility of losing some or all of the invested capital. Past performance does not guarantee future returns. The reader is encouraged to independently conduct a careful investigation and, if necessary, seek professional advice before making any investment decisions. I am not responsible for any consequences that may arise from using the information in this analysis, including inaccuracies or lack of updates.

The content herein is the exclusive content of Zellchair’s Substack, All Rights Reserved.

Quick Stats:

Name: Fortress Biotech Inc | 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock (FBIOP)

Sector: Healthcare

Series: A

Redeemable: Yes

Perpetual: YeS

Cumulative: Yes

Pay Period: Monthly

Pay Dates: Last day of the month

Liquidation Preference: $25.00

Annualized Dividend: $2.343756

Original Coupon: 9.375%

Recent Market Price: $6.61 (2025-05-05 before market open)

Discount to Liquidation Preference: -$18.39 (-73.56%)

Recent Ex-Date: 6/14/2024

The background/description of the decision to pause the dividend:

“Across our portfolio, we could receive up to three regulatory approvals on NDAs and BLAs in the next 12 months for DFD-29, cosibelimab and CUTX-101, and potentially a fourth BLA filing as early as 2025 for CAEL-101. Based on its public statements, AstraZeneca has estimated that it expects the FDA to accept its BLA submission of CAEL-101 to treat AL amyloidosis for review as early as 2025, which could lead to approval and commercial milestone payments to Fortress. Additionally, Cyprium Therapeutics, our subsidiary company that developed CUTX-101, will retain 100% ownership over any priority review voucher that may be issued at NDA approval for CUTX-101. This is a pivotal time for the Company, and we are pausing the preferred dividend payments in order to maintain financial flexibility ahead of our multiple potential near-term milestones.” - Lindsay A. Rosenwald, M.D., Fortress’ Chairman, President and Chief Executive Officer (UNLOXCYT is today the brand name of Cosibelimab after FDA approval)

Important detail in the press release:

“In accordance with the terms of the Series A Preferred Stock, dividends on the Series A Preferred Stock will continue to accrue and cumulate until such dividends are authorized or declared.” - Source

Quick pitch:

In early July 2024, Fortress announced a pause in payment of dividends on 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock. I believe that a couple of company-specific events will act as catalysts to reinstate the dividend to shareholders within 1-20 months. These triggers I believe will come from at least a couple of these:

I. Significantly reduced operating expenses

II. New restructured existing loans - Oaktree (Fortress Parent Company) & SWK (Journey Medical)

III. Subsidiary sold - Checkpoint Therapeutics (pending sale)

IV. Future CVR's - UNLOXCYT

V. FDA approval - CUTX-101 & CAEL-101

VI. Approvals outside the US - UNLOXCYT, EMROSI, CUTX-101 & CAEL-101

VII. Milestones from already completed deals - Cyprium Therapeutics (asset/drug CUTX-101 sold) & Caelum Biosciences (sold)

VIII. PRV Sale - CUTX-101

IX. New royalties from then approved drugs - UNLOXCYT (already FDA approved), CUTX-101 & CAEL-101

X. Significant sales growth in the already commercialized dermatology portfolio - Driven by the sales start (2025-03-24) of the Best-in-Class Oral drug for Rosacea in EMROSI

From today's 2025-05-05 share price of $6.61 until 2026-12-31, my estimates are for a share price of $22-$25 (+233-278%) and a total dividend of $5.8590 per share, which at today's share price corresponds to a dividend yield of 88.64%.

Note! I am a simple private investor who lacks both financial and medical education at university level. I have therefore not had the ambition to do a traditional financial analysis here, as I lack both the experience and the knowledge for that. I also want to mention that English is not my first language, so there is a risk of linguistic mistakes. This document/post I want only to be interpreted as a review of how I thought, reasoned and saw opportunities as risks with my personal investment in this specific case. Since my text is largely based on one company, I also advise all readers to read their own "Disclaimer" in their Investor Presentation material and read their "Risks" under “Part 1” in the latest Annual Report.

Table of Contents

1. Company

a. History & Structure

b. Business Model

c. Management

2. Ownership Structure

a. Common Stock

b. Preferred Stock

c. Public Subsidiaries

d. Private Subsidiaries

3. Overview of Portfolio/Pipeline

a. Preclinical

b. Phase 1

c. Phase 2

d. Phase 3

e. Commercial Portfolio

4. Public Subsidiaries

a. Checkpoint Therapeutics

b. Journey Medical

c. Mustang Bio

d. Avenue Therapeutics

5. Private Subsidiaries

a. Cyprium Therapeutics

b. Urica Therapeutics

c. Helocyte

d. Oncogenuity

e. Cellvation

6. Subsidiaries Deals

a. Checkpoint Therapeutics

b. Urica Therapeutics

c. Cyprium Therapeutics

d. Caelum Biosciences

e. AEVITAS

f. Avenue Therapeutics

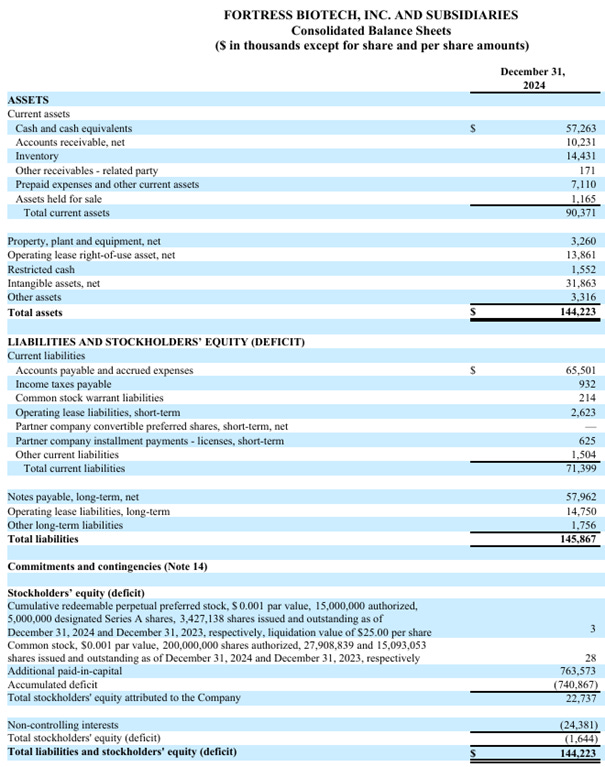

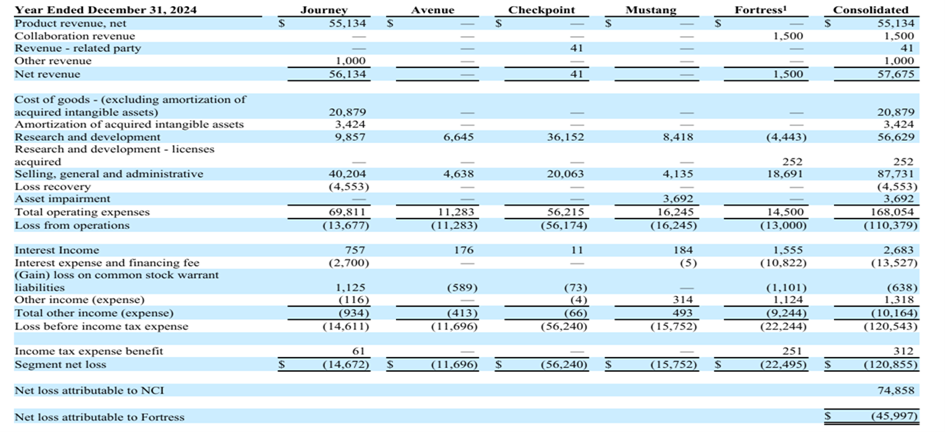

7. Financial

a. Revenue

b. Operating Expenses

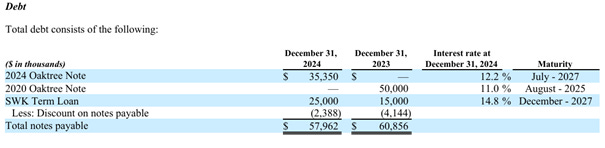

c. Debt

d. Dividend

e. Future Expected Revenues (2025-2026)

f. Future Expected Savings (2025-2026)

g. Financial Summary

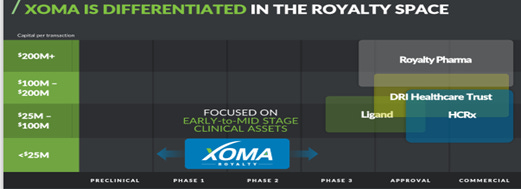

8. Closest comparable peers/stocks

a. Milestones & Royalty-based Companies

b. Investment Companies in part-ownership

9. Risks

10. Why (I believe) Fortress Biotech Preferred Stock will resume the dividend within 1-20 months

11. Valuation, Conclusion & Position

1. Company

a. History & Structure

Founded 2006 under the name Coronado Biosciences, initially as an oncology research company. In 2011 they changed their business model to acquire medical assets to further take the development forward under its own direction when they raised $47.4M in funding. Shortly thereafter it became a public company by registering all its private shares as common stock. Later in 2015, when the most assets for the start-up of their subsidiaries were acquired and the change in the business model was completed, they changed their name to Fortress Biotech.

Fortress Biotech is a biopharmaceutical company engaged in acquiring, developing and commercializing new pharmaceutical and biotechnology products. Fortress provide financing, board and management services to each of the subsidiaries and seek licensing, partnerships, joint ventures and/or public and private funding for research and development. Fortress subsidiaries have a broad portfolio in several different therapeutic areas including dermatology, oncology/haematology, pain management, rare diseases and others.

Current Partner Company/Subsidiary – Founding (effective year for inclusion in Fortress Biotech’s portfolio)

Journey Medical – 2014

Checkpoint Therapeutics – 2015

Mustang Bio – 2015

Avenue Therapeutics – 2015

Helocyte – 2015

Cellvation – 2016

Cyprium Therapeutics - 2017

Urica Therapeutics - 2017

Oncogenuity – 2017

Class of Stock - Outstanding Shares (2025-03-27)

Fortress Biotech Common Stock $FBIO ($0.001 par value) - 29,533,840 shares

9.375% Series A Cumulative Redeemable Perpetual Preferred Stock $FBIOP ($0.001 par value) - 3,427,138 shares

b. Business Model

Fortress has a unique model from its founding that differs from its closest peers. Namely, that it has founded all its subsidiaries entirely by itself, with the exception of Journey Medical, where there is also a co-founder. Fortress management has historically acquired medical assets with the aim of creating niche subsidiaries around these assets. This is with the aim of creating internal diversification, clarification, being able to increase/decrease focus and financing depending on the development of the subsidiaries and being able to create the best suited teams for knowledge against specific diseases and drugs in these subsidiaries. With this background Fortress also had the opportunity to become the majority owner in its subsidiaries, as it was the fact they who founded them, with the aim of controlling future decision-making by controlling all outstanding Common A-shares or Common Preferred A-shares in the subsidiaries. Fortress was also smart to create more incentives for future development with future royalties from sales (usually 4.5%) and annual equity dividend (usually 2.5%) from the subsidiaries.

According to Rosenwald, “the model would take the best attributes of a royalty business, private equity, and traditional biopharma to focus primarily on clinical development and commercialization, without the risk of extensive research and preclinical development”. (Source)

Fortress Biotech believes this model has the potential for snowballing growth as they acquire new assets and as their subsidiary/partner companies grow in value.

Fortress Biotech Company Webcast @ Lytham Partners Fall 2024 Investor Conference (Q3/Q4 2024) -

c. Management

Management in Fortress has founded, built, managed and sold pharma/biotech companies for several billions before starting Fortress Biotech. I want to highlight three people from management and what they have historically accomplished in the industry.

Lindsay A. Rosenwald, M.D. (Founder, Chairman, President and Chief Executive Officer)

From 1991 to 2008, Dr. Rosenwald served as the Chairman of Paramount BioCapital. Over the last 26 years, Dr. Rosenwald has acted as a biotechnology entrepreneur and has been involved in the founding and recapitalization of numerous public and private biotechnology and life sciences companies. To cite some examples:

Companies

Indevus Pharma

Co-Founded Indevus Pharma in 1988 which was bought out by Endo Pharmaceuticals in 2019 for $370M

Chelsea Therapeutics

Co-Founded Chelsea Therapeutics in 2002 which was then sold in 2014 to Lundbeck for $658M

Cougar Biotechnology

Co-founded Cougar Biotechnology in 2003, which just a few years later was bought out by J&J itself for $1B

Drugs

ZYTIGA

“… Zytiga at Johnson & Johnson, which is the biggest selling prostate cancer drug in the world. When I identified it for Cougar Biotechnology, it was being developed by a small British company. There were no patents, but we knew that it had dramatic effects on prostate-specific antigen levels at the end-stage. Before market exclusivity ended, it was generating annual revenue of about $4 billion.”

NORTHERA

“… Northera for dizziness and lightheadedness in patients who have Parkinson’s. We found out that it was being successfully used in Japan to treat highly untreatable neurogenic orthostatic hypotension patients, and there was no patent. We bought the data from the company developing it, set up Chelsea Therapeutics, got it approved, and sold it to Lundbeck for about $600 million.”

TRISENOX

“… Trisenox for acute promyelocytic leukemia, a form of leukemia that was incurable before the drug came on the market. It was being used in China and was highly effective. Then we found a researcher at Memorial Sloan Kettering Cancer Center who was already exploring it. We ultimately bought worldwide rights to the drug from the institution and completed the FDA approval process in record time, about two-and-a-half years.”

(Source for the three quotes above)

Here are some interviews/presentations from last year with Lindsay Rosenwald that I can recommend:

Linsday Rosenwald from Fortress Biotech - StockOcean Interview -

Is This "Biotech Winter" Worse Than Others? Stocks To Watch –

Biotalk Episode 18: A Conversation with Lindsay Rosenwald of Fortress Biotech – Source

Michael S. Weiss (Executive Vice Chairman, Strategic Development)

Weiss managed Paramount Capital/Aries Funds alongside Rosenwald and later went on to form Access Oncology which was later acquired/merged by Keryx Biopharmaceuticals in 2004. Following the merger Weiss remained as CEO of Keryx for a couple of years.

Founded TG Therapeutics (TGTX) in 2011 and joined Fortress Biotech 2014 in preparation for the acquisition of several medical assets and the formation of subsidiaries.

Weiss TG turned $31M into multi-billion valuation:

Manhattan Pharmaceuticals and their majority-owned subsidiary TG Therapeutics, with early expertise in antibody-dependent cell cytotoxicity (ADCC), receive a call in 2011 from LFB Group in France that their LFB wholly-owned subsidiaries LFB Biotechnologies and GTC Biotherapeutics need help presenting a poster on 53rd ASH Annual Meeting, San Diego USA, in December 2011 (Source).

Cooperation leads to, months later:

"TG Therapeutics Completes Licensing Agreement with LFB Biotechnologies for the Development of Ublituximab" (Source)

The deal leads to a name change and preparation for the IPO:

"Manhattan Pharmaceuticals, Inc. Announces Name Change to TG Therapeutics, Inc. and Reverse Stock Split" (Source)

In TG 2013 annual report, the financial details of the Ublituximab deal are revealed for the first time:

"In January 2012, we entered into an exclusive license agreement with LFB Biotechnologies, GTC Biotherapeutics, and LFB/GTC LLC, all wholly owned subsidiaries of LFB Group, relating to the development of TG-1101. Under the license agreement, we have acquired the exclusive worldwide rights (exclusive of France/Belgium) for the development and commercialization of TG-1101 (ublituximab). To date, we have made no payments to LFB Group and LFB Group is eligible to receive payments of up to an aggregate of approximately $31.0 million upon our successful achievement of certain clinical development, regulatory and sales milestones, in addition to royalty payments on net sales of TG-1101 at a royalty rate that escalates from mid-single digits to high-single digits.” (P. 12, Source)

Today years later, TG-1101 (ublituximab) is TG first and to date only approved product with the brand name BRIUMVI, and at the time of writing the stock is valued at $6.86B. Weiss owns approx. 9% TGTX today, and to my knowledge he has never sold a single share (other than a few due to tax reasons). So far, the return on that $31M described above has generated a 22061% return on the share price and a CAGR of approximately 57% per year from 2012 (when the acquisition was completed) through 2024.

Another one who was around throughout whole this era of TG Therapeutics was Director Neil Herskowitz, and to make the Fortress Biotech connection again, today he sits as a Director of all FBIO's publicly traded subsidiaries)

Rosenwald and Weiss also started Opus Point Partners a Hedge Fund managing a long/short equity that focused on the healthcare and biotechnology sectors in 2008. The fund closed down around 2019, most likely to focus only on Fortress and TG Therapeutics and the moral dilemma of standing on the buy/sell side of now direct colleagues in the industry or competitors/hedges to their respective companies and pipelines.

George Avgerinos, Ph.D (Senior Vice President, Biologics Operations)

First BASF Bioresearch, Abbott Laboratories and last AbbVie, where he was Vice President, HUMIRA Manufacturing Sciences and External Partnerships. In his 22-year career at AbbVie he supported expansion of the supply chain to over $9.0 billion in annual global sales. Humira then became the world's top-selling pharmaceutical in the world. For this, Dr. Avgerinos received several awards.

2. Ownership Structure

Here is the latest update of Fortress Biotech's ownership in percentage:

(Note that this is from 2024-12-31, and since Fortress is awarded its regular 2.5% Annual Equity Dividend starting from January 1st of each year, the ownership may be even higher today unless dilution with new shares has occurred)

a. Common Stock

Insider Ownership

Insider buys in Common Stock (FBIO) have been massive in relation to the company's market value and despite their high initial ownership:

Some buys that stand out:

Who – When – Shares Purchased – Stock Price - Total Cost

Rosenwald – 2024-09-23 - 763,359 - $1.84 - USD 1,404,58

Rosenwald – 2023-11-14 - 1,567,515 - $1.70 - USD 2,664,776

Weiss – 2023-11-14 - 147,058 - $1.70 - USD 249,999

Rosenwald – 2023-02-10 - 2,395,209 - $0.84 - USD 2,000,000

Weiss – 2023-02-10 - 1,197,604 - $0.84 - USD 999,999

In Q3 2024, Highbridge Capital Management purchased 2,734,854 shares of Common Stock issuable upon the exercise of warrants, which then increased their ownership in Fortress Common Stock to 9.0% (Source).

b. Preferred Stock

I have not seen any figures on whether and if so, how many shares, any insiders owned at the introduction in 2017. Despite the Founder/President/CEO's Lindsay Rosenwald large holdings of Common Shares (FBIO), he has purchased 139,167 shares of the Preferred Stock (FBIOP) worth $2,530,295M in total with an average acquisition value of $18.18 per share. Note that he bought for $1M on the Liquidation Preference value of $25 per share, and all well above today's share price of $6.61.

Buy in order of size (shares – share price – price paid)

40,000 - $25.00 - USD 1,000,000

52,500 - $18.00 - USD 945,000

16,667 - $18.00 USD 300,006

10,000 - $11.75 - USD 117,500

10,000 - $9.34 - USD 93,400

5,000 - $7.39 -USD 36,971

5,000 - $7.35 - USD 37,418

c. Public Subsidiaries

Here you can of course review the ownership pictures yourself based on your most suitable available tools. I just wanted to point out that in addition to Fortress management's high insider ownership in FBIO/FBIOP, they also own some shares privately in these subsidiaries, partly through options but also purchases over the market. This applies primarily to Rosenwald and Weiss.

In Journey Medical (DERM) I also want to draw your attention to the fact that the notorious (in small cap biotech) Kevin Tang and his Tang Capital Management have recently taken a larger position, for better or worse. Better because he is recognized as good at bottom fishing for cheap stocks, like Journey. Worse or better (from previous experience) that he has acted as an "activist" investor in a couple of companies and can create (in my opinion) concerns among a board of directors and the stock's private investors. However, it should be said that in most cases he is more of a useful demander who is also not afraid to make buyout offers for small and undervalued companies. (Source)

d. Private Subsidiaries

It is more difficult to get an overview here of course with considerably less public information. I think the same applies here, however, that at least Rosenwald and Weiss may own some privately or via own companies. According to an old list of owners in Cyprium PPS (more on that further down) judging by what I came across earlier, it looked like there were some private individuals and smaller Family Offices. I don't think it is a wild guess that these have good contact with Rosenwald privately or professionally and have been involved in one or more of his previous successful deals. But I can neither confirm nor vouch for this.

3. Overview of Portfolio/Pipeline

This is the idea to show what level a drug is/was at at the last update.

a. Preclinical (7/39)

AAV-ATP7A (AAV Gene Therapy) - Menkes Disease (CUTX-101 2.0)

MB-109 - Recurrent GBM and anaplastic astrocytoma (MB-101+MB-108)

CK-103 – BET Inhibitor for Myelofibrosis and Solid Tumors (Single Agent)

CK-302 - Anti-GITR for Solid Tumors (Single Agent/Combination)

CK-303 - Anti-CAIX Renal Cell Carcinoma/Solid Tumors (Single Agent/Combination)

AVTS-001 (AAV.SFH Gene Therapy) - Complement-mediated diseases (Asset sold to 4DMT in April 2023)

CEVA-102 (Cell Therapy) - TBI, GvHD, ARDS, CHF, Crohn’s (Off-the-Shelf)

b. Phase 1 (11/39)

Dotinurad* - URAT1 Inhibitor for Gout

MB-106 - CD20 CAR-T for autoimmune

Olafertinib - Frontline NSCLC with EGFR Mutations

Olafertinib + Cosibelimab (UNLOXCYT) – Second line NSCLC EGFR Mutations

AJ201 - Spinal and bulbar muscular atrophy (Kennedy’s Disease) P1b

MB-101 - IL13Rα2 CAR-T for recurrent glioblastoma (GBM)

MB-108 - HSV-1 oncolytic virus (OV) for recurrent GBM

Triplex- Allogeneic (Haplo, Mismatch) Stem Cell Transplant in Peds

Triplex - Combo with CD19 CAR for NHL

Triplex - CMV-HIV CAR (+/- Triplex)

BAER-101 - Rare epilepsies

c. Phase 2 (6/39)

AJ201 - Spinal and bulbar muscular atrophy (Kennedy’s Disease) P2a

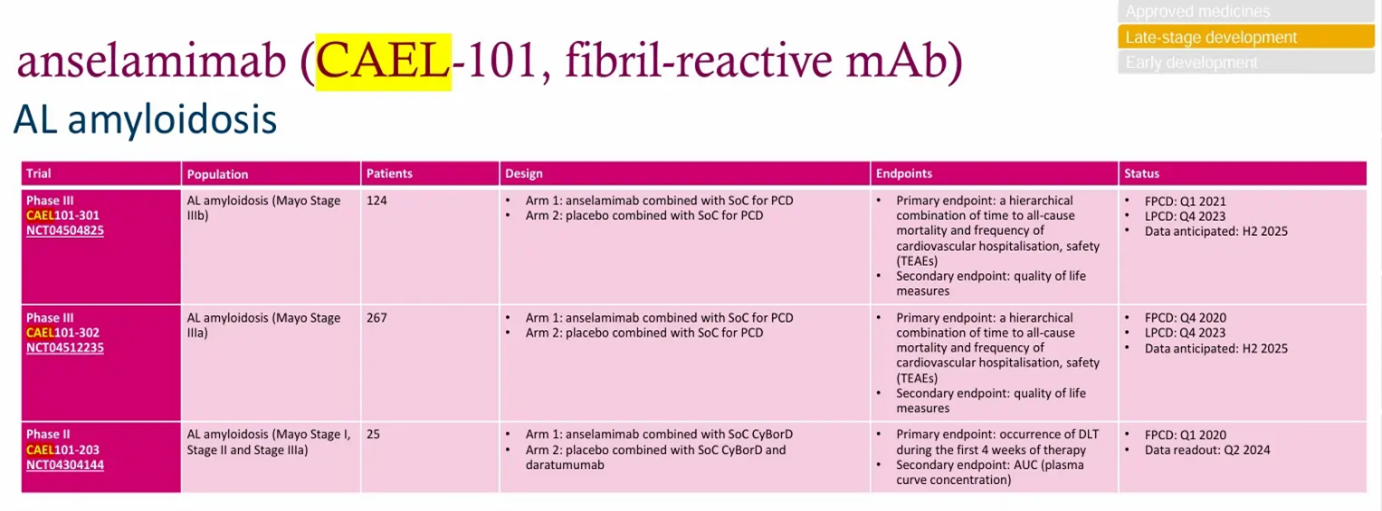

CAEL-101 - Light chain (AL) amyloidosis (Stage I, II & IIIa) + cyclophosphamide-bortezomib-dexamethasone (CyBorD) chemotherapy & daratumumab

Triplex - Liver Transplant (Recipient Vaccination)

Triplex - Kidney Transplant (Recipient Vaccination)

Triplex - CMV-HIV Co-Infection on ART

Triplex - Allogeneic (MRD) Stem Cell Transplant (Donor Vaccination)

d. Phase 3 (4/39)

CUTX-101 - Copper histidinate for Menkes

CAEL-101 - Light chain (AL) amyloidosis (Stage IIIa) + SoC

CAEL-101 - Light chain (AL) amyloidosis (Stage IIIb) + SoC

IV Tramadol - Post-operative acute pain management

e. Commercial Portfolio (10/39)

QBREXZA - Primary axillary hyperhidrosis (excessive sweating)

ACCUTANE - Severe recalcitrant nodular acne

EMROSI - Inflammatory lesions of rosacea

UNLOXCYT - Metastatic Cutaneous Squamous Cell Carcinoma (cSCC)

UNLOXCYT - Locally Advanced Cutaneous Squamous Cell Carcinoma (cSCC)

AMZEEQ- Inflammatory lesions of non-nodular acne

ZILXI- Inflammatory lesions of rosacea

EXELDERM - Antifungal cream for common skin infections

TARGADOX - Adjunctive therapy for severe acne

LUXAMED - Water-based emulsion for wounds

Unknown Stage – (1/39)

CEVA-D - Mechano-transduction Device for Cell Therapies

*Dotinurad - Dotinurad has been approved in several Asian countries since 2020, where two pivotal P3s are now planned in the US, so "judging" it as a Phase 1 drug is probably misleading (but more on that below).

This review will directly or indirectly focus on the marked assets due to triggers in the form of financial savings, sales or other growth opportunities for the time span May 2025-FY2026. Of course, this does not necessarily mean that more assets may have an impact during this time span (positively or negatively).

4. Public Subsidiaries

a. Checkpoint Therapeutics

Brief description: Checkpoint Therapeutics is a biopharmaceutical company focused on immunotherapy in oncology, and on acquisition, development and commercialization of new treatments for patients in a more effective and potentially more affordable way.

Ownership: 8.3%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

FDA Approved asset: UNLOXCYT (Q4 2024)

Pipeline: Olafertinib, CK-103, CK-302, CK-303

Comments: Read more under "Subsidiaries Deals" below.

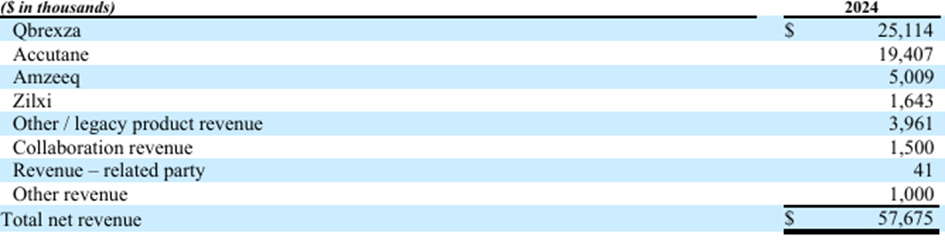

b. Journey Medical

Brief description: Journey Medical is focused on identifying, acquiring and strategically commercializing innovative, differentiated dermatology products through its efficient sales and marketing model.

Ownership: 44.5% (Co-Founder & CEO Claude Maraoui 13.5%, COO Ramsey Alloush 3.5%, Lindsay Rosenwald 2.2%)

Approved assets: QBREXZA, ACCUTANE, EMROSI, TARGADOX, AMZEEQ, ZILXI, EXELDERM, LUXAMEND

Total Sales 2024: $56M

Comments: Claude Maraoui has more than 30 years of experience in commercializing some of the most successful dermatology products in the world. He served as Vice President of Dermatology Sales at Medicis Pharmaceutical Corporation and has held various leadership positions in marketing and sales for therapeutic and aesthetic dermatology. He has executed more than 50 product launches during his career. Almost the entire Management (6/8) consists of former high-ranking executives from Maraouis former Medicis Pharmaceutical. Medicis were known for products such as SOLODYN and ZIANA for treating Acne, and for RESTYLANE and DYSPORT for treating facial wrinkles. In 2012 Medicis was acquired by Valeant Pharmaceuticals International for $2.6B.

8 marketed commercial products in Dermatology Therapeutics from Journey Medical is available today

QBREXZA - First and only prescription cloth towelette approved to treat excessive underarm sweating (primary axillary hyperhidrosis

TARGADOX - Indicated as adjunctive therapy for severe acne. It is the smallest branded doxycycline tablet available in the United States.

EXELDERM - Available as an antifungal cream or solution that helps relieve symptoms of common skin infections: ring worm, jock itch, and tinea versicolor. EXELDERM Cream can also help relieve the symptoms of tinea pedis.

LUXAMED- Water-based emulsion formulated to provide an optimally moist healing environment for superficial wounds; minor cuts or scrapes; dermal ulcers; donor sites; first- and second-degree burns, including sunburns; and radiation dermatitis.

ACCUTANE - Used to treat a type of severe acne (nodular acne) that has not been helped by other treatments, including antibiotics.

AMZEEQ - First and only FDA-approved topical formulation of minocycline for the treatment of inflammatory lesions of non-nodular moderate to severe acne vulgaris in patients 9 years of age and older.

ZILXI - First and only FDA-approved topical minocycline for the treatment of inflammatory lesions of rosacea in adults.

EMROSI – Indicated to treat inflammatory lesions (papules and pustules) of rosacea in adults.

Journey's historical plan in a growth model with increased risk

1. Acquire cheap dermatology products where patent protection was about to expire to squeeze out the last sales of these products. This is due to the low upfront and royalty costs where it was calculated that the products would be outcompeted by generics in almost all cases.

2. With point 1, they could slowly but surely build a sales team in addition to those who came with them from previous Medicis.

3. Acquire more expensive and more established products.

4. Acquire clinical products (DFD-29/EMROSI) that have proven themselves in humans (i.e. after P1 at the earliest).

5. Start selling outside North America via an out-licensing model (QBREXZA, AMZEEQ)

Journey Medical - Total Sales

2016: $3M

2017: $15M

2018: $23M

2019: $34M

2020: $44M (start of the generic infringements/competition within “others”)

2021: $63M

2022: $73M

2023: $79M (QBREXZA $19M upfront sales deal included)

2024: $56M

With this strategy, despite almost maximum generic counter-effect, Journey has not only managed to maintain sales but has also increased them. I know those who, in writing or speaking, both from investors and analysts, have shown certain question marks and concerns about declining or stagnant sales in certain products. Here I think Journey has been clear during presentations, quarterly reports and conference calls. In line with the ongoing success they could see from EMROSI's study results, they have continued to drastically cut back on the sales team in recent years despite the major downsizing in the team in 2020–2021, when they expected the first generic competitors to reach the market. They have also stopped marketing a couple of products to save money and in doing so have let certain products "die on their own" despite probably having a few million left in sales despite generic competition.

The goal has been simple on paper, to have as good a financial balance and as few diluted shares as possible on the day EMROSI reaches the market. As described above, the effort to get there has been difficult at times in reporting declining or stagnant sales figures for several products. In the long term I believe it has been the right strategy and something that the shareholders, regardless of whether they are owners of Fortress and/or Journey, will be rewarded for in the long run. Journey has so far had the “snowball-effect”, and with EMROSI now as a commercial drug, I believe the snowball has every opportunity to expand in both size and speed.

ACCUTANE & QBREXZA

Some numbers that describe the success of ACCUTANE and QBREXZA:

Journey's upfront payment for ACCUTANE was $1M. In less than 4 years, it has grown to have a 16% market share in the Isotretinoin market in the US.

Before Journey acquired QBREXZA, Dermira spent $82.8M in patient advertising during the 3-year period they promoted QBREXZA. Under Journey’s ownership, QBREXZA has grown TRx by over 58% in 3 years, spending less than 3% of Dermira’s commercial budget.

ACCUTANE

2021: $10.053M

2022: $18.373M

2023: $20.168M

2024: $19.407M

QBREXZA

2021: $17.056M

2022: $26.715M

2023: $25.410M

2024: $25.114M

(QBREXZAS $19M upfront sales deal 2023 not included)

Since 2024, ACCUTANE (from Q2-Q3) and QBREXZA (Q4) have also faced increased competition in the domestic US market. This was addressed in the Q&A during the conference call last quarter (Q4 2024):

“Scott Henry, Analyst, AGP: Okay. So none of the products you would say have kind of reset at lower levels. I mean, mostly I’m thinking QBREXZA and ACCUTANE are the main drivers there.

Claude Maraoi, Co-Founder, President and CEO, Journey Medical: Yes. QBREXZA continues to perform well for us. We continue to see script growth year over year. And it’s holding very solid. It obviously has some new competition out there. But again, the prescriptions continue to show very good positive signs. Again, when you look year over year, we’re growing that product. With ACCUTANE, as we’ve stated in the past, there were a couple new entries towards the second and third quarter of twenty twenty four. We did see some slowdown with ACCUTANE. We’ve stabilized that business relatively well and we believe we’re going to have good performance with ACCUTANE”

Other commercial assets

Sales – “Others”

2017: $15.5M

2018: $23.4M

2019: $34.9M

2020: $44.679 M (Start of the generic infringements/competition)

2021: $36.358M

2022: $25.907M

2023: $14.082M

2024: $10.613M

As you could see everything hasn’t been a straight line and a success story, especially not in cases where the generic risk was included but where new and better dermatological products also reached the market faster than expected. However, the choice of model and that it was delivered well is today reassuring but historically expected as the management has done this before, and also to a large extent even then under the same common roof for Medicis. Although not all of them sat in the highest-ranking roles in the management/board of Medicis, 6 current people in the management were responsible for almost the entire commercial team. In other words, they are experts in sales with experience of over 50 commercialized products in the US. With the addition of Joseph Benesch in finance & M&A and Srinivas Sidgiddi (EMROSIS's father who joined in connection with the acquisition from Dr. Reddy) in research, product development and clinical studies. Journey is now a complete team both on paper and based on the words of co-founder CEO Claude Maraoui. This is of course timely now when the company is facing a possible paradigm shift. Let me introduce EMROSI.

EMROSI

2021 Journey acquired global rights to EMROSI for Rosacea, including in the U.S. and Europe, except that Dr. Reddy’s Laboratories has retained certain rights to the program in select markets including Brazil, India, China and the Commonwealth of Independent States (“CIS”) countries Russia, Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan and Uzbekistan.

Under the agreement Journey and DRL would collaborate to monitor two P3s in the US and Germany, as well as a P1 aimed at generating more discoveries. In the previous P2 in Germany EMROSI had already demonstrated statistical significance over both placebo and active control, ORACEA (doxycycline, Galderma), on both co-primary endpoints. In fact, EMROSI had about double the efficacy when compared against ORACEA previous study results for both endpoints. And here it should be remembered that ORACEA had been unchallenged as an oral alternative for Rosacea since their FDA approval in 2006, i.e. for two decades. But how would EMROSI manage to follow this up in two extended studies that would also be head-to-head against the Standard of Care ORACEA? The study results in P3 did not come in line with P2, they were even better than that. I am not going to require you to review every word and number in the study results, but, if you have made it this far and want to continue reading, you almost have to go through Journey Medical's Corporate Overview to get a thorough overview of the results. (Source)

I hope you also want to hear how exciting these study results were for Journey themselves. Then listen to this Investor Presentation during the Planet MicroCap Showcase Conference in Las Vegas last year (recommend the whole thing, but DFD-29/EMROSI specifically between 12:50–20:30):

In November 2024, EMROSI was granted FDA Approval

Claude Maraoui, Co-Founder, President, and Chief Executive Officer of Journey Medical

“With approval from the FDA, Journey Medical is proud to deliver Emrosi, a unique treatment option for the millions of patients in the U.S. suffering from rosacea. Rosacea is a difficult to treat skin condition and based on the favourable results from our Phase 3 clinical trials, Emrosi has potential to become the best-in-class oral medication to treat the condition. Our seasoned dermatology-focused sales force is now preparing for a successful launch and to establish Emrosi as a new standard of care in the treatment of rosacea. Journey Medical is committed to bringing cutting-edge innovation to patients with dermatological conditions and the healthcare professionals who treat them.” (Source)

And of course, companies (perhaps especially in healthcare) are/can be biased, so you should always listen to the leading expertise in the field. The problem here? When the "Rosacea elite" in the US, who are heard at the major conferences and get to write/publish in the Medical Journals, saw the P2 result almost everyone seemed to want to be part of the P3 study when EMROSI entered the US via Journey (honour and glory for Linda Stein Gold, Joshua Zeichner, Zoe Diana Draelos, James Q Del Rosso and others).

"Emrosi offers a new treatment option, mainly for the pimple-like bumps, by reducing swelling and inflammation. Each capsule contains 40 milligrams of minocycline, including 10 milligrams that work immediately and 30 milligrams that are released slowly over time (called extended release). This helps maintain a steady level of the drug in the body over a longer duration and provides better results. It also means fewer daily doses and a lower risk for side effects." (Source)

"Minocycline from DFD-29 with its modified-release formulation provides higher dermal concentration than doxycycline from Day 1 onwards at a similar dose. The higher concentration from Day 1 at the site of action is expected to translate into a clinically meaningful impact in the treatment of patients with rosacea." (Source)

“The approval of Emrosi adds another arrow to the quiver for physicians targeting their patients’ papulopustular rosacea and may be of special interest to patients concerned about antibiotic resistance because of its narrow spectrum of antibiotic activity.” (Source)

“A Breakthrough Rosacea Treatment with Long-Lasting Effects for Adults” (Source)

"The approval of DFD-29 signals a shift in the treatment paradigm for rosacea, with Emrosi anticipated to become the best-in-class oral therapy for the condition." (Source)

“Not only does it prove the efficacy of minocycline, it is safe for the long-term per the study data. Patients were really happy. Nobody wanted to give it up" (Source)

"If Journey Medical effectively communicates Emrosi’s clinical advantages and secures favourable market access, the drug has the potential to become a leading treatment option for rosacea, improving outcomes and quality of life for patients.” (Source)

"The drug demonstrated statistically significant superiority over both Galderma’s standard-of-care Oracea” (Source)

“The launch will mark a change in the treatment landscape. GlobalData’s 2022 ‘Rosacea Marketed and Pipeline Drugs Assessment, Clinical Trials and Competitive Landscape‘ report stated that Galderma was ‘the most prominent player in the rosacea space, offering a comprehensive portfolio of solutions’. However, it also warned that with “no presence in the late-stage pipeline and with its existing marketed products widely genericised, the company may lose its position in the rosacea market” (Source).

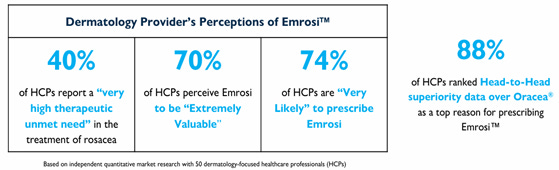

Even before EMROSI received its FDA approval, Journey was eager and smart enough to try, if possible, to get a first glimpse of the market picture of what the future might look like with EMROSI approved in the US. They enlisted help of an external survey company which collected survey results from HCPs in the country to compile into a report. The results were unheard of for the drug with several months to go before PDUFA (from Q1 2024 conference call transcript):

“Healthcare prescribers overwhelmingly confirmed their willingness to adopt and prescribe DFD-29 for the Rosacea patients, and a adoption rate of 79%. In our industry, this is an astoundingly high rate and translates into an approximate 8 out of 10 Rosacea prescriptions going to DFD-29. This rate exceeded even our own internal expectations and gives us the confidence in a successful DFD-29 launch.”

“Given the 16.5 million Rosacea sufferers in the United States and over four million prescriptions written annually, the prescriber adoption rate captured in our market research makes us even more excited about DFD's market potential.”

“With respect to the payer market research results, the data shows most, if not almost all PBMs, GPOs, and other managed care organizations are likely to contract with us to provide coverage for DFD-29 for over 200 million lives.”

“As a result of this market research, we are even more confident that DFD-29 will have high acceptance among prescribers and that negotiations with payers for formulary inclusion and reimbursement will be favorable after DFD-29 is approved. We will provide additional details on pre-launch activities later in the year as we finalize the launch plans, pricing, and product positioning for DFD-29.”

Robert Nevin (Chief Commercial Officer) topped this on the “EMROSI – U.S. Commercial Conference Call” in early February this year when he described what commercial opportunities he had to work with, now with EMROSI, which had never been better than this in his entire career. And remember that he was responsible for the commercial strategy for what was then some of the world's best-selling products in therapeutic dermatology history with brand names like SOLODYN, ZIANA, RESTYLANE and DYSPORT. This largely due to EMROSI’s superiority of SoC ORACEA and an award-winning sales team behind him.

Last quarter, Journey's sales team consisted of only around 35 people, but, given the market landscape, they will initially be able to cover a large part of the need. They have expressed during previous conference calls that over time they expect to gradually increase the ceiling somewhere around 40-45 people. To put a figure on this, management believes that they can quickly reach the top 80% of TRx prescriptions with the current sales team. And of these top 80% of TRx, 92% already prescribe at least one of Journey's previous products.

CEO Maraoui’s two specific sentences from the Las Vegas presentation still echo in my head:

“I will be able to look patients in the eye and say we have placebo-like side effects”

“We will be the new Standard of Care”

If you have superior results, you should also be able to sell at a premium to existing significantly inferior alternatives. During the commercial launch call, these figures were reported:

ORACEA Brand - $914

ORACEA AG -$783

EMROSI - $1298

In response to a direct question from me at an Investor Conference last year, CEO Maraouis answered “Yes” to the question of whether EMROSI will do $50M in sales in the first year (trailing twelve months). This should be compared to the $56M in sales that the remaining product portfolio in Journey did in total in 2024. It should also be noted that Journey themselves have stated on more than one occasion that they see the major increase in sales starting at 9-12 months in when sales subscription and coverage of EMROSI start to gain momentum.

When ROTH MKM analysed Journey in August 2024, they assumed that the price for EMROSI would be in line with ORACEA's price, and progressed the following sales development for EMROSI in the coming years:

2025

Q1: $0M

Q2: $5M

Q3: $14M

Q4: $21M

Total: $40M

2026

Total: $80M

2027

Total: ?

2028

Total: $200M

If they received $19M cash upfront in a sales deal (up to $45M in total) in parts of Asia for QBREXZA, what can EMROSI bring in (excluding BRIC and CIS)? A deal that includes, for example, the entire EU and UK? When it comes to sales deals for both EMROSI and other assets in the portfolio, Journey has been willing to point out in every conference call or investor presentation that they are in active discussions with several partners for various possible deals.

ROTH MKH latest Estimated EPS for Journey Medical (April 3, 2025), where it lowered its forecasts for ACCUTANE and QBREXZA given the increased competition mentioned above:

2026: $2.18 EPS

2027: $3.32 EPS

2028: $5.18 EPS

P/E based on todays $7.03 in DERM (2025-05-05) share price:

2026: P/E 3.22

2027: P/E 2.11

2028: P/E 1.35

Final Comments: The CEO explained at the 37th Annual ROTH Conference in Q1 2025 that EMROSI will become the new Standard of Care (over 50% prescription within its niche), given its superiority in head-to-head P3 clinical trials against current SoC ORACEA, with good potential of +$200M in US and +$100M outside the US (with partners) per year sales around peak sales. Add this, and +70% margins, to the bottom line to today's flat results and it should spike the market value from here significantly in the future. If Fortress, CEO, COO, Tang other insiders intend to keep all their shares, the free float is already low with potentially narrower openings for larger investors than alleys in an old Italian town.

If you want more thoughts and analysis on Journey Medical, I can recommend these:

Journey Medical FDA Approval For Emrosi Makes This An Exciting Stock (Source)

Journey Medical Coorporation Emrosis Launch Could Be A Turning Point (Source)

Journey Medical Corporation: Why It Might Be Worth Having A Skin In This Game (Source)

Journey Medical: A Small-Cap Multibagger Hiding in Plain Sight (Source)

c. Mustang Bio

Brief description: Mustang Bio is Pioneering Innovative CAR-T Therapies for Cancer and Gene Therapies for Primary Immunodeficiencies.

Ownership: 6.3%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Pipeline: MB-101, MB-106, MB-108 & MB-109 (MB-101+MB-108=MB-109)

Comments: First, read about Mustang Bio and uBriGene Biosciences' initial deal and then the collapse of that same deal to get an eye-opener on the big reason Mustang ended up where it is today, despite compelling clinical study results. Now the wait-and-see mode looks set to continue until Q4 unless the company or any of its assets are sold before then:

MB-106

“… further clinical development of MB-106 is currently focused solely on autoimmune diseases unless funding and resources become available to restart the program for hematologic malignancies. Planning for the aforementioned Phase 1 investigator-sponsored clinical trial in autoimmune diseases is in progress, with initiation anticipated in the fourth quarter of 2025.” – P.12, Annual Report 2024

MB-109

“In October 2023, we announced that the FDA accepted our IND application for the combination of MB-101 and MB-108 – which is referred to as MB-109 – for the treatment of patients with IL13Rα2+ relapsed or refractory glioblastoma (“GBM”) and high-grade astrocytoma. Pursuant to termination of the lease of our cell processing facility in Worcester, MA, we are exploring with COH and Nationwide the possibility of initiating this clinical trial as an investigator sponsored single-institution study at COH in the fourth quarter of 2025.” – P.6, Annual Report 2024

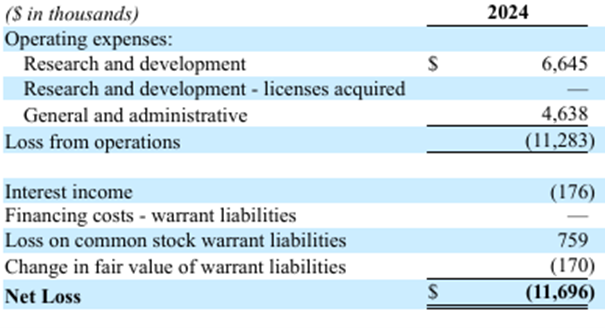

Due to the company's current financial and therefore medically uncertain status and declining clinical trial activity, I do not see any obvious impact on Fortress Preferred Stock reintroducing dividends during the 1-20 months’ timeframe. A sale of pipeline assets or a buyout of the entire company is seen as a possibility, but given today's valuation and Fortress' declining stake, it should not have a decisive impact on Fortress' decision to reinstate dividends. What will have a positive impact, relative to reintroducing dividends, is the decreasing R&D and other Operating expenses below on the Fortress consolidated balance sheet.

d. Avenue Therapeutics

Brief description: Avenue Therapeutics is a specialty pharmaceutical company focused on the development and commercialization of therapies for the treatment of neurologic diseases. The Company owns a diverse portfolio that includes first-in-class programs in a high-value neurologic landscape with significant unmet patient need.

Ownership: 9.2%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Pipeline: BAER-101 & IV Tramadol

Comments: Same as Mustang Bio's comments above, low value and mostly paused activity due to medical and financial reasons. Read about former asset AJ201 under “Subsidiaries Deals” below.

5. Private Subsidiaries

a. Cyprium Therapeutics

Brief description: Cyprium Therapeutics is a rare disease company with a focus on the development and commercialization of novel therapies for Menkes disease, a rare and fatal pediatric disease in copper metabolism.

Ownership: 73.1%%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

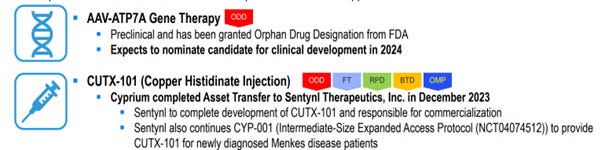

Pipeline: AAV-ATP7A (Gene Therapy: CUTX-101 2.0) for Menkes (read about CUTX-101 under “Subsidiaries Deals” below)

Comments: Given the CUTX-101 deal, I think it is both right and gratifying that Cyprium's AAV-ATP7A Gene Therapy for Menkes Disease has both been moved up and given more space in the latest investor presentations. If these results (picture) from preclinical studies compared to CUTX-101 can be followed up in the clinical study, we are talking potential peak sales north of $1B (Fortress' estimated ceiling for CUTX-101) per year.

Quote and text from Delveinsights Menkes Outlook (more about them later):

“Gene therapy is being explored as a potential approach to treat Menkes disease, although targeting all affected cells poses significant challenges. Targeted gene therapy for the brain may offer a promising avenue for future research.”

b. Urica Therapeutics

Brief description: Urica Therapeutics is a clinical-stage biopharmaceutical company developing a novel drug to address the significant unmet needs for the treatment of Gout and other conditions associated with Hyperuricemia.

Ownership: 69.6%

Annual Equity Dividend: 2.5%

Comments: Read under “Subsidiaries deals” below about Dotinurad.

c. Helocyte

Brief description: Helocyte is developing a novel immunotherapy Triplex for the prevention and treatment of Cytomegalovirus (CMV).

Ownership: 83%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Pipeline: Triplex

Fortress estimated potential peak global sales per year:

Solid Organ Transplant - $1B+

Hematopoietic Stem Cell Transplant - $500M+

Non-Hodgkin's lymphoma (NHL) - $1B+

HIV - $10B+

Comments: Given previous analysts on peer HOOKIPA’s HB-101 (before the failure) and comparative study results against Mercks PREVYMIS and its sales (2024: $785M, +33%), Helocyte's market value should, according to me, already today be significantly higher than what the entire Fortress is priced at.

Together with Dotinurad, Triplex is the most promising asset in the pipeline/portfolio according to me and Fortress CEO (statement from an Investor Conference 2024). However, as this analysis applies to Fortress Biotech Preferred Stock and the theory of reintroducing dividends in 1-20 months, Triplex will not come into play for commercialization before then. I believe, given Triplex's previous study results, and all the economic contributions it continues to make, that Fortress want to keep Triplex in their own hands for as long as possible despite the numerous ongoing studies. Especially if my title and thesis for this Preferred Stock analysis are correct, that money is starting to flowing into Fortress and its subsidiaries at the same time as the total costs are rapidly decreasing. Those of you who have followed my texts/posts in other context before knows that I have written meters of columns about Triplex already, but this will have to be saved for another time. However, I would not rule out a buyout of Helocyte in the next 1-20 months, but I don’t think I need to comment on the financial significance it would have for both Fortress Common and Preferred Stock in both the short and long term.

I think Triplex has good potential to become a "Blockbuster" for Fortress with at least $1 Billion in sales per year. This is based on the closest peer/competitor study results and current sales in relation to Triplex study results to date.

d. Oncogenuity

Brief description: Oncogenuity is developing novel oligonucleotides for the treatment of genetically driven diseases, including cancers and coronaviruses by targeting gene-silencing at the DNA level.

Ownership: 73.5%

Annual Equity Dividend: 2.5%

Royalty: 2.5%

Portfolio: ONCOlogues (Oligonucleotide Platform)

Comments: In addition to the description in the latest Annual Report (below) and the fact that they have modernized their website, activity in terms of figures in the latest Annual Report appears to remain low. It is not considered to have any impact on Fortress Preferred Stock opportunities over the reinstated dividend in the next 1-20 months.

“Oncogenuity is developing a delivery platform that allows peptic nucleic acids to enter a cell membrane and nucleus,displace the targeted mutant DNA strand, and prevent mutant mRNA transcription. Oncogenuity is seeking to optimize lead candidates targeting genetically driven cancers, including KRAS G12D, and other genetic disorders.” - P.17, Annual Report 2024

e. Cellvation

Brief description: Cellvation is a clinical-stage biopharmaceutical company developing novel cellular therapeutics for the treatment of traumatic brain injury (TBI).

Ownership: 79.2%

Annual Equity Dividend: 2.5%

Royalty: 2.5%

Pipeline: CEVA-D, CEVA-102

Comments: In addition to the description in the latest Annual Report (below) and the fact that they have modernized their investor presentation continuously for the past year (available on Fortress' website under "Presentations"), activity in terms of figures in the latest Annual Report appears to remain low. It is not considered to have any impact on Fortress Preferred Stock opportunities over the reinstated dividend in the next 1-20 months.

“Through our subsidiary Cellvation, we are developing CEVA-D, a novel bioreactor device that is designed to enhance the anti-inflammatory potency of bone marrow-derived cells without genetic manipulation, using wall shear stress to suppress tumor necrosis factor-a (“TNF-a”) production by activated immune cells. CEVA-102 is the first cell product produced by CEVA-D, and may be applicable for various indications, including the treatment of severe traumatic brain injury.” - P.17, Annual Report 2024

6. Subsidiaries Deals

a. Checkpoint Therapeutics

Ownership: 8.3%

Partner: Sun Pharmaceuticals

Status: Pending sale

Upfront payment: $28M

CVR per share:

$0.20 - $1.384M

$0.45 - $3.115M

$0.70 - $4.846M

Royalties: 2.5%

The figures above apply to Fortress' share/part in the entire deal (Source).

Comments: Fortress and Checkpoint have stated that they expect the deal to close in Q2. On May 28th, there will be an extraordinary shareholders meeting where shareholders will have the opportunity to vote for or against the deal.

Although 2.5% royalties apply to the entire pipeline of four more drugs besides UNLOXCYT, and that this could generate further revenue for Fortress given UNLOXCYT's expected beneficial combined medical opportunities, the focus for the reinstated dividend in the near term, as stated in the pitch, is solely on UNLOXCYT sales in the US and possible CVR:

“Cosibelimab shows significant promise as a treatment for advanced CSCC, offering anovel immunotherapeutic approach for patients with limited treatment alternatives. Itsdual mechanism of action, which includes PD-L1 inhibition and potential ADCC, positionscosibelimab as a unique candidate in the ICI landscape. Clinical trials have demonstratedits efficacy, with ORRs comparable to existing therapies such as pembrolizumab andcemiplimab. Additionally, its favorable safety profile, characterized by a lower incidence ofsevere irAEs, further supports its viability as a treatment option.” - (Idris, O.A.; Westgate, D.; Saadaie Jahromi, B.; Shebrain, A.; Zhang,T.; Ashour,H.M. PD-L1 Inhibitor Cosibelimab for Cutaneous Squamous Cell Carcinoma: Comprehensive Evaluation of Efficacy, Mechanism, and Clinical Trial Insights. Biomedicines 2025, 13, 889. https:// doi.org/10.3390/biomedicines13040889)

According to Sun Pharma's latest investor presentation (February 2025), they are a global company with over 43,000 employees, operating in 100 countries, of which approximately 80 of them in large-scale. With them, I believe that a potential Best-in-Class drug, if it only stops at cSCC (which I don't think it will), will sell quite well, even if it only stops at the US (which I don't think it will). Fortress Potential peak global sales for just CSCC was $300M-$500M. Over time, it will be added with a CVR and royalties on a continuous and increasing basis for years into Fortress pockets.

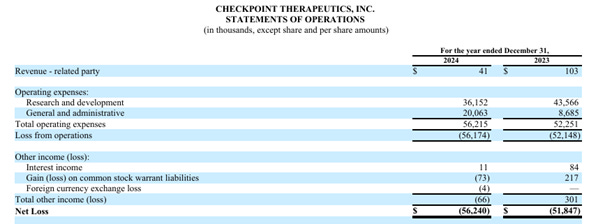

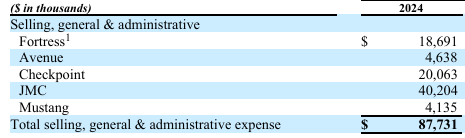

If we look at the cost savings on Fortress' balance sheet starting in H2 this year, with 1.5 years left until the maximum dividend cap for reinstated Preferred Stock (according to my theory), they would be significant:

A much more comprehensive text would have been in order if it weren't for the fact that the deal is in its final stages. In a possible later text for Fortress Common Share, I will be able to develop the history and potential of UNLOXCYT and the other pipeline assets in Sun Pharma's (hopefully) hands for more possible royalties in the future.

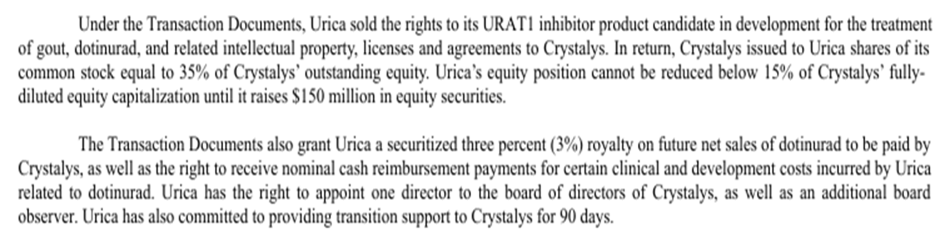

b. Urica Therapeutics

Asset deal: Dotinurad

Partner: Crystalys Therapeutics

Deal: Urica owns 35% of Crystalys and 3% royalty on future net sales of Dotinurad

Fortress estimated potential peak global sales per year: $1B+

Urica Therapeutics – Crystalys Therapeutics deal (2024-07-15)

"The APA also gives Urica the right, but not the obligation, to repurchase the sold assets for a repurchase price not to exceed $6.4 million plus accrued interest; in the event that Crystalys has not consummated a qualified financing of at least $120 million before January 8, 2026." – P.139, Fortress Biotech Annual Report 2024

Dotinurad – Initial Market

Gout

“In the United States, the prevalence of gout has risen dramatically over the past few decades, affecting approximately 3.9% of the adult population, or about 9.2 million people-” (Murdoch, R. et al. Gout, Hyperuricaemia and crystal-associated disease network common language definition of gout, 2021)

“In 2020, 55.8 million (95% uncertainty interval 44.4–69.8) people globally had gout, …”

“The total number of prevalent cases of gout is estimated to reach 95.8 million (81.1–116) in 2050, …”

Hyperuricemia

“… , hyperuricemia affects about 20% of the general populations.”

(Chen-Xu, M., Yokose, C., Rai, S. K., Pillinger, M. H. & Choi, H. K. Contemporary prevalence of gout and hyperuricemia in the United States and decadal trends: The national health and nutrition examination survey, 2007-2016. 2019).

“The global prevalence rate has been reported to be ranging from 2.6% to 36% in different populations”

(Dehlin, M., Jacobsson, L. & Roddy, E. Global epidemiology of gout: prevalence, incidence, treatment patterns and risk factors. 2020)

“The U.S. National Health and Nutrition Examination Survey (NHANES) indicates that approximately 21% of adults, or 43 million individuals, have been diagnosed with hyperuricemia.”

(Zhu, Y., Pandya, B. J. & Choi, H. K. Prevalence of gout and hyperuricemia in the US general population: the National Health and Nutrition Examination Survey 2007-2008. 2011).

Comments: Together with Helocytes Triplex, Dotinurad is the most promising asset in the pipeline/portfolio according to me and Fortress CEO (statement from an Investor Conference 2024). However, as this analysis applies to Fortress Biotech Preferred stock and the theory of reintroducing dividends in 1-20 months, Dotinurad will not come into play for commercialization before then. However, I have written hundreds of posts about Dotinurad in other contexts with a small library of saved texts and studies that I hope to return to in a longer analysis of the future of Fortress Biotech Common stock. But for a little relevance, I think Dotinurad has potential to become a "Blockbuster" for Fortress with at least $1 Billion in sales per year. This is based on the closest peer/competitor study results and current sales in relation to Dotinurad study results to date.

c. Cyprium Therapeutics

Cyprium

Ownership: 73.1%

Annual Equity Dividend: 2.5%

Deal asset: CUTX-101 (deal below)

Status: PDUFA 30/9-2025

Partner: Sentynl/Zydus

Milestones: Up to $129 million in aggregate development and sales milestones

Royalties (on every annual sale):

3.00% of net sales up to $75M

8.75% between $75M and $100M

12.50% over $100M

PRV sale: Potential ~$150M, numbers depending on last year’s PRV sales:

IPN - $158M

ACAD - $150M

PTCT - $150M

In addition to the information (image below) about Cyprium PPS, NIH is entitled to 20% of PRV sale.

Fortress estimated potential peak global sales per year (CUTX-101): $500M - $1B

Comments: Cyprium Therapeutics is a rare disease company with a focus on the development and commercialization of novel therapies for Menkes disease, a rare and fatal pediatric disease in copper metabolism which affects between 50-225 children per year in the US. They had two drugs in their pipeline. CUTX-101 (Copper Histidinate Injection) first drug targeting Menke's disease already awarded FDA granted Breakthrough Therapy, Orphan Drug, Fast Track, and Rare Pediatric Disease Designations. Sentynl (100% owned subsidiary of Zydus Lifesciences) assumed control over development of CUTX-101 in December 2023 and will develop and commercialize the drug if approved (PDUFA 30/9-2025). Track two, which Cyprium still owns/control, is 2.0 targeting Menke's disease in AAV-ATP7A Gene Therapy, which will combine CUTX-101 with gene therapy. Preclinical studies have been done and evaluated, and they have already been awarded Orphan Drug Designation from FDA here and they expect to nominate candidate for clinical development during this year 2025.

Cyprium has 100% rights for the voucher PRV worth approximately $150M (based on last 3 PRV sales). This will be awarded upon FDA approval as CUTX-101 is directed against Menke's disease, a rare pediatric disease, which designation and requirements for PRV you can read about here.

What Is Menkes Disease?

Copper is an essential mineral that our bodies use in many ways. While the body only uses a small amount of copper, even this tiny amount is required for many functions. Copper helps with metabolism, brain functioning, blood vessel and blood cell formation, wound healing and the immune system. Copper also helps to convert iron into a usable form in the body. It is naturally available in many foods and dietary supplements.

Menkes disease, also known as Menkes syndrome, is a disorder caused by a mutation of the ATP7A gene. This ATP7A gene affects how the body transports copper and maintains copper levels (Source).

The disease thus arises from disorder of copper metabolism caused by mutations in the Copper transporter ATP7A and If untreated, premature death occurs at approximately 3 years of age.

CUTX-101 is done via an injection to replenish copper histidinate. Because so few are affected by the disease, the studies for CUTX-101 have taken a long time. The FBIO CEO Rosenwald said in an interview a while ago that study results of 14-15 years are behind the results they have today. In fact, the full research behind Cyprium today dates to 1993, over 3 decades ago (Source).

CUTX-101 - Efficacy Data

- 75-79% reduction in risk of death compared to untreated Historical Control (HC-ET and HC-LT) arms

- Increase in Median OS from 1.3 years to 14.8 years in the ET cohort

- p-value <0.0001

It is almost impossible to comprehend how convincing this effect is, and what impact it can/will have on the children and their families and environment. But the results become even more compelling when you break down the results:

Early Treatment with CUTX-101

"ET subjects who completed 3 years of treatment attend(ed) school and remain active and engaged."

Late Treatment with CUTX-101

"Most surviving LT subjects resided with their families; some require respiratory and feeding support."

Untreated Historical Control:

“Median child/patient died after 16.1 months. “

CUTX-101, Safety in ET & LT:

"CUTX-101 was safe and well tolerated."

"No TEAEs were considered related to study treatment."

I initially had difficulty getting a somewhat close overview of what the competition for Cyprium looked like in the present and what it could look like in the future. It turned out that there was an explanation for that. The competition, in clinical studies, is non-existent. I was able to learn about this in the comprehensive report “Menkes Disease Market Insights, Epidemiology, and Market Forecast-2034” from 2024 by Delveinsights. Some highlights from the report in text and images:

“Without treatment, most Menkes disease patients do not survive past age three. Early diagnosis and treatment can vastly improve a child’s survival and symptoms. Once diagnosed, treatment with copper supplements should be initiated immediately, delivered by daily subcutaneous injections. However, results can vary depending on the type of copper complex used and the severity of the ATP7A mutation.”

“Currently, no FDA-approved treatments exist for Menkes disease. However, injections of copper histidinate (CuHis), a novel freeze-dried formulation, have demonstrated potential in enhancing blood copper levels and improving neurodevelopmental outcomes, although its efficacy in older symptomatic patients remains uncertain.”

“The treatment landscape is evolving, with promising candidates in the pipeline, including Cyprium Therapeutics’ /Sentynl Therapeutics’ CUTX-101 (Copper Histidinate) and Cyprium Therapeutics’ AAV-ATP7A Gene Therapy”

There was no other drug candidates mentioned in the Menkes report. So, the only competitor for Cyprium's cash inflows from milestones and royalties from Sentynl/Zydus can only come from themselves for the foreseeable future. Because remember here that the studies from CUTX-101, where we may now be months away from a first FDA approval for Menkes, date back to 1993 and are exceptionally strong. The barriers to entry are very high even for Big Pharma to even dare to try to compete.

Two Healthcare Analysts at ROTH MKM (2024-08-14), whose job is to have a certain discount for the probability of a drug approval, assessed before even Sentynl/Zydus had its NDA application approved at 94% and the same for the chance of PRV, i.e. an equality that FDA approval also gives PRV. The results speak for themselves, there are no other medical help for children who die before the age of 3 without help from CUTX-101.

CUTX-101 – Future sales

PRV

If you take the average of the 3 latest PRV sales at $152.66M and throw in a discount/safety margin of 15% lower, I calculate a PRV sale of $129.8M.

Milestones

Historically, Fortress deals linked to milestones have been structured so that they can easily achieve the full amount for milestones upon FDA approval, which in this case is $129M. A discount/safety margin of 25% lower also gives $96.75M.

Reasonably (I've searched hard but can't find details for milestones in this deal) milestones are largely built and based on regulatory approvals globally starting with the US and FDA on September 30th of this year. I believe these approvals will come quickly (read below).

Royalties

Fortress estimates for global peak sales are $500M-1B. In simple terms, the average drug usually reaches peak sales somewhere between 5-10 years depending on everything from regulatory approvals in the world, marketing, distribution, sales ability, competition, expanded indications, etc. Regardless of whether it takes more or less than 5-10 years, Cyprium's drugs (CUTX-101 & AAV-ATP7A if possible, at a later stage) will be completely alone in the market for Menkes.

When it comes to these Rare Diseases with Orphan Drug status, history clearly speaks for rapid regulatory approval for large parts of the world after the FDA gives the go-ahead. Now we should remember that CUTX-101 has been granted all the drug statuses that one can get and wants to introduce a PDUFA in:

- Breakthrough Therapy

- Orphan Drug

- Fast Track

- Rare Pediatric Disease Designations

Here are a couple of helpful texts regarding Rare Disease that has been awarded Orphan designation from the FDA and what applies in my home region of Europe and the EMA:

Orphan designation: Overview (Source)

Regulatory Processes for Rare Disease Drugs in the United States and European Union: Flexibilities and Collaborative Opportunities (2024) (Source)

Orphan incentives (Source)

FDA orphan drug designation vs. EMA orphan drug designation (Source)

It is usually said that 6-12 months in general for a Rare Disease that has received FDA approval in Europe after the FDA has approved the drug, but that it can go faster than that, among other things due to the type of disease and effect/safety that the drug is supposed to cure/alleviate. I don't know what will be on the tables of the various drug agencies around the world from H2 2025 onwards, but, I find it hard to believe that it is wise/human to prioritize the review of something else so much faster than CUTX-101 for Menkes.

Add then the knowledge that only 50-220 patients per year in the US are affected and a large proportion of those children affected in recent years are already being treated within CUTX-101 studies, and I have a very hard time seeing a more average 5-10 years to peak sales that also applies to CUTX-101. When the diagnosis is made and the "choice" is between extending life expectancy by an average of 13.5 years, and with significantly better quality of life along the way, or that the child will die months later, it is not even a choice, the order for the CUTX-101 injection from Sentynl/Zydus will come immediately.

Now read again what I wrote about what determines the time for peak sales on average 5-10 years previously above and connect it to the CUTX-101 expected reality:

Regulatory approvals – Rare disease with no other options speaks for early regulatory approvals even outside the US if FDA approves

Competition – None

Marketing – Barely needed given the two answers above

Distribution & Sales ability – Few patients and large global company behind (Zydus)

Expanded indications – No

Still, to take all the safety margins and lifebuoys that are available, let's put ourselves in the range and calculate 7 years to peak global sales and put ourselves in the lower peak ($500M-$1B) amount of $600M:

Year – Sales – Royalties

2026: $70M - $2.1M

2027: $180M – $22.5M

2028: $300M - $37.5M

2029: $390M - $48.75M

2030: $480M - $60M

2031: $560M - $70M

2032: $600M - $75M

Royalties: $315.85M

PRV: $129.8M

Milestones: $96.75M

Royalties to peak global sales: $315.85M

Total: $542.4M

Note that without all the safety margins/discounts, the sum could easily have added a couple of hundred million, and above all much earlier as I believe peak global sales will be closer to 4 years than my exemplified 7 years. Note that this is also only up to peak and that it is currently somewhat impossible based on the current state of research that anyone without Cyprium themselves (CUTX-101 2.0) can compete at the time of year 2032 that I refer to (remember previous references about decades of research). And of course sales and royalties won't stop just because they reach a plateau, they will continue to flow in.

If you want to calculate the net, add NIH's 20% right of PRV and possible outcome for Cyprium PPS based on:

Short Summary: There are currently no approved drugs for Menkes and the only competition in clinical trials will come from themselves for the foreseeable future. CUTX-101 studies have been ongoing for three decades, so understandably the market to entry is incredibly tough and the competition is understandably weak thereafter. Healthcare analysts' (ROTH MKM, 14/8-2024) chances of FDA approval and PRV at 94% for CUTX-101 even before NDA accepted now in January.

d. Caelum Biosciences

Caelum

Ownership: 42% (sold)

Asset deal: CAEL-101

Partner: Alexion/AstraZeneca

FDA approval: $19.6M

Milestones (payment at latest 31/12 the year milestones are reached):

$10.5M when sales exceed $250M in total sales

$21M when sales exceed $500M in total sales

$31.5M when sales exceed $750M in total sales

$42M when sales exceed $1B in total sales

Total potential: $124.6M

Estimated potential peak global sales per year: ~$1B

Comments: AL amyloidosis is a rare, severe, progressive, systemic disease caused by free light chain misfolds due to plasma cell dyscrasia into amyloid fibrils. Amyloid fibrils deposit into organs, leading to severe damage and dysfunction and death.

Anti-plasma cell dyscrasia, which suppresses plasma cell growth, is a standard-of-care (SOC) treatment. However, there are no FDA-approved treatments that target fibrils that have already been deposited in organs.

CAEL-101 is a chimeric monoclonal antibody designed to bind a cryptic epitope on misfolded kappa and gamma light chains and resulting amyloid fibrils, leading to their removal from organs and tissues.

Extended Treatment With CAEL-101 Plus SOC Therapy Proves Safe in Light-Chain Amyloidosis:

“The addition of the chimeric monoclonal antibody CAEL-101 to standard therapy with cyclophosphamide, bortezomib (Velcade), and dexamethasone with or without daratumumab (Darzalex) demonstrated a manageable toxicity profile with prolonged clinical benefit in patients with amyloid light-chain amyloidosis, according to findings from a phase 2 trial (NCT04304144) that were presented at the 2023 EHA Congress.

Responders were defined as having at least 30% reduction from baseline and decrease of NT-proBNP above 300 ng/L in patients with a baseline NT-proBNP of at least 650 ng/L. Stable disease was defined as neither response nor progression, the latter of which was defined as having at least 30% increase from baseline and at least 300 ng/L of NT-proBNP without decline in eGFR at least 25% from baseline.

‘Among patients with AL amyloidosis treated with CAEL-101 for 18 months, CAEL-101 was generally well tolerated without evidence of toxicity in patients with AL amyloidosis. Most treatment-emergent adverse effects were mild to moderate, and cardiac response persisted even after cessation of anti–plasma cell dyscrasia treatment,’ lead study author Michaela Liedtke, MD, associate professor of medicine (hematology) at Stanford Medicine in California, said in a presentation of the data.” - https://www.onclive.com/view/extended-treatment-with-cael-101-plus-soc-therapy-proves-safe-in-light-chain-amyloidosis

There are two ongoing global Phase 3 studies of CAEL-101 for Stage IIIa and Stage IIIb AL amyloidosis (ClinicalTrials.gov identifiers: NCT04512235 and NCT04504825). The P3a patient part should have been completed by April 7 and P3b is expected to be completed this week on May 7. Then a couple of months of collecting and compiling the results await. Alexion has active job applications in the US and Japan for Regional Managers with a job description that is based solely on the drug CAEL-101, so if I may guess, Alexion/AstraZeneca assumes that CAEL-101 will be approved.

AstraZeneca Q1 (2025-04-29) - Update on CAEL-101

Alexion (AstraZeneca's Rare Disease Division) continues to confirm the readout for P3a-b during H2 this year. My guess is that, if the timeline continues to hold, the goal, like previous presentations in Al amyloidosis, is to present the data at the ASH Annual Meeting which will be held in 2025, December 6-9.

Short Summary: Two healthcare at ROTH MKM analysts rated the chance of FDA approval at 72% in Q3 2024 and since then new positive data has been presented (ASH Annual Meeting, December 2024). With positive P3 results, I expect PDUFA sometime in Q2-Q3 next year 2026, given that CAEL-101 has both Fast Track and Orphan designations in both the US and EU, which makes Fortress' $19.6M directly upon FDA approval really come into play for my timing aspect for reinstated dividends in Fortress Preferred Stock within 1-20 months. Milestones are structured in such a way that it is my belief that all $124.6M will accrue to Fortress in the future with FDA approval. The milestones for sales from CAEL-101 will be a longer bet on safer dividends in the stock and an increase in Fortress Common Stock.

Also worth noting Fortress bought CAEL-101 for about $1.5M back in the day and has already collected $56.9M in milestones in the deal.

e. AEVITAS

Brief description: Aevitas Therapeutics - Sold to 4D Molecular Therapeutics in April 2023 for up to ~$140M in future milestone proceeds, plus royalties from AVTS-001 (AAV.SFH Gene Therapy), now 4D-175 for Geographic Atrophy:

“Aevitas will receive the payment as potential late-stage development, regulatory and sales milestones. The firm will also receive single-digit royalties on net sales.” (Source)

From Q4 2024 (28/2-2025):

“Paused significant additional capital allocation and investment, pending additional financing or partnerships for the following therapeutics:

4D-175 for geographic atrophy

4D-725 for alpha-1 antitrypsin deficiency lung disease

4D-310 for Fabry disease cardiomyopathy”

Comments: The reprioritization/pause for 4D-175 was a shame given the promising reporting that initially came from 4D Molecular, but, understandable given their economic situation and the need to try to get the 4D-150 project done first. Hopefully, P1 for 4D-175 can start after that. As milestones and royalties are negotiated based on a late stage in development and sales, it would not have affected Fortress' possible need to reinstate the dividend within 1-20 months.

f. Avenue Therapeutics

Last week there was a press release about the settlement and resale of AJ201, which could lead to future income in the long term and savings on further study costs in the short term, this because AJ201 was really the only active drug in the pipeline that was in ongoing clinical trials.

7. Financial

Reporting in an Investment Company like Fortress Biotech

When an investment company reports its financial results according to applicable accounting principles (such as IFRS here in Sweden or equivalent local standards), the aim is to provide a comprehensive and holistic view of the financial position of the group. Here are some key reasons:

1. Consolidated perspective: An investment company that owns subsidiaries is considered as a single entity where the parent company's reporting is supplemented by the subsidiary's figures. By consolidating the income, expenses, assets and liabilities of all subsidiaries, a true and fair view of the entire business is obtained, rather than just seeing an isolated part of it.

2. Transparency for investors and stakeholders: Complete reporting enables investors, analysts and other stakeholders to assess the group's performance and risk profile. This is important for making informed investment and business decisions, as the total exposure – both positive and negative – is clearly visible.

3. Comparability and consistency: By reporting all income and liabilities in a consolidated manner, it becomes easier to compare the investment company's performance with other companies and industry standards. This provides a unified picture that is necessary to analyze overall profitability and financial stability.