Fortress Biotech – The numbers that describe the uniqueness behind the company

A review of the acquisitions and numbers behind some of Fortress' most relevant and commercializable assets today

Disclaimer

This analysis represents only my personal opinions and is based on information that was current at the time of publication. The information is not intended as an investment recommendation or as advice from a certified financial advisor. All content in this analysis should only be used as a basis for further study and not as the sole basis for investment decisions. Investments in stocks and other securities always involve risk, including the possibility of losing some or all of the invested capital. Past performance does not guarantee future returns. The reader is encouraged to independently conduct a careful investigation and, if necessary, seek professional advice before making any investment decisions. I am not responsible for any consequences that may arise from using the information in this analysis, including inaccuracies or lack of updates.

In his 2008 annual letter to Berkshire Hathaway shareholders, Warren Buffett wrote, “Long ago, Ben Graham taught me that 'Price is what you pay; value is what you get”. Applying this and including Graham's continued wisdom that “margin of safety is the secret to successful investing”, Fortress Biotech's early investments in its key assets today in CUTX-101, Triplex, CAEL-101, Dotinurad, UNLOXCYT and EMROSI support a somewhat unique and fantastic potential outcome.

Table of Contents

1. Acquisitions - Strategy

2. Acquisitions - Upfront Payments

3. Acquisitions – Full Details

a. Dotinurad

b. CUTX-101

c. Triplex

d. CAEL-101

e. UNLOXCYT

f. EMROSI

4. Acquisitions - Summary

a. Dotinurad

b. CUTX-101

c. Triplex

d. CAEL-101

e. UNLOXCYT

f. EMROSI

5. Acquisitions – Discussion

1. Acquisitions - Strategy

In my first post about Fortress, I reviewed the management's history of buying cheap and keep and/or selling significantly more expensively, as a business model that they have brought into the creation of the Fortress we see today. A risk management profile that CEO Rosenwald, in particular, has repeatedly stated that they want to achieve by acquiring undiscovered but still proven (clinical studies in humans), cheap and multiple assets that then contribute with a significant diversification into multiple clinical assets in multiple subsidiaries where the combined strength of knowledge can be specified.

“We search for and find assets where others fail to look.”

“There are far more quality drug candidates than there are people and capital to develop them, and that gap has grown significantly over the past couple of years.”

“We’ve always been incredibly selective with our acquisitions, and now the bar is higher because there are more opportunities available.”

“Our model is designed to try to decrease risk and expense while at the same time creating a regular flow of value-creating events for our shareholders.”

“… , all Fortress Biotech cares about is the drug in the clinic. We look at whether it treats an unmet need, if we can get a good return, and if it’s good for society. We call experts to learn more about the disease and figure out if there’s a market for it. We’re interested in drug candidates that are furthest along and have good human data.”

“I see five or six new opportunities a day. There are new drugs going into the clinic every day, so there are many opportunities, and we’re very selective.”

“Fortress Biotech often jumps in at a later stage of the drug development process, so we’re not starting from square one. We are very risk averse. We work hard upfront to find things that will work, though sometimes we’ll identify fixable issues and take care of them ourselves.”

“No matter how big the company is, they have to live within their budget. Giant companies are always reprioritising. At least 10 to 20 companies drop major programmes every year. If you’re there at the right time, you can pick up these assets at very favourable terms.”

“We have a thorough due diligence process that often costs around half a million dollars. Data show that only 70 percent of drugs move from Phase 1 trials to Phase 2, and only 33 percent of those go from Phase 2 to Phase 3. It’s a long, expensive process, and we have to be confident that we’re going to generate a return and help meet patients’ needs.”

These quotes only give an indication of the strategy, I prefer to listen directly from the source. If you are like me, I recommend first going back to my first part here on substack and listening/watching the 4 video presentations/interviews.

When it comes to the strategy and approach within it and the market for it, Fortress also refers to it in a couple of pages in the latest investor presentation (June 2025), here are two examples (P.23-24):

(4)

But it's arguable that this, buy low – sell high, is what all small cap companies in this sector are trying to do? Sure, so it's the execution that will matter to Fortress as well as its competitors. So, let's now take a closer look at Fortress' execution in today's key assets. Let’s start with the initial upfront payments.

2. Acquisitions - Upfront Payments

Drug – Upfront Payment – Licensed Countries

Dotinurad - $0M - 98-99 Countries

(after Dotinurad was approved in Japan with efficacy/safety data on over 1000 people)

CUTX-101 - $0.1M – Global

(the price also includes AAV-ATP7A, a CUTX-101 2.0 with gene therapy, that remains in Cyprium's ownership and pipeline today)

Triplex - $0.15M – Global

(of which Triplex was one of two assets at this price)

CAEL-101 - $0.219M – Global

UNLOXCYT - $0.5M – Global

(of which UNLOXCYT was one of three assets at this price)

EMROSI - $2M – All countries in the world except Brazil, Russia, India and China

(at that time EMROSI already had P2 results that were significantly better than Standard of Care for the last two decades in ORACEA which has been unthreatened by competition in its niche during this time)

Total: $2.969M

Comments

So far "only" upfront payments, but, based on my two previous posts about the study results for these drugs today, the market, and what some have already brought in financially, all of these individual and initial purchases are beyond impressive. All the sums together and the low figure are barely understandable and almost too good to be true. Now I am also aware that it is the total sum (we will get to them later) and the ratio between income and expenses that Fortress and its subsidiaries and shareholders should and will be assessed. However, this does not take away from the favourable initial conditions that Fortress management gives themselves, the subsidiaries and shareholders with these low upfront payments, unless in the long run they are so "back-heavy" that the total profit may be low given the costs and risks along the way to a possible commercialization stage.

3. Acquisitions – Full Details

This section will be based on quotes from sources of deal flow and how it changes over time in each drug. However, there will be some of my own parts primarily to explain to the reader, and even a small portion of my own opinions (although I have tried to save most of it for the discussion section). I have tried to focus on the financial part that is only directed towards these 6 drugs but have also included a couple of company-specific decisive events that have affected subsidiaries both positively and negatively for relevance to the summary later. As for Dotinurad and CAEL-101, it was easy given that they were alone in the pipeline and for CUTX-101, Triplex, UNLOXCYT and EMROSI somewhat more difficult given a broader pipeline from the start or over time. It has therefore not been possible to find out the development costs for these drugs to date.

Also note that this part will not focus on the clinical development facts of each drug as they have either already been touched upon by me in previous substack posts (parts 1-2) or the plan is to do so in the future (Triplex & Dotinurad).

If you as a reader trust the research presented (although I cannot guarantee that I got it right or with all the valuable details) and just want the summary, you can skip ahead to the next point. However, if you want to read this part, focus on the details carefully, as the quotes may be perceived as repetitive, even though details in various deals have changed and thus also in the texts.

a. Dotinurad

Urica Therapeutics name before shift to Urica:

FBIO Acquisition Corp. VIII 2017 Incentive Plan

UR-1 Therapeutics

Dotinurad

“Through our partner company UR-1, in May 2021, we acquired an exclusive license from Fuji Yakuhin Co. Ltd. (“Fuji”) to develop Dotinurad in North America and Europe. Dotinurad is a potential best-in-class urate transporter (URAT1) inhibitor for gout and possibly other hyperuricemic indications. Dotinurad (URECE® tablet) was approved in Japan in 2020 as a once-daily oral therapy for gout and hyperuricemia. Dotinurad was efficacious and well-tolerated in more than 500 Japanese patients treated for up to 58 weeks in Phase 3 clinical trials.

In December 2021, UR-1 filed an IND with the FDA. UR-1 expects to initiate a Phase 1 clinical trial to evaluate Dotinurad for the treatment of gout in the first half of 2022.”

Fortress Biotech Annual Report 2021 (P.12)

“In December 2022, Urica commenced an offering of 8% Cumulative Convertible Class B Preferred Stock (“Urica Preferred Offering”) in an aggregate maximum amount of $5.0 million. Urica issued an aggregate of 101,334 Class B Preferred shares at a price of $25.00 per share, for gross proceeds of $2.5 million. Following the payment of placement agent fees and other expenses of $0.3 million, Urica received $2.2 million in net proceeds.”

Fortress Biotech Annual Report 2022 (P.83)

“In May 2021, Urica entered into an exclusive license agreement with Fuji Yakuhin Co. Ltd. (“Fuji”) to develop Dotinurad in North America, Europe, and the UK. Dontinurad is approved for the treatment of gout and hyperuricemia in Japan. The license agreement includes contingent regulatory and commercial milestone payments totaling up to $88 million with subsequent sales royalties ranging from approximately 7% to approximately 10% payable on net sales of Dotinurad. Urica paid a $3.0 million milestone payment in December 2021 upon IND submission of Dotinurad.

In December 2022 Urica Therapeutics expanded its exclusive license agreement with Fuji for the development of Dotinurad to include the Middle East and North Africa (“MENA”) and Turkey territories. The amendment to the exclusive license agreement included a one-time amendment payment of $0.3 million, which was paid in December 2022.”

Fortress Biotech Annual Report 2022 (P.114)

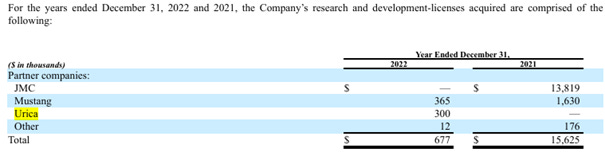

This image confirms that Ulrica did not pay any upfront for the first license part in 2021 for North America, Europe, and the UK but only for the second in 2022 including the Middle East and North Africa (“MENA”) and Turkey territories. Hence the $0 upfront in May 2021 which first rose to $3M at the IND filing in December 2021 + $0.3M in December 2022 for the above license deal:

Fortress Biotech Annual Report 2022 (P.113)

Urica 8% Cumulative Convertible Class B Preferred Offering

“In December 2022 and February 2023, Urica closed private offerings of its 8% Cumulative Convertible Class B Preferred Stock (the “Urica Preferred Stock”), at a price of $25.00 per share (“Subscription Price”) pursuant to which it sold a total of 135,494 shares of Preferred Stock for gross proceeds of $3.4 million, before deducting underwriting discounts and commissions and offering expenses of approximately $0.5 million (the “Urica Offering”). A non-cash contingent warrant value of $0.1 million was also recorded in debt discount (see Note 6).

Dividends on the Urica Preferred Stock are payable monthly by Fortress in shares of Fortress Common Stock based upon a 7.5% discount to the average trading price over the 10-day period preceding the dividend payment date. Dividends are recorded as interest expense. For the year ended December 31, 2023, the Company recorded expense of $0.3 million associated with the Urica dividends owed on the outstanding Urica Preferred Stock.

The shares mandatorily convert into Urica common stock upon either: (i) a qualified financing pursuant to which Urica raises at least $20 million in aggregate gross proceeds; or (ii) a sale of Urica (in each case, at a 20% discount to the lowest price per share at which Urica common stock is issued/sold in such transaction). Additionally, in the event that neither such a qualified financing nor a sale of Urica has occurred prior to June 27, 2024, then each holder of Urica Preferred Stock is eligible to receive, at Fortress’ election, one of: (x) a cash payment equal to the product of the Subscription Price and the number of shares of Urica Preferred Stock held by such holder; (y) a number of shares of Fortress common stock equal to the Fortress Share Exchange Amount; or (z) a combination of the foregoing (in each case plus cash in lieu of any fractional shares, plus cash in lieu of accumulated and unpaid dividends otherwise payable in Fortress shares up to the conversion/exchange date).”

Fortress Biotech Annual Report 2023 (P.124-125)

“Through our subsidiary Urica Therapeutics, Inc. (“Urica”), we acquired an exclusive license from Fuji Yakuhin Co. Ltd. (“Fuji”) to develop a URAT1 inhibitor product candidate in development for the treatment of gout, dotinurad, in North America, Europe, the Middle East and North Africa. In July 2024, Urica entered into an asset purchase agreement, royalty agreement, and related agreements (collectively, the “Transaction Documents”) with Crystalys Therapeutics, Inc. (“Crystalys”). Crystalys is a Delaware corporation founded in 2023 and seeded by leading life sciences institutional investors. Under the Transaction Documents, Urica transferred rights to dotinurad and related intellectual property, licenses and agreements to Crystalys. In return, Crystalys issued to Urica shares of its common stock equal to 35% of Crystalys’ outstanding equity including certain anti-dilution provisions through the raise of $150 million in equity securities. The Transaction Documents also granted Urica a secured 3% royalty on future net sales of dotinurad to be paid by Crystalys, and a right to receive nominal cash reimbursement payments for certain clinical and development costs incurred by Urica related to dotinurad.”

Fortress Biotech Annual Report 2024 (P.12)

Agreement with Crystalys Therapeutics, Inc (“Crystalys”)

“On July 15, 2024, Urica entered into an asset purchase agreement (the “APA”), royalty agreement (the “Royalty Agreement”), and related agreements (collectively, the “Transaction Documents”) with Crystalys, a Delaware corporation incorporated in 2022 and seeded by life sciences institutional investors. Under the Transaction Documents, Urica sold the rights to its URAT1 inhibitor product candidate (see Note 7) in development for the treatment of gout, dotinurad, and related intellectual property, licenses and agreements to Crystalys. In return, Crystalys issued to Urica shares of its common stock equal to 35% of Crystalys’ outstanding equity. Urica’s equity position cannot be reduced below 15% of Crystalys’ fully-diluted equity capitalization until it raises $150 million in equity securities.

The Transaction Documents also grant Urica a secured three percent (3%) royalty on future net sales of dotinurad to be paid by Crystalys, as well as the right to receive $0.6 million cash reimbursement for certain clinical and development costs incurred by Urica related to dotinurad. Urica has the right to appoint one director to the board of directors of Crystalys, as well as an additional board observer. Crystalys is obliged to use commercially reasonable efforts to develop and commercialize dotinurad.

The APA also gives Urica the right, but not the obligation, to repurchase the sold assets for a repurchase price not to exceed $6.4 million plus accrued interest; in the event that Crystalys has not consummated a qualified financing of at least $120 million before January 8, 2026. Urica recorded a liability for the $0.6 million received, which will be accreted up to the repurchase price over the term of the repurchase option, and will not recognize an asset for its ownership interest received in Crystalys until the expiration of the repurchase option. Accordingly, for the year ended December 31, 2024, Urica recorded accretion of $0.7 million of the repurchase option price, booked to interest expense in the condensed consolidated statement of operations.”

Fortress Biotech Annual Report 2024 (P.138-139)

“Urica’s outstanding contingently issuable placement agent warrants were exchanged at the time of the exchange of the Urica 8% Cumulative Convertible Class B Preferred Stock on June 27, 2024 (see Note 9) for 202,834 warrants to purchase Fortress common stock at an exercise price of $1.68. The Fortress common stock warrants have a five-year life, expiring on June 27, 2029. The Company determined the placement agent warrants met the criteria for equity classification. At December 31, 2024 and 2023, the value of Urica’s contingent payment warrant was nil and $0.2 million, respectively, and was recorded on the consolidated balance sheet.”

Fortress Biotech Annual Report 2024 (P.143)

Under clauses 4.3 (a) and 5.2(c)(iii) of the license agreement between Urica and Crystalys, it is stated that Urica transfers all rights and obligations related to the acquired assets to Crystalysys, i.e. any future milestones and royalties to Fuji.

(5)

b. CUTX-101

”Cyprium is a clinical-stage biopharmaceutical company focused on the development of novel therapies for the treatment of Menkes disease and related copper metabolism disorders. In March 2017, Cyprium and the Eunice Kennedy Shriver National Institute of Child Health and Human Development (“NICHD ”), part of the NIH, executed a Cooperative Research and Development Agreement (“CRADA ”) to advance the clinical development of Phase 3 candidate CUTX-101 (copper histidinate injection) for the treatment of Menkes disease. Cyprium and NICHD also entered into a worldwide, exclusive license agreement to develop and commercialize AAV-based ATP7A gene therapy for use in combination with CUTX-101 for the treatment of Menkes disease and related copper transport disorders. Originally incorporated on June 18, 2014, Cyprium is a Delaware corporation and a majority-owned subsidiary of Fortress.”

Fortress Biotech Annual Report 2017 (P.6)

“Cyprium’s purchase of $0.1 million for a worldwide, exclusive license from the NIH to develop and commercialize an AAV based gene therapy, called AAV ATP7A, for the treatment of Menkes disease”

Fortress Biotech Annual Report 2017 (P.49)

Fortress Biotech Annual Report 2017 (P.107)

“In January 2019, Cyprium received notification from the FDA that the sponsorship of the Investigational New Drug (“IND”) Application for CUTX-101 was successfully transferred to Cyprium.”

Fortress Biotech Annual Report 2019 (P. 5)

“Cyprium made an upfront payment of $0.1 million to NICHD upon execution of the exclusive license. NICHD is eligible to receive payments of up to an aggregate of approximately $1.7 million upon Cyprium’s successful achievement of certain clinical development and regulatory milestones for each licensed product, in addition to $1 million upon first commercial sale of a product candidate. In addition, in the event Cyprium sells a Priority Review Voucher that it receives from the FDA in connection with the approval of one of its product candidates (a “PRV”) to a third party, it is obligated to pay to NIH 20% of the proceeds that it receives from such third party with respect to the first PRV sold, and 15% of the proceeds with respect to the second PRV sold. In the alternative, in the event Cyprium redeems a PRV in connection with seeking priority review for one of its product candidates, Cyprium will be obligated to pay NIH $15 million. For the years ended December 31, 2019 and 2018, no expense was recorded in connection with this license.”

Fortress Biotech Annual Report 2019 (P.81)

“On February 24, 2021, Cyprium announced the execution of an asset purchase agreement with Sentynl Therapeutics, Inc. (“Sentynl”), a U.S.-based specialty pharmaceutical company owned by the Zydus Group. The asset purchase agreement commits Sentynl to an upfront cash payment to Cyprium of $8.0 million, which was paid upon execution of the agreement, and $12.0 million in future development and regulatory cash milestones through NDA approval, as well as potential sales milestones. Royalties on CUTX-101 net sales ranging from the mid-single digits up to the mid twenties are also payable. Cyprium will retain development responsibility of CUTX-101 through approval of the NDA by the FDA, and Sentynl will be responsible for commercialization of CUTX-101 as well as progressing newborn screening activities. Continued development of CUTX-101 will be overseen by a Joint Steering Committee consisting of representatives from Cyprium and Sentynl. Cyprium will retain 100% ownership over any FDA priority review voucher that may be issued at NDA approval for CUTX-101.”

Fortress Biotech Annual Report 2020 (P.7)

“On February 24, 2021, Cyprium announced the execution of an asset purchase agreement with Sentynl Therapeutics, Inc. (“Sentynl”), a U.S.-based specialty pharmaceutical company owned by the Zydus Group. The asset purchase agreement commits Sentynl to an upfront cash payment to Cyprium of $8.0 million for development, a $3.0 million cash milestone payment at NDA acceptance, the purchase price of $9.0 million, as well as potential sales milestones totaling $255.0 million. Royalties on CUTX-101 net sales range from the mid-single digits up to the mid-twenties are also payable. Cyprium will retain development responsibility of CUTX-101 through approval of the NDA by the FDA, and Sentynl will be responsible for commercialization of CUTX-101 as well as progressing newborn screening activities. Continued development of CUTX-101 will be overseen by a Joint Steering Committee consisting of representatives from Cyprium and Sentynl. Cyprium will retain 100% ownership over any FDA priority review voucher that may be issued at NDA approval for CUTX-101.”

Fortress Biotech Annual Report 2020 (P.161)

“In September 2020, we closed a private offering of Cyprium’s 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock for gross proceeds of $8.0 million.”

Fortress Biotech Annual Report 2020 (P.72)

Fortress Biotech Annual Report 2020 (P.147)

“In February 2021, our partner company, Cyprium, and Sentynl signed a Development and Asset Purchase Agreement for CUTX 101 for the treatment of Menkes disease. Under the terms of the agreement, Cyprium received $8 million upfront to fund the development of CUTX-101 and could receive up to $12 million in regulatory milestone payments through NDA approval, and is eligible to receive sales milestones plus royalties. Royalties start from mid-single digits, scaling up to 25% on sales exceeding $100 million annually.”

Fortress Biotech Annual Report 2021 (P. 68)

“Following the transfer of CUTX-101 to Sentynl (if any), Cyprium would remain eligible to receive up to $255.0 million in additional sales milestone payments (payable pursuant to five milestones), as well as royalties on CUTX-101 net sales ranging from mid-single digits up to the mid-twenties. Cyprium would retain 100% ownership over any FDA Priority Review Voucher that may be issued at NDA approval for CUTX-101.

The Company determined that this agreement falls within the scope of ASC 606-10-15-3 and ASC 808-10-15-5A Revenue from Collaborative Arrangements (“ASC 808”) and as such the Company will recognize revenue in connection with achievement of two future development milestone payments.

In connection with the $8.0 million upfront payment to Sentynl, the Company is recognizing revenue using an input method based upon the costs incurred to date in relation to the total estimated costs to complete the development activities. Accordingly, revenue is being recognized over the period in which the development activities are expected to occur. For the year ended December 31, 2021, the Company recognized revenue of $5.4 million. No revenue was recognized in connection with this agreement in 2020.”

Fortress Biotech Annual Report 2021 (P.112)

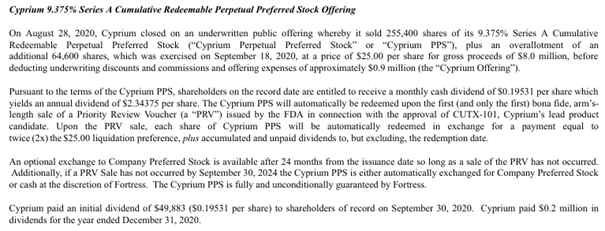

“Cyprium On August 28, 2020, Cyprium closed on an underwritten public offering whereby it sold 255,400 shares of its 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock (“Cyprium Perpetual Preferred Stock” or “Cyprium PPS”), plus an overallotment of an additional 64,600 shares, which was exercised on September 18, 2020 at a price of $25.00 per share for gross proceeds of $8.0 million, before deducting underwriting discounts and commissions and offering expenses of approximately $0.9 million (the “Cyprium Offering”). Pursuant to the terms of the Cyprium PPS, shareholders on the record date are entitled to receive a monthly cash dividend of $0.19531 per share which yields an annual dividend of $2.34375 per share. The Cyprium PPS will automatically be redeemed upon the first (and only the first) bona fide, arm’s-length sale of a Priority Review Voucher (a “PRV”) issued by the FDA in connection with the approval of CUTX 101, Cyprium’s lead product candidate. Upon the PRV sale, each share of Cyprium PPS will be automatically redeemed in exchange for a payment equal to twice (2x) the $25.00 liquidation preference, plus accumulated and unpaid dividends to, but excluding, the redemption date.

An optional exchange to Company Preferred Stock is available after 24 months from the issuance date so long as a sale of the PRV has not occurred. Additionally, if a PRV Sale has not occurred by September 30, 2024 the Cyprium PPS is either automatically exchanged for Company Preferred Stock or cash at the discretion of Fortress. The Cyprium PPS is fully and unconditionally guaranteed by Fortress.

Cyprium paid $0.7 million in dividends for the year ended December 31, 2021, and $0.2 million in dividends for the year ended December 31, 2020, including the initial dividend of $49,883 ($0.19531 per share) paid to shareholders of record on September 30, 2020.”

Fortress Biotech Annual Report 2021 (P.134-135)

“Royalties on CUTX-101 net sales ranging from the mid-single digits up to the mid-twenties are also payable. All of the foregoing milestone and royalty payments are subject to 50% diminution in the event Sentynl decides, at its option, to assume development control of CUTX-101 during the 45-day period beginning on September 30, 2023. Under the asset purchase agreement, Cyprium retains development responsibility of CUTX-101 (subject to the aforementioned right by Sentynl to assume development) and Sentynl will be responsible for commercialization of CUTX-101 as well as progressing newborn screening activities. Continued development of CUTX-101 is overseen by a Joint Steering Committee consisting of representatives from Cyprium and Sentynl. Cyprium will in any event retain 100% ownership over any FDA priority review voucher that may be issued at NDA approval for CUTX 101.”

Fortress Biotech Annual Report 2022 (P. 9)

“Cyprium is currently in a dispute with its contract manufacturing organization (the “CMO”), regarding the CMO’s attempt to terminate a Master Services Agreement (together with related work orders, the “MSA”) between Cyprium and the CMO. Cyprium believes the CMO’s grounds for purporting to terminate the MSA are without merit and is currently availing itself of all appropriate legal remedies in efforts to ensure that the CMO abides by its obligations under the MSA and/or to pursue monetary damages claims against the CMO. To that end, Cyprium obtained a temporary restraining order in August 2022 and a preliminary injunction in September 2022 from a court in New York State; the injunction invalidated the CMO’s attempted termination of the MSA and prohibited the CMO from further attempts to terminate the MSA during the pendency of dispute resolution procedures, which are ongoing.”

Fortress Biotech Annual Report 2022 (P. 9)

“On February 24, 2021, Cyprium entered into a development and asset purchase agreement (the “Sentynl APA”) with Sentynl, a U.S.-based specialty pharmaceutical company owned by the Zydus Group. Under the Sentynl APA, Sentynl provided $8.0 million of upfront development funding for Cyprium’s CUTX-101 program, with Cyprium remaining in control of development of such program; upon approval of the NDA for CUTX-101 by the FDA, Cyprium would be obligated to assign the NDA and certain other assets pertaining to the CUTX-101 program to Sentynl, after which point Sentynl would commercialize the drug and owe Cyprium royalties and regulatory and sales milestones.

The Sentynl APA contained an alternative “Approval Deadline Transfer” mechanism pursuant to which, in the event that CUTX-101 NDA approval had not been obtained by September 30, 2023, then Sentynl could elect, during the subsequent 45-day period, to assume control over development of CUTX-101 by effecting a Closing under the Sentynl APA. Cyprium received notice of Sentynl’s election to effect the Approval Deadline Transfer during such 45-day period, and the Closing of such transfer occurred in December 2023. The Approval Deadline Transfer obligated Sentynl to pay Cyprium $4.5 million in connection with the Closing, which was received by Cyprium in December 2023 and recorded as collaboration revenue by Fortress in its consolidated statements of operations for the year ended December 31, 2023. There are no further obligations required by Cyprium in regards to the $4.5 million.

Following such Closing, Sentynl is obligated to use commercially reasonable efforts to develop and commercialize CUTX-101, including the funding of the same. Additionally, Cyprium remains eligible to receive up to $129 million in aggregate development and sales milestones under the Agreement, and royalties on net sales of CUTX-101 as follows: (i) 3% of annual net sales up to $75 million; (ii) 8.75% of annual net sales between $75 million and $100 million; and (iii) 12.5% of annual net sales in excess of $100 million. Cyprium will retain 100% ownership over any FDA priority review voucher that may be issued at NDA approval for CUTX-101.

With respect to the $8.0 million upfront payment from Sentynl received in 2021, the Company recognized revenue over the period in which the development activities occurred using an input method based upon the costs incurred to date in relation to the total estimated costs to complete the development activities. As of the date of the Approval Deadline Transfer, the revenue related to the upfront payment has been fully recognized. For the years ended December 31, 2023 and 2022, the Company recognized revenue from this arrangement of $0.7 million and $1.9 million, respectively.”

Fortress Biotech Annual Report 2023 (P. 113)

Cyprium 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock Dividend Obligation

“Pursuant to a private placement in August 2020, Cyprium sold shares of its 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock (“Cyprium PPS”); as of December 31, 2023, there are 300,600 shares of Cyprium PPS outstanding.

Pursuant to the terms of the Cyprium PPS, shareholders on the record date are entitled to receive a monthly cash dividend of $0.19531 per share which yields an annual dividend of $2.34375 per share. The Cyprium PPS will automatically be redeemed upon the first (and only the first) bona fide, arm’s-length sale of a Priority Review Voucher (a “PRV Sale”) issued by the FDA in connection with the approval of CUTX-101, a product candidate previously developed by Cyprium. Upon the PRV Sale, each share of Cyprium PPS will be automatically redeemed in exchange for a payment equal to twice the $25.00 liquidation preference, plus accumulated and unpaid dividends to, but excluding, the redemption date.

An optional exchange for Fortress Series A Preferred Stock is available after 24 months from the issuance date so long as a sale of the PRV has not occurred. Additionally, if a PRV Sale has not occurred by September 30, 2024, the Cyprium PPS is either automatically exchanged for Fortress Series A Preferred Stock or cash at the discretion of Fortress. The Cyprium PPS is fully and unconditionally guaranteed by Fortress.”

Fortress Biotech Annual Report 2023 (P. 142)

“In January 2025, we announced that the FDA had accepted the NDA for CUTX-101, a copper histidinate injection, for priority review for the treatment of Menkes disease. The Prescription Drug User Fee Act (“PDUFA”) target action date is September 30, 2025 and the candidate has been granted Rare Pediatric Disease Designation by the FDA for the treatment of Menkes disease, Fast Track Designation for classic Menkes disease in patients who have not demonstrated significant clinical progression, and Breakthrough Therapy Designation.

Cyprium is eligible to receive up to $129 million in aggregate development and sales milestones from its partner Sentynl Therapeutics, Inc. (“Sentynl”), as well as royalties on net sales of CUTX-101 as follows: (i) 3% of annual net sales up to $75 million; (ii) 8.75% of annual net sales between $75 million and $100 million; and (iii) 12.5% of annual net sales in excess of $100 million. Cyprium will retain 100% ownership over any FDA priority review voucher that may be issued if the NDA for CUTX-101 is approved.”

Fortress Biotech Annual Report 2024 (P. 8)

“In December 2024, the NDA for CUTX-101 was accepted by the FDA. The NDA, which has been granted Priority Review, has an assigned Prescription Drug User Fee Act (“PDUFA”) target action date of September 30, 2025. Cyprium received a milestone payment of $1.5 million from Sentynl that was due upon NDA acceptance, which was recorded as collaboration revenue by Fortress in its Consolidated Statements of Operations for the year ended December 31, 2024.”

Fortress Biotech Annual Report 2024 (P. 138)

“If a PRV Sale has not occurred by March 31, 2026 (the “Exchange Date), the Cyprium PPS will automatically be exchanged for Fortress Series A Preferred Stock or cash, at the discretion of Fortress.”

Fortress Biotech Annual Report 2024 (P. 172)

c. Triplex

License Agreement with the City of Hope

“On April 2, 2015, Helocyte entered into an agreement with COH to secure the exclusive license to the worldwide rights for two T-cell immunotherapeutic vaccines, known as Triplex and PepVax, for controlling CMV in HSCT and SOT recipients, for an upfront payment of $150,000. As further consideration for the license, Helocyte is to grant to COH, upon their acceptance of the terms of the grant, 500,000 shares of Helocyte common stock. Triplex and PepVax have now both entered into Phase 2 clinical studies, with PepVax expected to enroll patients later this year. Both programs are supported by grants paid and payable to COH by the National Cancer Institute. In connection with the licensing of Triplex and PepVax, Helocyte further entered into an option for exclusive worldwide rights to Pentamer, a universal immunotherapeutic vaccine being developed for the prevention of CMV transmission in utero. On April 28, 2015, Helocyte exercised the option and secured exclusive worldwide rights to the Pentamer vaccine from COH for an upfront payment of $50,000. If Helocyte successfully develops and commercializes PepVax, Triplex and Pentamer, COH will receive additional milestone and other payments. During the year ended December 31, 2015, Helocyte recorded an expense of $0.2 million in research and development-licenses acquired on the Consolidated Statements of Operations.”

Fortress Biotech Annual Report 2015 (P.68)

“In February 2016, Helocyte paid $1.0 million to enter into a Clinical Trial Agreement with the City of Hope National Medical Center, to support a Phase 2 clinical study of its Triplex vaccine for CMV control in allogeneic stem cell transplant recipients. The Phase 2 study is additionally supported by grants from the National Institutes of Health / National Cancer Institute. Helocyte expects data to emerge from this Phase 2 clinical study in the first half of 2017.”

Fortress Biotech Annual Report 2015 (P.86)

“If DiaVax exercises its option, and successfully develops and commercializes PepVax, Triplex and Pentamer, City of Hope could receive in excess of $100MM in upfront, milestone and other payments.”

(6)

Fortress Biotech Annual Report 2016 (P.38)

“If Helocyte successfully develops and commercializes Triplex, COH could receive up to $9.0 million for the achievement of three developmental milestones, $26.0 million for three sales milestones, single digit royalties based on net sales reduced by certain factors and a minimum annual royalty of $0.75 million per year following a first marketing approval.”

Fortress Biotech Annual Report 2016 (P.89)

Fortress Biotech Annual Report 2016 (P.90)

Helocyte Convertible Notes

“During 2016 Helocyte entered into an agreement with Aegis Capital Corp. (“Aegis ”) to raise up to $5.0 million in convertible notes. The notes have an initial term of 18 months, which can be extended at the option of the holder, on one or more occasions, for up to 180 days and accrue simple interest at the rate of 5% per annum for the first 12 months and 8% per annum simple interest thereafter. The notes are guaranteed by Fortress. The outstanding principal and interest of the notes automatically converts into the type of equity securities sold by Helocyte in the next sale of equity securities in which Helocyte realizes aggregate gross cash proceeds of at least $10.0 million (before commissions or other expenses and excluding conversion of the notes) at a conversion price equal to the lesser of (a) the lowest price per share at which equity securities of Helocyte are sold in such sale less a 33% discount and (b) a per share price based on a pre-offering valuation of $50.0 million divided by the number of common shares outstanding on a fully-diluted basis. The outstanding principal and interest of the notes may be converted at the option of the holder in any sale of equity securities that does not meet the $10.0 million threshold for automatic conversion using the same methodology. The notes also automatically convert upon a “Sale” of Helocyte, defined as (a) a transaction or series of related transactions where one or more non-affiliates acquires (i) capital stock of Helocyte or any surviving successor entity possessing the voting power to elect a majority of the board of directors or (ii) a majority of the outstanding capital stock of Helocyte or the surviving successor entity (b) the sale, lease or other disposition of all or substantially all of Helocyte’s assets or any other transaction resulting in substantially all of Helocyte’s assets being converted into securities of another entity or cash. Upon a Sale of Helocyte, the outstanding principal and interest of the notes automatically converts into common shares at a price equal to the lesser of (a) a discount to the price per share being paid in the Sale of Helocyte equal to 33% or (b) a conversion price per share based on a pre-sale valuation of $50.0 million divided by the fully-diluted common stock of Helocyte immediately prior to the Sale of Helocyte (excluding the notes).

As of December 31, 2016, Helocyte realized net proceeds in its four separate closings of $3.9 million after paying Aegis, its placement fee of $0.4 million, or approximately 10% of the net proceeds, and legal fees of approximately $0.1 million. Additionally, Aegis received warrants (“Helocyte Warrants ”) to purchase the number of shares of Helocyte’s common stock equal to $0.4 million, divided by the price per share at which any note sold to investors first converts into Helocyte’s common stock. The warrants are issued at each closing. The Helocyte Warrants, which were recorded as a liability in accordance with ASC 815, have a five-year term and have a per share exercise price equal to 110% of the price per share at which any note sold to investors first converts into Helocyte’s common stock. The Offering expired on December 31, 2016.”

Fortress Biotech Annual Report 2016 (P.93-94)

“We Have Processed Over $50B In Capital Markets Transactions” - Aegis Capital

“During 2016 Helocyte entered into an agreement with Aegis Capital Corp. (“Aegis ”) to raise up to $5.0 million in convertible notes. The notes have an initial term of 18 months, which can be extended at the option of the holder, on one or more occasions, for up to 180 days and accrue simple interest at the rate of 5% per annum for the first 12 months and 8% per annum simple interest thereafter. These notes are recorded at fair value, which approximated $4.7 million at December 31, 2017. On January 1, 2018 the first $1.0 million tranche matured and was paid.”

Fortress Biotech Annual Report 2017 (P.55)

“During the first quarter of 2018, Helocyte elected to discontinue the further development of its HLA-restricted, single-antigen PepVax program and as such will cease to incur costs associated with this program.”

Fortress Biotech Annual Report 2018 (P.97)

“During the twelve months ended December 31, 2018, the Helocyte Convertible Notes matured, and were all repaid in full.”

Fortress Biotech Annual Report 2018 (P.103)

“If Helocyte successfully develops and commercializes Triplex, COH is eligible to receive up to $3.7 million related to three financial milestones, $7.5 million in development milestones for the remaining two development milestones and up to $26.0 million in three milestones related to net sales for each licensed product.”

Fortress Biotech Annual Report 2019 (P.82)

“For the twelve months ended December 31, 2019 and 2018, Helocyte recorded nil and $1.5 million respectively in research and development - licenses acquired on the Consolidated Statement of Operations in connection with this license. The expense recorded in 2018 was in connection to the achievement of the development milestone related to the completion of the Phase 2 clinical study for Triplex.”

Fortress Biotech Annual Report 2019 (P.82)

d. CAEL-101

“Caelum’s payments totaling $0.2 million for worldwide license rights to CAEL-101”

(on page 101 the exact figure is given as 0.219, so I assume this is a rounded number)

Fortress Biotech – Annual Report 2017 (P.49, 101)

“In January 2017, Caelum entered into an exclusive license agreement with Columbia University (“Columbia”) to secure worldwide license rights to CAEL-101 (11-1F4), a chimeric fibril-reactive monoclonal antibody (mAb) being evaluated in a Phase 1a/1b study for the treatment of amyloid light chain (“AL”) amyloidosis. This transaction was accounted for as an asset acquisition pursuant to ASU 2017 01, Business Combinations (Topic 805): Clarifying the Definition of a Business, as the majority of the fair value of the assets acquired was concentrated in a group of similar assets, and the acquired assets did not have outputs or employees. Caelum made an upfront payment of approximately $0.2 million to Columbia upon execution of the exclusive license and also granted Columbia 1,050,000 shares of Common Stock, representing 10% ownership of Caelum, as of such date valued at $29,000 or $0.028 per share utilizing an Option pricing Method Equity Allocation model, applying a volatility of 70%, a risk free rate of return of 1.93%, a term of 5 years and a discount for lack of marketability of 49.5%.

Under the terms of the agreement, Columbia is eligible to receive additional milestone payments of up to $5.5 million upon the achievement of certain development milestones, in addition to royalty payments for sales of the product. CAEL-101 is a novel antibody being developed for patients with AL Amyloidosis, a rare systemic disorder caused by an abnormality of plasma cells in the bone marrow.”

Fortress Biotech Annual Report 2017 (P.103-104)

Fortress Biotech Annual Report 2017 (P.118)

“On March 12, 2018, Caelum entered into a Sponsored Research Agreement with Columbia University to conduct preclinical research in connection with CAEL-101. The total cost of the study approximates $0.1 million. For the year ended December 31, 2018, Caelum recorded expense of approximately $0.1 million in connection with the agreement. The expense was recorded in research and development expense in the Company’s Consolidated Statements of Operations. No expense related to this Agreement was recorded in 2017.”

Fortress Biotech Annual Report 2018 (P.97)

“In January 2019, Caelum Biosciences, Inc. (“Caelum”) signed an agreement with Alexion Pharmaceuticals, Inc. (“Alexion”) (NASDAQ: ALXN) to advance the development of CAEL-101. Under the terms of the agreement, Alexion purchased a 19.9% minority equity interest in Caelum for $30 million. Additionally, Alexion agreed to make potential payments to Caelum upon the achievement of certain developmental milestones, in exchange for which Alexion obtained a contingent exclusive option to acquire the remaining equity in the company. The agreement also provides for potential additional payments, in the event Alexion exercises the purchase option, for up to $500 million, which includes an upfront option exercise payment and potential regulatory and commercial milestone payments.”

Fortress Biotech Annual Report 2018 (P.40)

“During 2019, Caelum’s convertible notes were converted into Common shares of Caelum”

Fortress Biotech Annual Report 2018 (P.67)

Agreement with Alexion

“In January 2019, Caelum, a subsidiary of the Company, entered into a Development, Option and Stock Purchase Agreement (the “DOSPA”) and related documents by and among Caelum, Alexion Therapeutics, Inc. (“Alexion”), the Company and Caelum security holders parties there to (including Fortress, the “Sellers”). Under the terms of the agreement, Alexion purchased a 19.9% minority equity interest in Caelum for $30 million. Additionally, Alexion has agreed to make potential payments to Caelum upon the achievement of certain developmental milestones, in exchange for which Alexion obtained a contingent exclusive option to acquire the remaining equity in Caelum. The agreement also provides for potential additional payments, in the event Alexion exercises the purchase option, for up to $500 million, which includes an upfront option exercise payment and potential regulatory and commercial milestone payments. The Company deconsolidated its holdings in Caelum immediately prior to the execution of the DOSPA. Following the DOSPA execution, the Company owns approximately 40% of the issued and outstanding capital stock of Caelum. The following table provides a summary of the assets and liabilities of Caelum impacted by the deconsolidation:”

Fortress Biotech Annual Report 2019 (P.73)

Summary of the Agreement Between Caelum and Alexion

The deal is divided into four main components:

First-Stage Purchase: Alexion buys a portion of Caelum's shares for $30 million. This gives Alexion 19.9% of Caelum's total capitalization.

Subsequent Development Funding Payments: Alexion can pay up to an additional $30 million to Caelum based on Caelum's lead product candidate, CAEL-101, achieving certain development milestones.

Second-Stage Acquisition: Alexion gains an option to purchase all remaining equity of Caelum from all shareholders (including Fortress). The purchase price can be either $150 million or $200 million, depending on the timing of CAEL-101's BLA (Biologics License Application) approval.

Contingent Earn-Out Payments: If Alexion exercises the option to acquire Caelum, an additional up to $325 million could be paid to the shareholders. These payments are tied to CAEL-101 achieving certain regulatory and commercial milestones.

Alexion also gains influence in Caelum through a board seat and certain veto rights regarding key corporate decisions.

The total amount Fortress can receive from this deal depends on several factors and milestones. Since Fortress owns approximately 40% of Caelum, they will receive a proportional share of the payments.

Here's an estimate of the maximum potential amounts that could be distributed to shareholders, thus indicating what Fortress could receive:

From the First-Stage Purchase: Fortress will receive its share of the $30 million Alexion pays for the initial equity stake. (Fortress owns 40% of Caelum, so 40% of $30 million = $12 million).

Subsequent Development Funding Payments: Up to $30 million to Caelum. These are payments to the company for development and not directly to shareholders initially.

From the Second-Stage Acquisition (if option exercised): Between $150 million and $200 million. (Fortress's share would be 40% of this, i.e., between $60 million and $80 million).

From Contingent Earn-Out Payments: Up to $325 million if all regulatory and sales milestones are met. (Fortress's share would be 40% of this, i.e., up to $130 million).

This results in a potential maximum total sum of: $12 million + $80 million + $130 million = $222 million for Fortress, provided all milestones are achieved and Alexion exercises its option.

Fortress Biotech Annual Report 2019 (P.93)

“In December 2020, AstraZeneca (“AZ”) announced its intention to acquire Alexion, with the acquisition expected to close by the third quarter of 2021, as the acquisition is subject to approval by both AZ and Alexion shareholders, as well as certain regulatory approvals, share listing approvals, and other customary closing conditions. The acquisition of Alexion by AZ triggers the Change of Control clause in the Amended and Restated Development, Option and Stock Purchase Agreement entered into by and among Caelum, Alexion, the Company, and Caelum security holders, such that Alexion’s purchase option expires on the date that is six months after the closing of any Change of Control.”

Fortress Biotech Annual Report 2020 (P.69)

“On October 5, 2021, AstraZeneca acquired Caelum for an upfront payment of approximately $150 million paid to Caelum shareholders, of which approximately $56.9 million was paid to Fortress, net of the ten percent, 24-month escrow holdback amount and other miscellaneous transaction expenses. The agreement also provides for additional potential payments to Caelum shareholders totaling up to $350 million, payable upon the achievement of regulatory and commercial milestones. Fortress is eligible to receive 42.4% of all possible proceeds of the transaction, totaling up to approximately $212 million.”

Fortress Biotech Annual Report 2021 (P.10)

“On September 28, 2021 AstraZeneca notified Caelum of its intention to exercise its purchase option, and on October 5, 2021 AstraZeneca acquired Caelum. The Company received 42.4% of the distribution of proceeds from the option exercise price of $150 million, approximately $56.9 million, which is net of the 10%, 24-month escrow holdback and other miscellaneous transaction expenses. The Sellers currently remain eligible to receive up to an additional $350 million in contingent regulatory and commercial milestone payments, of which Fortress is eligible to receive 42.4% or approximately $148.6 million.”

Fortress Biotech Annual Report 2021 (P.112)

Fortress Biotech Annual Report 2023 (P.140)

University of Tennessee Research Foundation v. Caelum Biosciences, Inc.

“Caelum Biosciences, Inc. (“Caelum”), a former subsidiary of Fortress that was sold to AstraZeneca’s Alexion Pharmaceuticals, Inc. subsidiary (“Alexion”) in October 2021, was the defendant in a lawsuit brought by The University of Tennessee Research Foundation (“UTRF”) captioned as University of Tennessee Research Foundation v. Caelum Biosciences, Inc., No. 19-cv-00508, which was formerly pending in the United States District Court for the Eastern District of Tennessee (the “UTRF Litigation”). UTRF brought claims against Caelum, for, inter alia, trade secret misappropriation. UTRF primarily alleged that Caelum unauthorizedly used non-patent trade secrets owned by UTRF in the development of Caelum’s 11-1F4 monoclonal antibody, known as CAEL-101. Under the agreement pursuant to which Alexion acquired Caelum (as amended, the “DOSPA”), Fortress had certain indemnification obligations of Caelum pertaining to the UTRF litigation and maintained a consent right over any potential settlements of the UTRF litigation by Caelum.

On September 16, 2024, Caelum and UTRF entered into a stipulation with the court pursuant to which UTRF’s claims were dismissed without prejudice; on October 16, 2024, Caelum and UTRF entered into a definitive settlement agreement (the “UTRF-Caelum Settlement Agreement”) pursuant to which UTRF’s claims were dismissed with prejudice and Caelum agreed to make an upfront payment and additional potential milestone-based payments to UTRF. Fortress and the other sellers under the DOSPA are explicit releasees and third party beneficiaries under the UTRF-Caelum Settlement Agreement. In connection with the execution of the UTRF-Caelum Settlement Agreement, Caelum, Alexion and Fortress entered into an amendment to the DOSPA (the “DOSPA Amendment”), which, inter alia: (1) terminated any continuing indemnification by Fortress and the other sellers under the DOSPA in respect of the UTRF Litigation; (2) reduced the amounts of the potential future earn-out payments potentially owing to the sellers under the DOSPA (including Fortress) from an aggregate amount up to $350 million to an aggregate amount up to $295 million; (3) released to Caelum all amounts remaining in an escrow fund that had been established at the time of the Alexion acquisition to backstop potential indemnifiable damages, including those incurring under the UTRF Litigation (with 100% of such released amount constituting reimbursement for legal fees and other expenses incurred by Caelum in defending the UTRF Litigation); and (4) memorialized Fortress’ consent for Caelum to settle the UTRF Litigation. Neither the UTRF-Caelum Settlement Agreement nor the DOSPA Amendment implicates any out-of-pocket payment by Fortress or any other seller under the DOSPA. Fortress remains eligible to receive approximately $19 million upon regulatory approval of CAEL-101 and approximately $125 million in the aggregate across all remaining regulatory and sales milestones.”

Fortress Biotech Annual Report 2024 (P.167-168)

e. UNLOXCYT

Fortress Biotech Annual Report 2015 (P.67)

Anti-PD-L1 in this text refers to Cosibelimab which was given the name UNLOXCYT upon FDA approval. Since the agreement from the start was that UNLOXCYT would be included in the deal with Weiss TG Therapeutics (Checkpoint and TG shared an office) regarding the indication for hematological malignancies, I think it is fairest that the upfront payment is written as $1M - $0.5M = $0.5M.

“In December 2015, Checkpoint closed on gross proceeds of $57.8 million, before commissions and expenses, in a series of private placement equity financings. Net proceeds from this offering were approximately $51.5 million.”

Fortress Biotech Annual Report 2015 (P.6)

“Following this capital raise, the Company’s ownership in Checkpoint decreased to 37.7%. Since the Company’s ownership of Checkpoint is through Class A Common Shares, which have super-majority voting rights, the Company maintains voting control, thereby consolidating Checkpoint.”

Fortress Biotech Annual Report 2015 (P.79)

As you read this, it is important to remember that they include all three acquired assets from Dana-Faber in Cosibelimab/UNLOXCYT, CK-302 and CK-303:

“Dana-Farber is eligible to receive payments of up to an aggregate of approximately $21.5 million for each licensed product upon Checkpoint’s successful achievement of certain clinical development, regulatory and first commercial sale milestones. In addition, Dana Farber is eligible to receive up to an aggregate of $60.0 million upon Checkpoint’s successful achievement of certain sales milestones based on aggregate net sales, in addition to royalty payments based on a tiered low to mid-single digit percentage of net sales.”

And this refers to Cosibelimab/UNLOXCYT and CK-302 within hematological malignancies:

“In connection with the license agreement with Dana-Farber, Checkpoint entered into a collaboration agreement with TGTX, a related party, to develop and commercialize the anti-PD-L1 and anti-GITR antibody research programs in the field of hematological malignancies, while Checkpoint retains the right to develop and commercialize these antibodies in the field of solid tumors. Michael Weiss, Chairman of the Board of Directors of Checkpoint is also the Executive Chairman, President and Chief Executive Officer and a stockholder of TGTX. Under the terms of the agreement, TGTX paid Checkpoint $0.5 million, representing an upfront licensing fee, and Checkpoint is eligible to receive substantive potential milestone payments up to an aggregate of approximately $21.5 million for each product upon TGTX’s successful achievement of certain clinical development, regulatory and first commercial sale milestones. Checkpoint’s potential milestone payments are comprised of up to approximately $7.0 million upon TGTX’s successful completion of clinical development milestones, and up to approximately $14.5 million upon first commercial sales in specified territories. In addition, Checkpoint is eligible to receive up to an aggregate of $60.0 million upon TGTX’s successful achievement of certain sales milestones based on aggregate net sales, in addition to royalty payments based on a tiered high single digit percentage of net sales.”

Fortress Biotech Annual Report 2016 (P.87)

“In connection with the Jubilant License, Checkpoint entered into a sublicense agreement with TGTX (the “Sublicense Agreement”), a related party, to develop and commercialize the compounds licensed in the field of hematological malignancies, with Checkpoint retaining the right to develop and commercialize these compounds in the field of solid tumors. Michael Weiss, Chairman of the Board of Directors of Checkpoint and the Company’s Executive Vice Chairman, Strategic Development, is also the Executive Chairman, President and Chief Executive Officer and a stockholder of TGTX. Under the terms of the Sublicense Agreement, TGTX paid Checkpoint $1.0 million, representing an upfront licensing fee, recorded as collaboration revenue - related party and Checkpoint is eligible to receive substantive potential milestone payments up to an aggregate of approximately $87.2 million upon TGTX’s successful achievement of preclinical, clinical development, and regulatory milestones. Such potential milestone payments may approximate $25.5 million upon TGTX’s successful completion of three clinical development milestones for two licensed products, and up to approximately $61.7 million upon the achievement of five regulatory approvals and first commercial sales in specified territories for two licensed products. In addition, Checkpoint is eligible to receive potential milestone payments up to an aggregate of $89.0 million upon TGTX’s successful achievement of three sales milestones based on aggregate net sales by TGTX, for two licensed products, in addition to royalty payments based on a mid single digit percentage of net sales by TGTX. TGTX also pays Checkpoint for 50% of IND enabling costs and patent expenses. The Company recognized $1.0 million and $1.5 million in revenue related to this arrangement during the year ended December 31, 2017 and 2016, respectively. There was no related revenue recognized during 2015.”

Fortress Biotech Annual Report 2017 (P.106)

“In November 2020, Checkpoint announced the expansion of a long-term manufacturing partnership for cosibelimab with Samsung Biologics. Building upon an existing contract manufacturing agreement entered into in 2017, Samsung Biologics will provide additional commercial scale drug substance manufacturing for cosibelimab.”

Fortress Biotech Annual Report 2020 (P.70)

“Checkpoint also receives an annual license maintenance fee, which is creditable against future milestone payments or royalties. TGTX also pays Checkpoint for its out-of-pocket costs of material used by TGTX for their development activities. For the years ended December 31, 2020 and 2019, Checkpoint recognized approximately $1.0 million and $1.6 million, respectively, in revenue related to the collaboration agreement in the Consolidated Statements of Operations. The revenue for the year ended December 31, 2020 included a milestone of $925,000 upon the 12th patient dosed in a phase 1 clinical trial for the anti-PD-L1 antibody cosibelimab during March 2020.”

Fortress Biotech Annual Report 2020 (P.114)

“… , Checkpoint submitted a Biologics License Application (“BLA”) to the U.S. Food and Drug Administration (“FDA”) for cosibelimab in January 2023. On December 15, 2023, the FDA issued a Complete Response Letter (“CRL”) for the cosibelimab BLA for the treatment of patients with metastatic or locally advanced cSCC who are not candidates for curative surgery or radiation. The CRL only cited findings that arose during a multi-sponsor inspection of our third-party contract manufacturing organization as approvability issues to address in a resubmission. The CRL did not state any concerns about the clinical data package, safety, or labeling. Following resolution of the inspection issues at the third-party contract manufacturing organization raised in the CRL, a resubmission of the BLA is planned in 2024 to support the marketing approval of cosibelimab.”

Fortress Biotech Annual Report 2023 (P.8)

“Checkpoint also previously had a collaboration agreement with TG Therapeutics, Inc. (“TGTX”) whereby TGTX was granted the rights to develop and commercialize cosibelimab in the field of hematological malignancies, while Checkpoint retained the right to develop and commercialize these assets in solid tumors. Effective September 30, 2023, Checkpoint and TGTX agreed to mutually terminate these collaborations, with full rights reverting back to Checkpoint.”

Fortress Biotech Annual Report 2023 (P.9)

“In December 2024, we announced that Checkpoint had received approval for UNLOXCYT, which is the first and only programmed death ligand 1 (“PD-L1”) blocking antibody to receive U.S. Food and Drug Administration (“FDA”) marketing approval for the treatment of adults with metastatic cutaneous squamous cell carcinoma (“cSCC”) or locally advanced cSCC who are not candidates for curative surgery or curative radiation.

In March 2025, we announced that Checkpoint entered into an agreement to be acquired by Sun Pharmaceutical Industries, Inc. (“Sun Pharma”) for $4.10 per share in cash plus a contingent value right of up to $0.70 per share upon the achievement of EU approval. The closing of the transaction is subject to various conditions including the approval by requisite majorities of holders of Checkpoint’s shares at a meeting of Checkpoint’s stockholders. We expect the transaction to close in the second quarter of 2025, although there can be no assurance that the transaction closes in a timely manner, or at all.

As of the announcement date, Fortress owned approximately 6.9 million shares of Checkpoint (including Class A Common Stock on an as converted basis to Common Stock). Fortress also entered into a royalty agreement with Checkpoint and Sun Pharma pursuant to which Fortress is eligible to receive a royalty of 2.5% on worldwide net sales of UNLOXCYT. Due to uncertainties as to the timing of the completion of the acquisition, uncertainties as to whether Checkpoint’s.”

Fortress Biotech Annual Report 2024 (P.7)

Fortress Biotech Annual Report 2024 (P.180)

“Royalty Agreement Concurrently with the execution of the Merger Agreement, Checkpoint entered into a Royalty Agreement (the “Royalty Agreement”) with Parent and Fortress pursuant to which following, and subject to the occurrence of, the Effective Time, Fortress will receive a royalty interest right based on worldwide net sales of certain products of Checkpoint and Parent. The royalty interest right represents the right to receive quarterly cash payments of 2.5% of net sales of such products during the time period set forth in the Royalty Agreement.”

“As of March 31, 2025, Fortress beneficially owned an aggregate of 6,222,249 shares of common stock and 700,000 shares of Class A common stock of Checkpoint and controlled a majority of the outstanding voting power of Checkpoint’s capital stock through its ownership of all outstanding shares of Checkpoint’s Class A common stock”

Fortress Biotech Q1 2025 (P.17)

30 May 2025: Fortress Biotech Announces Closing of Sale of Subsidiary Checkpoint Therapeutics

“Fortress will receive ~$28 million shortly after closing and is eligible for an additional contingent value right (CVR) of up to $4.8 million, plus a 2.5% royalty on future net sales of UNLOXCYT”

f. EMROSI

“On June 29, 2021, Journey entered into a license, collaboration, and assignment agreement (the “DFD Agreement”) to obtain the global rights for the development and commercialization of DFD-29 with DRL. Journey paid $10.0 million, of which $2.0 million was paid upon execution and $8.0 million was paid on September 29, 2021. Additional contingent regulatory and commercial milestone payments totaling up to $163.0 million are also payable. Royalties ranging from approximately 10% to approximately 15% are payable on net sales of the DFD-29 product. Additionally, Journey is required to fund and oversee the Phase 3 clinical trials at a cost approximating $24.0 million, based upon the current development plan and budget.

The DFD Agreement also included contingent payments to be made to DRL in the event of a Journey IPO or the sale of Journey, See Note 6. The fair value of the contingent payment was deemed to be $3.8 million, and was recorded in research and development, licenses acquired expense for the year ended December 31, 2021. In connection with the closing of Journey’s IPO on November 16, 2021, Journey issued 545,131 unregistered shares of Journey Medical Inc. common stock to DRL to settle the obligation, calculated using a 15-day volume weighted average price (“VWAP”) of $9.1721 per share.”

Fortress Biotech Annual Report 2021 (P.116)

“Journey filed a New Drug Application (“NDA”) with the FDA for DFD-29 on January 4, 2024, paying a $4.0 million filing fee, and announced on March 18, 2024 that the FDA accepted the NDA and assigned a Prescription Drug User Fee Act (“PDUFA”) goal date of November 4, 2024.”

Fortress Biotech Annual Report 2023 (P.9)

Emrosi (also known as DFD-29)

“In June 2021, Journey entered a license, collaboration, and assignment agreement (the “Emrosi Agreement”) to obtain global rights for the development and commercialization of EmrosiTM (Minocycline Hydrochloride Extended-Release Capsules, 40mg), for the treatment of rosacea with Dr. Reddy’s Laboratories, Ltd (“DRL”); provided, that DRL retained certain rights to the program in select markets including Brazil, Russia, India and China. Pursuant to the terms and conditions of the Emrosi Agreement, Journey paid $10.0 million. In addition, Journey paid two developmental milestones in 2024. In April 2024 Journey paid a $3.0 milestone to DRL, based on FDA acceptance of the NDA application for Emrosi, and in December of 2024 Journey paid a $15.0 million milestone payment to DRL, which was triggered by the FDA marketing approval of Emrosi. Upon the $15.0 million milestone payment, the assets that had been the subject of the exclusive license related to Emrosi, including the NDA itself, the patents and other intellectual property, were assigned to Journey (see Note 8). Pursuant to the Emrosi Agreement, Journey may be required to pay additional contingent regulatory, commercial, and corporate-based milestone payments, totaling up to $150.0 million. Journey is required to pay royalties ranging from approximately ten percent to fourteen percent on net sales of Emrosi, subject to certain possible reductions.”

Fortress Biotech Annual Report 2024 (P.143)

“Pursuant to the Emrosi Agreement, the Company agreed to make an upfront payment of $10.0 million, comprised of a $2.0 million payment upon execution and $8.0 million which was paid on September 29, 2021, 90 days following execution. In addition, the Company paid two developmental milestones in 2024. In April 2024 the Company paid a $3.0 milestone to DRL, based on FDA acceptance of the Company’s NDA application for Emrosi, and in December of 2024 the Company paid a $15.0 million milestone payment to DRL, which was triggered by the November 1, 2024 FDA marketing approval of Emrosi. Upon the $15.0 million milestone payment, the assets related to Emrosi, including the NDA, regulatory documentation and intellectual property, transferred to the Company. Pursuant to the Emrosi Agreement, the Company may be required to pay additional contingent regulatory, commercial, and corporate-based milestone payments, totaling up to $150.0 million. Royalties ranging from ten percent to fourteen percent are payable on net sales of the product. Royalties are payable in each country until the last-to-expire patent in such country expires. Royalties are subject to a 50% reduction in the event that a generic competitor launches in an applicable country where the Company markets and sells the product.”

Milestones

The total of $10M ($2M upfront + $8M after 90 days) in connection with the acquisition has been added by the $3M mentioned for the FDA acceptance of the NDA application and the accounting and payment plan for the $15M that related to the FDA acceptance of the drug EMROSI. The possible up to $150M total should be seen in light of new markets outside the US where Journey Medical's own license agreements with partners can bring in significant revenue in relation to that amount.

The milestones are built based on a descending escalation model of 5 steps where Journey will first look at the highest sales milestone they have achieved during that year at the end of each calendar year. They then pay DRL the amount corresponding to that milestone within 30 days of the end of the year. After the first payment, Journey has 12 months to pay DRL for the next highest unpaid milestones that they have already achieved. Think of it as them paying their way down the ladder, one level at a time, if they have reached multiple levels. If, within a year of a previous payment, Journey reaches an even higher milestone than they previously paid for, they only have to pay DRL for the new higher milestone. They don’t pay for lower levels they have already reached. Once a milestone is reached, Journey is obligated to pay for it and any lower milestones that haven’t already been paid. The goal is to pay all milestone payments listed in Table 7.5. Each milestone payment is only paid once. This means that once Journey has paid for a particular milestone, they don’t have to pay for it again, even if they reach it again. The money is also non-refundable. There is a maximum amount, up to the $150M listed above that remains, that Journey may have to pay in total under this section.

In short, this section ensures that DRL is paid when Journey's sales reach predetermined levels, with a clear structure for how and when these payments are to be made, and that each level is paid only once until all possible milestones are completed.

4. Acquisitions - Summary

a. Dotinurad

(Fortress Biotech Investor Presentation June 2025, P.18)

Fortress ownership in Urica at the end of first year 2021

Ownership percentage: 65.5%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Fortress ownership in Urica last reported quarter (2025-03-31)

Ownership percentage: 69.6%

2.5% annual equity dividend

Urica Therapeutics owns 35% of Crystalys Therapeutics and 3% royalty on future net sales of Dotinurad

Uricas paying licenses, milestones and royalties for Dotinurad to latest reported quarter

$3M milestone payment in December 2021 upon IND submission of Dotinurad

$0.3M (December 2022) for a new license agreement for more markets for Dotinurad that does not include the first deal for $0M

Total: $3.3M

Paying licenses, milestones and royalties for Dotinurad that Urica received from Crystalys up to the latest reported quarter

$0.7 million of the repurchase option price

b. CUTX-101

(Fortress Biotech Investor Presentation June 2025, P.16)

Fortress ownership at the end of Its first year (2017-12-31)

Ownership percentage: 88.9%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Fortress ownership in last reported quarter (2025-03-31)

Ownership percentage: 73.8%

Annual Equity Dividend: 2.5%

Cyprium paying licenses, milestones and royalties for CUTX-101 to latest reported quarter

Upfront payment: $0.1M (including AAV-ATP7A)

Future potential Cyprium deal costs for milestones, royalties & PRV for CUTX-101 in the future

$1.7M upon Cyprium’s successful achievement of certain clinical development and regulatory milestones for each licensed product (the sum is the total amount for CUTX-101 and AAV-ATP7A together)

$1M upon first commercial sale of a product candidate (regardless of whether CUTX-101 or AAV-ATP7A will be first).

These refer to max milestones, but probably all or part of the sum regarding CUTX-101 for the $1.7M has already been paid out by either Cyprium or Sentynl and should then be moved away or up to the above part for already paid. However, it is difficult to separate out in the Annual Reports as many parts of Fortress' unlisted subsidiaries are lumped together.

PRV

NIH – Rights to 20%

Cyprium PPS - $16.0M

And possible 320 000 X $0.19531 X number of months that Cyprium PPS shareholders may not have received their dividend, but excluding, the redemption date.

Cyprium's revenue from Sentynl deal to the latest quarter reported (2025-03-31)

Total amount Cyprium has received from Sentynl:

$8.0M (upfront development funding, received in 2021)

$4.5M (for "Approval Deadline Transfer," received in December 2023)

$1.5M (milestone payment upon NDA acceptance, received in December 2024)

Total sum to date: $8.0M + $4.5M + $1.5M = $14.0M

Future potential Cyprium revenues of deal/sales and the following milestones, royalties & PRV for CUTX-101 in the future

Milestones -Up to $129 million in aggregate development and sales milestones

Royalties

3.00% of net sales up to $75M

8.75% between $75M and $100M

12.50% over $100M

(on every annual sale)

PRV sale

Potential ~$150M-160M

($154,6M average over the last 5 PRV sales from BAVN.CO - $160M, ABEO - $155M, IPN - $158M, ACAD - $150M, PTCT - $150M)

It should also be noted that Fortress as a founder only invested about $2M in the first three years for the value we see above today.

c. Triplex

(Fortress Biotech Investor Presentation June 2025, P.19)

Fortress ownership in Helocyte at the end of first year 2016

Ownership percentage: 79.5%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

(despite Fortress founding Helocyte in March 2015, then under the name DiaVax Biosciences, the ownership percentage is first stated for 2016 in the annual reports)

Fortress ownership in the latest quarter reported (2025-03-31)

83.4% (2025-03-31)

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Helocyte paying licenses, milestones and royalties for Triplex to latest reported quarter

$0.15M upfront license

Awarded shares in Helocyte worth $48,500

$1M in development milestone for the first start of the P2 study for Triplex

$1.5M after the first P2 with Triplex was completed

Total: $2.6985M

Future potential Helocyte deal costs for Triplex milestones & royalties

$3.7M related to three financial milestones

$7.5M in development milestones for the remaining two development milestones

$26M in three milestones related to net sales for each licensed product

Total: $37.2M

The early license agreement also states “single digit royalties based on net sales reduced by certain factors and a minimum annual royalty of $0.75 million per year following a first marketing approval”, linked to the 3 licensed products where right now "only" Triplex remains. It is therefore unclear what applies there, especially when that description was not included in the latest license summary of Fortress.

Others

If Triplex makes it all the way to FDA approval, they will have received more money from funding/grants than the total amount of milestone costs above.

d. CAEL-101

(Fortress Biotech Investor Presentation June 2025, P.17)

Fortress ownership in Caelum at the end of its first year (2017-12-31)

Ownership percentage: 65.3%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Fortress ownership on the day the deal with AstraZeneca/Alexion was finalized (October 5, 2021)

Ownership percentage: 42.4%

Annual Equity Dividend: 2.5%

Royalty: 4.5%

Caelum investments before the deal with AstraZeneca/Alexion:

$0.219M upfront global license to Columbia University

$0.5M of a part of development milestones totalling $5.5M that Alexion/AstraZeneca then took over in connection with that deal

$29,000 worth of shares to Columbia University

$0.1M sponsor agreement with Columbia University

Total: $0.848M

Rosenwald has called this deal extremely successful in several interviews, which is easy to understand given the numbers above and below. From my own memory bank, he has then given different figures regarding the total amount invested, ranging from $0.4M-$1.5M (if I remember correctly).

However, this interview and its quote from 2023 are consistent with the figure “less than $1M”:

“As an example of the market inefficiency prevalent in the market, Fortress’ total investment was less than $1M ...”