Fortress Biotech – News since first published Substack-post about $FBIOP

Fortress continues to move its "chess pieces" of drug assets forward on the board with several vital pieces of news in recent weeks

Disclaimer

This analysis represents only my personal opinions and is based on information that was current at the time of publication. The information is not intended as an investment recommendation or as advice from a certified financial advisor. All content in this analysis should only be used as a basis for further study and not as the sole basis for investment decisions. Investments in stocks and other securities always involve risk, including the possibility of losing some or all of the invested capital. Past performance does not guarantee future returns. The reader is encouraged to independently conduct a careful investigation and, if necessary, seek professional advice before making any investment decisions. I am not responsible for any consequences that may arise from using the information in this analysis, including inaccuracies or lack of updates.

My advice if you are going to be able to keep up with the relevance of today's post content is that you first read my previous and first post about Fortress Biotech as I will be using that post as a starting point and refer to it several times. You can find the post here:

Fortress Biotech Preferred $FBIOP - Zellchair

Summary of the news that I intend to touch on in this post

I. Changes within the FDA that could potentially be very beneficial for Fortress Biotech, its subsidiaries and collaboration partners in the future

II. Q1 reports from Fortress and its listed subsidiaries

III. Fortress Biotech CEO's participation at H.C. Wainwright Conference

IV. The sale of Checkpoint Therapeutics is now official

V. Sun Pharma announces that they will initially spend $100M on commercialization of their two new approved assets, which includes UNLOXCYT

VI. Journey Medical included in Russell 2000 & 3000 Index

VII. Confirmation that the largest investors (Fortress not included) all continued to increase their holdings in Journey Medical in Q1

VIII. New EMROSI study that continues to demonstrate its total superiority against today's Standard of Care

IX. EMROSI with perhaps the best possible advertisement with a live promotion on national TV in the US

X. My own revelation about Crystalys Therapeutics' background and management

XI. Several new publications on Dotinurad superior study results to competitors in Asia

XII. Publication indicating that Dotinurad's total addressable market may be expanded with new indications

XIII. New and higher PRV sales that could drive up the price of CUTX-101

XIV. Helpless parents continue to describe the hopelessness of Menkes Disease in the media (without the knowledge of CUTX-101)

XV. CAEL-101's main competitors Birtamimab failed with its pivotal P3 study and NXC-201 confirms that they will not compete directly against CAEL-101 as they have chosen to focus solely on second line treatment for R/R

XVI. New confirmed studies on Triplex

XVII. International Consensus Guidelines on the Management of Cytomegalovirus in Solid Organ Transplantation continue to highlight the need and progress in CMV Vaccine where Helocytes Triplex, to say the least, is one of the few leading players

Table of Contents

1. Brief Biotech/Pharma Macro Update

2. Fortress Biotech (“Parent Company”)

3. Checkpoint Therapeutics (Now Sold)

4. Journey Medical

5. Urica Therapeutics & Crystalys Therapeutics (Deal)

6. Cyprium Therapeutics (Deal)

7. Caelum Biosciences (Sold)

8. Helocyte

9. Mustang Bio

10. Avenue Therapeutics (New Deal)

11. ,Cellvation, Oncogenuity, AEVITAS (Sold)

12. Discussion – Updated Own Reflections

13. Summay & Positions

Note! The goal of points 1-11 was to mostly present the news and then weigh in with my own reflections under point 12, to update and summarize my view of the case under point 13.

As this is a post about news updates from my initial review, I have chosen not to include “risks”, but I want to be careful to point out that the risks in this type of investment are extensive. Therefore, I would like to refer specifically to Fortress Biotech's latest segment for risks in the latest Annual Report, and that you may find it useful to read “9. Risks” in my previously referenced post.

1. Brief Biotech/Pharma Macro Update

6 June – Mentions of the Priority Review Voucher Program in FDA Cell and Gene Therapy Roundtable

President of American Society of Gene and Cell Therapy:

"...The FDA's rare disease pediatric priority review voucher program, the PRV, provides incentives for life-saving innovations that might otherwise be commercially non-viable. The PRV program is unique in that it's a government incentive, but it does not use government money. It’s a win-win for products, product developers, patients, and their families, and it is very much needed to be renewed to attract investment in this space..."

Director, Parker Institute for Cancer Immunotherapy, Stanford University:

"...I also want to highlight the critical importance of the priority review voucher. This is absolutely essential for any commercial—for any business model that has any chance at being sustainable..."

17 June – FDA to Issue New Commissioner’s National Priority Vouchers to Companies Supporting U.S. National Interests

The reason I have the PRV section under "Macro" and not under "Cyprium Therapeutics" is to provide a glimpse into the possible future. As of December 20, 2024, the FDA will no longer be able to issue PRVs unless the product has already been designated as a rare pediatric disease before that date (CUTX-101 was already designated as such on January 16, 2020). To qualify for a voucher, the drug must also receive FDA approval by September 30, 2026 (CUTX-101's PDUFA is due exactly one year earlier on September 30, 2025).

2. Fortress Biotech (“Parent Company”)

13 May - H.C. Wainwright 1st Annual Royalty Company Virtual Conference (13 May)

I summarized my impressions of the conference in a couple of posts on another platform on May 13th as follows:

“CEO Lindsay Rosenwald begins by talking about the $100B-$100T market of opportunity they are in, where he quotes Wayne Gretzky's quote that Fortress wants to ‘skate to where the puck is going to be, not where it has been’.

He keep talk about the structure Fortress is built from, its ecosystem of subsidiaries is due to them wanting inside management and board seats and that Wall Street would never have financed all the clinical assets it had in the portfolio in one and the same company (back in 2011-2015 period), when Fortress wanted and still wants to invest broadly. He further means that Fortress wants to be able to go for it and invest if, for example, 2 clinical assets are in the final stage (I assume he means that it would have been more difficult if these 2 had been in the same company form). Guess he had EMROSI and UNLOXCYT in the back of his mind here, both of which PDUFA were in Q4 2024.

He then explained the incredible upside he sees with AI in Fortress' business. According to Rosenwald, they understood this already two years ago and therefore started to cut down on staff and collaborate with Palantir. Then the fire alarm went off… After a short break with Rosenwald, we walked the company's corridors and the discussion continued where the analyst J.P. asked him to tell us about the milestones for last year and the future. And now it gets really interesting...

Rosenwald says that they will get more than $30M for the Sun deal and that they hope to close it this month, which means more or less immediately after the shareholder meeting on 28/5.

He said (if I understood correctly) that they are basically already cash flow positive (unclear if he included the CKPT money then) and that they expect to be able to pay off all loans in 2026 (!). He also said that Fortress will get “tens of millions” from CUTX-101 PRV (!!). Those of you who have been around for a long time and remember from H1 2024 know that he referred to about 40%, and then rephrased this, probably to be legally correct, as Cyprium has money first due to the NIH and PPS payments, but Fortress will therefore get money into their account from this (!!!).

He then talks about how positive they are about CAEL-101 and the sales ability with Alexion/AstraZeneca behind them.

Rosenwald emphasized from a question that you have to separate the costs of the subsidiaries to look at Fortress costs at the group level (which I touched on a lot in my Substack post). He says that the annual overhead will be $10-$15M for Fortress. Based on this, he sees enormous scalability of the business in the future based on all the royalties and milestones, and where their new AI collaboration does the work that 20 people did before, can now be done by 1-2 people and 10,000 times better. In addition, the costs were down to $0.5M per year for this compared to $2-3M 2 years ago when they started looking at this.

They are already in the next phase of the ‘Search’ for new assets to acquire, which testifies a lot to the belief that the existing portfolio will contribute to rising valuations, milestones and royalties. Rosenwald said that this could happen in the form of new subsidiaries and other partners, but, he also said that if they get access to any new ‘Blockbuster’ potential, they will probably try to keep it 100% in Fortress.

And for all Journey owners, yes, he talked about EMROSI being superior in H2H against the previous Standard of Care on every parameter you could count on.”

Panel Discussion

“During the panel discussion that has just ended, Rosenwald continues to emphasize EMROSI, UNLOXCYT AND CUTX-101. He says, unlike his colleagues on the panel, that Fortress does not buy its royalties but develops/is awarded them in its subsidiaries and can then sell them. He then said that Fortress can resell the royalties they receive from the Sun Parma deal and that they can sell their PRV for CUTX-101 both before (cheaper) and after it is awarded (more expensive), however, I got the feeling at first that these examples were more to explain the model and that they were based on a hypothetical scenario. But then he came back to it 5 minutes later, and then said that they plan to sell some of their royalties/milestones in the future

XOMA’s (write about them in my last Substack post) CEO praised Fortress and Lindsey and said he creates future royalties every day in his work.

Rosenwald later says that he has licensed over 100 products in the industry and that there is no competitor in what they do in their model, which he loves. He also says that discovering new drugs is getting easier every day with the experience he now has.

Later, Rosenwald mentions they receive several offers from smaller biotech companies/drugs that are desperate in this tough market that now prevails in biotech. And even though they initially show interest but at a much lower price and the offers are rejected, Rosenwald believes that 80-85% come back with new offers to Fortress. He mentioned CAEL-101 where he said that they bought the asset for $0.5M (I have thought and written that it was $1.5M) and that the total sum could be over $500M after Fortress brought in new investors (Fortress owned 43% of Caelum).

Here I think it is important to reflect. The other investors in Caelum & Cyprium, i.e. everyone else except Fortress, once they have multiplied their profits via CAEL-101 & CUTX-101 with Rosenwalds, there must be a good chance that they will consider reinvesting some of the profits into any future subsidiaries they start. Especially if they have been involved longer than that from Rosenwald business before FBIO.

At the end, Rosenwald mentions that they are capitalists and their model is based on the fact that they have several opportunities to build NPV for shareholders. One reason why they don't just want to build their model on milestones and royalties is that they want to continuously build value until these milestones and royalties are possible. They achieve this by also being owners in the subsidiaries. All this because Fortress wants to have as much optionality in each asset as possible.”

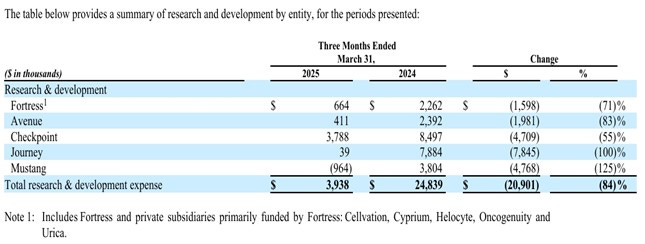

15 May – Q1 Report

Note! The figures apply to Q1 reported end 205-03-31 and Fortress' ~$28M in revenue from the Checkpoint Therapeutics buyout that closed later is therefore not included here.

I mainly want to show these images/figures for relevance during "12. Discussion" later:

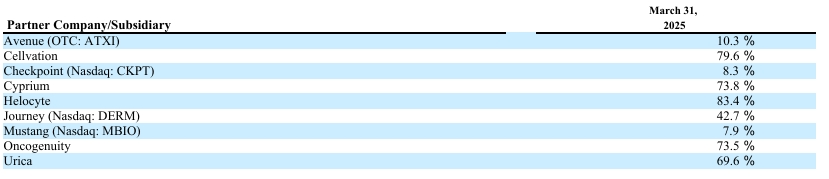

2 June – Fortess Biotech - Ownership Update

Note! The figures below apply to Q1 reported end 205-03-31 with the exception of an update regarding Avenue Therapeutics new deal with AnnJi Pharmaceutical for AJ201 and Checkpoint Therapeutics buyout and which closed later, and updated new PRV sales as compared to CUTX-101 (more about that later).

Checkpoint Therapeutics* – Sold

Royalties: 2.5%

Possible CVR:

CVR $0.20 - $1.384M

CVR $0.45 - $3.115M

CVR $0.70 - $4.846M

(credit to "TwongStocks" for the graphic)

Journey Medical – 42.7%

Urica Therapeutics* – 69.6%, 2.5% annual equity dividend

Urica Therapeutics owns 35% of Crystalys Therapeutics and 3% royalty on future net sales of Dotinurad

Cyprium Therapeutics* – 73.8%, 2.5% Annual Equity Dividend

Milestones: Up to $129 million in aggregate development and sales milestones

Royalties:

3.00% of net sales up to $75M

8.75% between $75M and $100M

12.50% over $100M

(on every annual sale)

PRV sale: Potential ~$150M ($154,6M average over the last 5 PRV sales), numbers depending on last year’s PRV sales (BAVN.CO - $160M, ABEO - $155M, IPN - $158M, ACAD - $150M, PTCT - $150M)

Caelum Biosciences* - Sold

FDA approval: $19.6M

Milestones:

$10.5M when sales exceed $250M in total sales

$21M when sales exceed $500M in total sales

$31.5M when sales exceed $750M in total sales

$42M when sales exceed $1B in total sales

(Payment 31/12 the year milestones are reached)

Total potential: $124.6M

Helocyte – 83.4%, 4.5% Royalty, 2.5% Annual Equity Dividend

Mustang – 7.9%, 4.5% Royalty, 2.5% Annual Equity Dividend

Avenue Therapeutics* – 10.3%, 4.5% Royalty, 2.5% Annual Equity Dividend

New AJ201 deal with AnnJi:

AEVITAS* - Sold

Eligible to ~$140M in potential late-stage development for 4D-175, regulatory and sales milestone payments plus royalties from FDMT

From Q4 2024 (28/2-2025):

“Paused significant additional capital allocation and investment, pending additional financing or partnerships for the following therapeutics:

4D-175 for geographic atrophy

4D-725 for alpha-1 antitrypsin deficiency lung disease

4D-310 for Fabry disease cardiomyopathy”

Cellvation – 79.6%, 4.5% Royalty, 2.5% Annual Equity Dividend

Oncogenuity – 73.5%, 4.5% Royalty, 2.5% Annual Equity Dividend

* = Deals made

3. Checkpoint Therapeutics (Now Sold)

20 May – Sun Pharma's Checkpoint Bid Seen As A Strategic Win By Macquarie

“This offer also included mid-single-digit royalties on net sales and was substantially above the competing $200 million bid from a large Asian pharma company.”

“The acquisition strengthens Sun Pharma’s position in dermatology-oncology, according to Macquarie. The lead asset, Unloxcyt, is seen as a strong strategic fit, filling a critical gap in the pharmaceutical company's derm-onco portfolio and supporting its focus on the US Medicare channel. The asset offers promising potential in combination with PD-1 inhibitors and through other future indications. Macquarie estimates a base case net present value of over $500 million for Unloxcyt, with a bull case NPV exceeding $1.5 billion.”

“The acquisition is also viewed positively due to Unloxcyt’s mechanism of action, offering high-affinity, fully human monoclonal antibody benefits and the potential for broader therapeutic use. The investment is considered accretive in the longer term, especially with the anticipated expansion of Sun’s specialty product pipeline.”

23 May – Sun Pharma to ramp up specialty play, eyes more acquisitions

“The company currently has around $3 billion in cash and has already completed two notable acquisitions in recent years—Concert Pharmaceuticals, which brought in Leqselvi, and Checkpoint Therapeutics, which added Unloxcyt to its pipeline. Sun Pharma also plans to spend $100 million in FY26 on the US launch of these two new specialty products. ‘This spend will cover all the launch-related expenses in the current fiscal,’ Muralidharan noted.”

30 May – Sun Pharma Completes its Acquisition of Checkpoint Therapeutics

“Sun Pharmaceutical Industries Limited (Reuters: SUN.BO, Bloomberg: SUNP IN, NSE: SUNPHARMA, BSE: 524715 (together with its subsidiaries and/or associated companies, ("Sun Pharma") today announced the successful completion of its acquisition of Checkpoint Therapeutics, Inc. ("Checkpoint"), an immunotherapy and targeted oncology company. As part of the acquisition, Sun Pharma acquires UNLOXCYT, the first and only FDA-approved anti-PD-L1 treatment for advanced cutaneous squamous cell carcinoma.”

"This acquisition exemplifies Sun Pharma's commitment to supporting patients and growing its innovative therapies business,’ said Dilip Shanghvi, Chairman & Managing Director of Sun Pharma. ‘By adding UNLOXCYT, we will be able to leverage our leadership in the onco-derm space to help patients access an important treatment option while growing our product portfolio."

Financial Terms

“Sun Pharma has acquired all outstanding shares of Checkpoint at a price of $4.10 per share in cash, without interest, plus one non-tradable contingent value right (CVR) per share representing the right to receive up to an additional $0.70 in cash, without interest, if certain specified milestones are met, as set out in the terms and conditions of the contingent value rights agreement.”

31 May – Sun Pharma's Checkpoint buy: Why it's a strategic fit in the new SPIL focus

“The portfolio integration not only enhances the company’s therapeutic offerings but also positions it to capitalise on the expanding global market, …”

“Unloxcyt will complement existing products …”

“With Sun Pharma’s extensive global distribution network, the drug is well-positioned for rapid market penetration in the U.S., Europe, and beyond.”

30 June - Pharmaceutical Industry is Set to Benefit from $63.7 Billion U.S. Patent Expiry Wave

“India’s pharmaceutical industry is gearing up to tap into a significant opportunity, as the U.S. prepares to lose exclusivity on small-molecule drugs worth $63.7 billion between 2025 and 2029. According to a report by Antique Stock Broking, this represents a 65% increase over the previous five-year period”

“Business-standard.com reports that Sun Pharma, despite a cautious FY26 outlook amid global uncertainty, is aggressively expanding in oncology. The company expects its recent acquisition of UNLOXCYT (cosibelimab) to bolster U.S. revenue. Although it has factored Keytruda’s patent expiry into the deal, Sun remains confident that UNLOXCYT—targeting only one of Keytruda’s indications—will strongly contribute to its U.S. specialty portfolio.”

4. Journey Medical

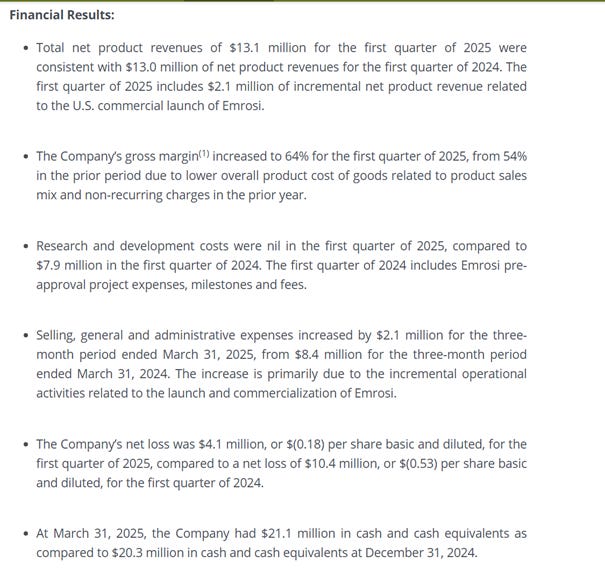

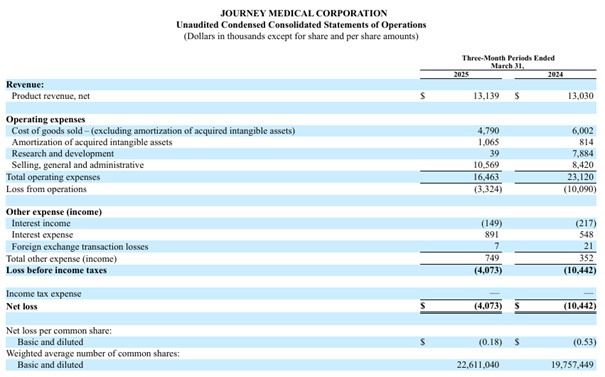

14 May - Q1 Report

“The first quarter of 2025 was highly productive, as our in-line dermatology products continue to perform and the launch of Emrosi, our best-in-class oral rosacea treatment, is off to a strong start,’ said Claude Maraoui, Journey Medical’s Co-Founder, President and Chief Executive Officer. ‘The Emrosi launch is enjoying high visibility among dermatology prescribers with momentum from our exhibition booth at the American Academy of Dermatology (AAD) conference in late March, the recent publication of Emrosi’s statistically superior Phase 3 clinical trial results over Oracea and placebo in JAMA Dermatology, and the promotional efforts from our experienced and highly effective dermatology salesforce. Emrosi was also recently incorporated into the National Rosacea Society’s Rosacea Treatment Algorithms, and payer coverage of the product continues to increase.”

“Financially, we remain in a strong position with $21.1 million in cash as of March 31, an improvement in our gross margin, and overall operating spend down year-over-year. We believe that our first quarter financial results and launch progress with Emrosi demonstrate that we are executing on our strategic objectives, and that 2025 will be a transformational year for the Company as we drive the business to sustainable positive EBITDA and profitability.”

15 May - 13F Update for Q1

Tang continued to increase his Journey Medicals holding in Q1. Owns 8% of Journey now, but still only 0.6% of his total portfolio.

Wasatch owns 5.4% now. They own 20 different Mutal Funds and had "… $28.4 billion in assets under management as of October 31, 2024”.

Of the 7 largest institutional owners (according to the latest 13F update), all of them have increased their holdings in the last quarter.

9 June – Journey Medical Corporation Announces Emrosi Featured on “The Balancing Act” Airing on Lifetime TV

National TV Segment Highlights FDA-Approved Treatment for Rosacea

Segment premiered on Monday, June 9 and will be rebroadcast on Thursday, June 19, at 7:30 a.m. PT/ ET

“We’re proud to see Emrosi featured on ‘The Balancing Act,’ bringing national visibility to what we believe is a potential paradigm shift in the treatment of rosacea,” said Claude Maraoui, Co-Founder, President, and Chief Executive Officer of Journey Medical. ‘This segment is an important opportunity to educate patients, caregivers and healthcare providers about Emrosi’s unique formulation and benefits, as well as our broader commitment to advancing dermatologic care through innovative, patient-focused solutions.’

The feature included insights from Pura Dermatology’s Saurabh Lodha, MD, FAAD, who discussed Emrosi’s unique formulation and its significance in the treatment landscape for rosacea. Approved by the U.S. Food and Drug Administration (FDA) in November 2024, Emrosi is the lowest-dose oral minocycline available, offering patients an effective treatment option with a favorable safety profile. It is available by prescription at specialty pharmacy chains.”

9 June – A New FDA-Approved Oral Medication for Pimples & Bumps of Rosacea

First, read:

https://thebalancingact.com/rosacea/

Then watch but above all listen to the 6-minute TV spot here:

12 June - Finally! FDA Approves a New Type of Treatment for Pimples & Bumps of Rosacea

- Gentle on aging skin and powerful on persistent breakouts, this new pharmaceutical option is perfect for women battling midlife flare-ups.

“For many women, midlife brings a new sense of self-assurance, but it can also bring unexpected changes in skin health. One of the most frustrating and often misunderstood conditions that tends to flare during this time is rosacea, particularly the subtype that causes persistent pimples and bumps on the face.

Unlike teenage acne, rosacea-related breakouts are inflammatory, chronic and often resistant to typical skin care treatments. And for women in their 40s, 50s and beyond, managing rosacea can feel like an uphill battle.

That’s why the recent FDA approval of a new oral medication specifically targeting the inflammatory lesions of rosacea is such welcome news.

EMROSI, a once daily oral medication, offers a scientifically backed, effective option for controlling the bumps and breakouts associated with the condition—without the harsh side effects often associated with older therapies like antibiotics or topical steroids.

What makes this medication particularly exciting for midlife women is its dual promise: not only does it address the physical symptoms of rosacea, but it also does so in a way that respects the evolving needs of aging skin.”

And:

“While the majority of major treatment options for rosacea are topical, EMROSI, a recently FDA-approved oral medication, is offering a renewed sense of hope for many.

What sets EMROSI apart is how it works: it targets the inflammation that causes rosacea-related breakouts from the inside out. Unlike older treatments that rely on antibiotics or harsh topical creams, EMROSI is taken once a day and is formulated to reduce redness and bumps without compromising the skin’s natural barrier. That’s a big deal, especially for midlife women, whose skin may already be more reactive and sensitive due to hormonal shifts during perimenopause and menopause.

In clinical trials, patients using EMROSI saw a noticeable reduction in flare-ups and clearer skin over time. For those who’ve tried multiple creams or skin care routines without real results, this oral treatment offers a new approach that feels more aligned with the needs of aging and easily irritated skin.

The drug is also formulated with a low dose of medicine that gradually releases throughout the day, and it demonstrated a safety profile similar to placebo. The frequency of side effects was low, and most were reported as mild or moderate.

Of course, EMROSI isn’t a one-size-fits-all fix. As with any prescription treatment, it’s important to talk with a dermatologist to see if it’s the right fit for your rosacea type and overall skin health. But for many women dealing with stubborn midlife flare-ups, this new medicine represents a meaningful step toward clearer, calmer skin—not to mention, a bit more confidence.”

20 June - Announces Emrosi Data Analysis to be Presented at the Society of Dermatology Physician Associates (SDPA) 2025 Annual Summer Dermatology Conference

“Emrosi showed superior efficacy on both co-primary endpoints, in both the body weight categories, compared to placebo and doxycycline. Emrosi was generally well tolerated, with no notable between-group differences in the frequency or severity of reported adverse events.”

“This analysis demonstrated that Emrosi is body weight independent, which means it can be prescribed without regard to the patient's body weight. This is an important attribute, as it avoids the potential for errors in dose calculations,’ said Julie Harper, MD, past president of the American Acne & Rosacea society (AARS) and Owner of the Dermatology and Skin Care Center of Birmingham, AL. ‘If doses were to be calculated based on body weight, the wide range of body weights in the real world would pose a challenge.”

“These compelling Phase 3 results reinforce the potential of Emrosi to become a new standard of care for patients with rosacea. Emrosi is the lowest oral dose of minocycline approved by the FDA that is a body weight–independent formulation, enabling physicians to prescribe confidently without the need for dose adjustments,’ said Claude Maraoui, Co-Founder, President, and CEO of Journey Medical Corporation. “Demonstrating statistically significant and clinically meaningful improvements over both placebo and the current standard of care, regardless of body weight, Emrosi represents a major step forward in managing this chronic and often frustrating skin condition. We are proud to bring forward this FDA-approved treatment that offers patients faster, more effective treatment with a favorable safety profile.”

21 June – Emrosi: A Breakthrough in Rosacea Treatment with Weight-Neutral Efficacy

“Rosacea, a chronic inflammatory skin condition affecting over 16 million Americans, has long relied on oral antibiotics like doxycycline for managing papulopustular lesions. However, existing therapies face limitations, including the need for weight-based dosing, suboptimal efficacy, and safety concerns. Enter Journey Medical Corporation's (DERM) FDA-approved Emrosi (DFD-29), a novel 40-mg modified-release minocycline capsule that has emerged as a game-changer. By demonstrating body weight-independent efficacy and a favorable safety profile, Emrosi positions itself to dominate the rosacea treatment landscape. Here's why investors should take notice.”

The Problem with Existing Therapies: Why Emrosi Fills a Critical Gap

“Current first-line treatments for rosacea, such as doxycycline (Oracea), require dose adjustments based on body weight to avoid toxicity—a cumbersome process that complicates prescribing and increases dosing errors. Additionally, these therapies often fall short in efficacy, with only ~40–50% of patients achieving clear or almost clear skin after 16 weeks of treatment. Emrosi, however, addresses both issues:”

Key Advantages of Emrosi

Weight-Independent Dosing:

“Phase 3 trials (MVOR-1 and MVOR-2) showed no correlation between baseline body weight and efficacy. Subgroup analyses revealed consistent results across patients weighing ≤83.5 kg and >83.5 kg, eliminating the need for dose adjustments.

This simplifies prescribing and enhances adherence, a critical factor in managing chronic conditions.”

Superior Efficacy:

“In trials, 75–65% of Emrosi-treated patients achieved Investigator's Global Assessment (IGA) treatment success, compared to 28–35% for placebo and 46–50% for doxycycline.

Emrosi also reduced inflammatory lesion counts by an average of 20–22 lesions, outperforming doxycycline's 14–15-lesion reduction.”

Favorable Safety Profile:

“Adverse events (AEs) were mild and comparable to doxycycline, with dyspepsia as the sole ≥1% incidence differentiator. No serious AEs were reported in trials.

While warnings include risks of hepatotoxicity and idiopathic intracranial hypertension (IIH), these align with minocycline's known profile and are mitigated by its lowest FDA-approved dose (40 mg) versus higher-dose alternatives.”

Competitive Edge Over Doxycycline:

“Emrosi's superior efficacy (20–22% higher IGA success vs. doxycycline) and simpler dosing make it a clear upgrade.

Doxycycline's 40-mg formulation, while effective, requires adherence to weight-based guidelines, which Emrosi's fixed dose eliminates.”

Untapped Patient Demographics:

“With efficacy consistent across weight groups, Emrosi appeals to diverse populations, including overweight patients and those in rural areas where weight data may be less accessible.”

23 June - SDPA News: Emrosi Shows Efficacy Independent of Body Weight Differences in Rosacea

JDNPPA highlighted EMROSI.

The Journal of Dermatology for Nurse Practitioners (NPs) and Physician Assistants (PAs) or JDNPPA is the only independent, omni-channel resource that is for NPs and PAs and by NPs and PAs.

24 June - Journey Medical to Join Russell 2000 and Russell 3000 Indexes

“… , today announced that the Company will join the small-cap Russell 2000 Index and the broad-market Russell 3000 Index, effective after the close of U.S. equity markets on June 27, 2025, as a result of their 2025 annual Russell Index reconstitution.

‘We are very pleased to be included in the Russell 2000 and Russell 3000 Indexes, which we anticipate will increase the company’s visibility with investors and institutions,’ said Claude Maraoui, Journey Medical’s Co-Founder, President and Chief Executive Officer. ‘The launch of Emrosi™ (40 mg Minocycline Hydrochloride Modified-Release Capsules, 10 mg immediate release and 30 mg extended release), our FDA-approved treatment for inflammatory lesions of rosacea in adults, is off to a strong start, and we are focused on expanding access, growing prescription volume, and publishing additional peer-reviewed data that further supports Emrosi’s clinical value. We believe 2025 could be a transformational year for Journey Medical.”

26 June – DFD-29 Data Analysis Highlights Efficacy in Rosacea Regardless of Patient Differences in Body Weight

Dermatology Times highlighted EMROSI:

1 July – Three Things to Know This Rosacea Awareness Month With Dr. Julie C. Harper

From April but posted on YouTube yesterday:

(Number 3 = EMROSI)

5. Urica Therapeutics & Crystalys Therapeutics (Deal)

9 May - I revealed the history and management of Crystalys Therapeutics

I wrote in another context/board:

Here I give you, Crystalys Therapeutics

“Rising superstar Brian Taylor “BT” Slingsby is the Founder of Crystalys Therapeutics. He has flown back and forth between Japan (lives part-time in Tokyo, speaks fluent Japanese) and the US for the past decade and founded companies such as Global Health Innovative Technology (GHIT) Fund, Minrealys Therapeutics. Pathalys Pharma, Aculys Pharma, Renalys Pharma, Hepalys Pharma and Catalys Pacific. Before all this, Slingsby was a senior executive at Eisai Co.& Ltd in Japan, who bought the rights to Dotinurad in China, Indonesia, Malaysia, Myanmar, the Philippines and Thailand. Together with Slingsby’s closest colleague and partner from Catalyst Pacific and Pathalys Pharma Ashwin Ram and James Mackay, the three will be the highest-ranking executives at Crystalys Therapeutics.

James Mackay was the CEO of Ardea Biosciences when AstraZeneca bought them for $1.2B in 2012. And what’s so special about that? Ardea was the one who developed Lesinurad (https://www.astrazeneca.com/media-centre/press-releases/2012/AstraZeneca-to-acquire-Ardea-Biosciences-for-1-billion-23042012.html#modal-historic-confirmation), the selective inhibitor of URAT1 for Gout, which is actually the only comparable peer Dotinurad has had. Those of you who have read my previous posts know what happened to Lesinurad after a few years on the market and at the same time why the whole road is open for Dotinurad now. After leading the entire Gout division for AstraZeneca, Mackay took over as Vice President of AstraZeneca's entire Diabetes division.

And now you need to do your homework. Spend a few hours reading about these 3 people and their company history and present, especially which drugs are in the portfolio/pipeline. Otherwise, you will not understand the scope of the following posts.

Everyone knows the great BiC/SoC potential of Dotinurad in both Gout and Hyperuricemia. The fact is that it has already been proven in Asia. But this deal is based on something much bigger than this.

In the last 2-3 years, very promising study results have come out that indicate that Dotinurad can have a unique effect in Chronic Kidney Disease (CKD) and Cardiovascular Disease (CVD). And then, the already enormous market can become colossal.

So before you go any further, I advise you to spend some time reading Dotinurad studies specifically against these disease groups or when these are mentioned in Dotinurad studies for Gout or Hyperuricemia.

The reason is partly attributed to ABCG2.

ABCG2 is a gene that codes for a protein that belongs to the ATP-binding cassette (ABC) transporters. These proteins transport various molecules across the cell membrane and play an important role in drug resistance and detoxification. ABCG2 is specifically known as the breast cancer resistance protein (BCRP) and is involved in pumping drugs and other substances out of cells. It also has a function in regulating uric acid levels in the body, which can affect the risk of Gout. And here Dotinurad is unique (see picture under the tab for ABCG2) with its non-inhibition of ABCG2 that does not increase the accumulation of renal and plasma IS, which makes it as it is favorably associated with the development and progression of CKD and CVD.

Dotinurad, Crystalys and thus also Fortress can be something really, really big. Today's post is part of the reason for the Crystalys deal & why Novo Nordisk (check their portfolio/pipeline for CKD/CVD) chose to invest money, according to me.

A Crystalsys that thus consists of a star who I almost dare to promise has the strongest and best ties between the USA and Japan in the industry, his closest partner and a person who was head of AstraZeneca's Gout and Diabetes program. And from Fortress' side with Rosenwald, Weiss and Urica's CEO Jay Kranzler. I also have unconfirmed information that Weiss's man from TG Therapeutics Neil Herskowitz sits as an observer on the board.

The image for the rebus in my post the other day comes from an illustration from Crystalys headquarters in the link, which is located in this building (I think it's on the 12th floor, https://100pine.com/), where Crystalsys will produce crystals of value for Fortress in the future.

First of all, I don't think you understand how big the content of today's posts is without doing yourself a favor by following up on these threads I gave you with some longer research.

Then I don't think you can understand why the idiot from Scandinavia knows this, when there is no public information about it and then both sides of the deal want to keep this secret for the time being. Not even any info in the Annual Report which should rather point to something negative.

Regardless of whether it takes a week, a month or a year before you are reached by this information I have now shared today, remember the idiot from Sweden then.”

Note! Fortress have still not shared anything about this on their public channels. As far as I know, there are no sources for this either.

26 May – Dotinurad study results published in Arthritis & Rheumatology

Efficacy and safety of dotinurad versus febuxostat for the treatment of gout: a randomised, multicentre, double-blind, phase 3 trial in China

Results

“A total of 451 patients were randomised and 441 were included in the FAS. Baseline characteristics were well-balanced between treatment groups. The responder rate at week 24 was significantly higher for dotinurad 4 mg/day vs febuxostat 40 mg/day (73.6% vs 38.1%; …”

Conclusions

“Dotinurad 4 mg/day was superior to febuxostat 40 mg/day in achieving serum urate levels ≤6.0 mg/dL at week 24 and was well tolerated in Chinese patients with gout.”

“Dotinurad significantly outperformed febuxostat in lowering urate levels for gout treatment, while maintaining a similar safety profile.”

“Phase 3 RCT in Chinese patients with gout showed dotinurad 4 mg/day was superior to febuxostat 40 mg/day in achieving serum urate levels ≤6.0 mg/dL at week 24. Treatment-emergent AE incidence was similar between treatment groups”

12 June - Dotinurad: Gout associated with kidney failure could pave the way for a therapeutic breakthrough

“Dotinurad, an ideal drug for reducing uric acid, is expected to be characterized by high efficacy in reducing uric acid, low impact on liver and kidney function, and clear mechanism of action thanks to its precise mechanism of action, Dotinurad can not only effectively reduce urate but also has unique benefits for patients with kidney failure. So how does he become the "precision sniper" in the field of urate reduction? And why is it considered the best choice for patients with gout associated with kidney failure? Let's find out!”

“Find out!” by read more from the source.

12 June - Dotinurad Lowers Urate More Effectively Than Febuxostat

TOPLINE:

“Dotinurad 4 mg/d was superior to febuxostat 40 mg/d in achieving target serum urate levels (≤ 6.0 mg/dL) at week 24 in patients with gout, with both the drugs showing comparable safety profiles.”

26 June – The Promise of Dotinurad for Hyperuricemia in CKD

The highlights of this report are promising to say the least. So interesting that I will return to them for a broader and deeper approach in my future intended analysis of Urica/Crystalys - Dotinurad. Until then, I can recommend everyone to read this report at least once.

26 June - Study Sheds Light on Role of URAT1, Offering Insights for Improved Gout Therapies

“… , Dotinurad provides more selective inhibition of urate reabsorption with fewer off-target effects.”

“This comprehensive structural study of URAT1 marks a significant advance in our understanding of urate transport and its inhibition. By providing a detailed structural framework for the function and inhibition of URAT1, our work paves the way for the rational design of next-generation therapeutics for hyperuricemia and gout. The insights gained from this study could have the potential to guide the development of more effective and selective URAT1 inhibitors, ultimately leading to improved treatment options for millions of patients worldwide affected by gout and related conditions.”

During the time span of news for this substack, there is one more important piece of news that concerns Dotinurad. However, I have chosen to postpone this to the intended separate post about Urica/Crystalys Dotinurad.

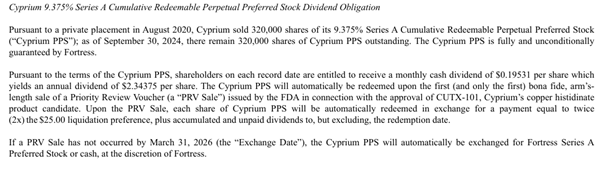

6. Cyprium Therapeutics (Deal)

12 May - Abeona Therapeutics Enters into Agreement to Sell Priority Review Voucher for $155 Million

“Abeona Therapeutics Inc. (Nasdaq: ABEO) today announced it has entered into a definitive asset purchase agreement to sell its Rare Pediatric Disease Priority Review Voucher (PRV) for gross proceeds of $155 million upon the closing of the transaction. Abeona was awarded the PRV following the U.S. Food and Drug Administration (FDA) approval of ZEVASKYN (prademagene zamikeracel) on April 28, 2025.”

It was recently confirmed that Regeneron Pharmaceuticals was the buyer.

4 June – FDA’s Prasad Vows To Make Rare Disease Drugs Available at ‘First Sign of Promise’

“The FDA plans to ‘rapidly make available’ rare disease drugs and make use of surrogate endpoints to get promising medicines to patients before they clear the traditional efficacy bar for authorization, Prasad said Tuesday.”

And:

“Prasad made the comments, which were first reported by Endpoints News, during his keynote speech at an event organized by the National Organization for Rare Disorders. Biotech investors had reacted negatively to Prasad’s appointment as head of CBER, hitting rare disease stocks particularly hard, potentially because of the physician’s earlier criticisms of the bar for drug approvals at the FDA.

The new CBER chief struck a different tone in the keynote speech on Tuesday. Under the new leadership, the FDA will ‘rapidly make available’ rare disease drugs, Prasad said, and make use of surrogate endpoints to get new medicines to patients before they clear the traditional efficacy bar for authorization.

‘We will take action at the first sign of promise for rare diseases. We’re not going to wait,’ Prasad said.”

“he acknowledged not every drug is going to be transformational, &that FDA is interested in bringing forward (and approving) drugs that have even incremental advancements for rare diseases.also described that it is important to rapidly make these products available”

5 June - Mum left 'helpless' after baby son diagnosed with rare life-limiting disease

Too heartbreaking to write "highlights" from this publication. Read the full story. Patients and their families need access to CUTX-101 now.

18 June - Bavarian Nordic Announces Sale of Priority Review Voucher for USD 160 Million

“Bavarian Nordic A/S (OMX: BAVA) announced today that it has entered into an agreement to sell its Priority Review Voucher (PRV) for a total cash consideration of USD 160 million.”

7. Caelum Biosciences (Sold)

9 May – New comprehensive review of CAEL-101

CAEL-101 purpose/need

“The heart and kidneys are the most commonly affected organs in AL amyloidosis. Advanced symptomatic heart failure secondary to infiltration of cardiac tissues with amyloid deposits is associated with worse outcomes and is usually the primary cause of mortality related to the disease. Therefore, early diagnosis and treatment are crucial in suppressing the formation and deposition of amyloidogenic proteins, eventually preventing end-organ damage.”

“The prognosis in AL amyloidosis depends on both hematologic parameters and the extent of organ dysfunction. Hematologic biomarkers include quantifying serum FLC and clonal bone marrow plasma cells (BMPC) and their cytogenetic evaluation. Serum FLC levels reflect an amyloidogenic light chain burden that correlates with organ dysfunction. Increased difference between involved and uninvolved free light chains (dFLC) is associated with an unfavorable prognosis independent of other risk factors.”

Treatment of AL amyloidosis

“In patients with newly diagnosed AL amyloidosis, the current standard of care treatment is combination therapy with cyclophosphamide, bortezomib, and dexamethasone (CyBorD), along with an anti-CD38 monoclonal antibody, daratumumab (Dara). This approach is based on the favorable results observed in the phase III ANDROMEDA trial comparing dara-CyBorD with CyBorD. The addition of daratumumab to CyBorD led to increased deep hematologic response (HR: 92 % vs. 77 %), complete remission (CR: 53 % vs. 18 %), and progression-free survival rates from significant organ deterioration. Besides improved outcomes, dara-CyBorD was well tolerated with minimal cardiotoxicity. However, one of the limitations of the ANDROMEDA trial was the exclusion of patients with severe heart failure, New York Heart Association (NYHA) classes 3B and 4. Limited retrospective data with positive outcomes support the use of this regimen even in stage IIIB patients. Given favorable results, this regimen is also used in transplant-eligible cases as an induction therapy before autologous stem-cell trans plantation (ASCT). Additionally, patients who are previously deemed ineligible for ASCT can be re-evaluated for transplant eligibility after two to four cycles of induction therapy with dara-CyBorD. Notably, the role of ASCT in amyloidosis is being questioned in the era of dara-CyBorD due to higher treatment-related complications. The advantages of stem cell transplantation are an increased complete response rate and progression-free survival compared to other treatment modalities. However, only 20% of the patients qualify to receive ASCT at diagnosis due to strict eligibility criteria, including age, functional status, type, and degree of organ involvement, specifically the extent of heart failure. In addition, potential toxicities of ASCT, such as infections, cardiac tachyarrhythmias, progression of heart failure, and acute renal failure requiring dialysis, increase the risk of short-term morbidity and mortality. Despite significant advancements in the therapeutic realm of AL amyloidosis, mortality remains high, especially in patients with advanced cardiac and renal involvement. The median survival of patients with Mayo 2004 with European modification stage IIIa AL amyloidosis is 24 months, and with IIIb is 4 months. Currently available anti-plasma cell dyscrasia (anti-PCD) therapies for AL amyloidosis target clonal plasma cells in the bone marrow, suppressing the production and further deposition of misfolded light chain proteins. This strategy has led to improved hematologic response, but it has no significant impact on the pre-existing amyloid deposits that can cause progressive organ dysfunction, resulting in early mortality. Therefore, it is crucial to develop therapies that target and enhance the body’s ability to remove amyloid fibrils from the affected organs, thus restoring their function and improving quality of life. There has been a shift in the research focus towards developing drugs that deplete organs of the amyloid fibrils.”

Birtamimab

“One such example is Birtamimab (NEOD001), a humanized mono clonal antibody. It neutralizes both deposited and circulating light chain fibrils, eradicating amyloid aggregates from organs via macrophage- induced phagocytosis. NEOD001 showed favorable cardiac (57 %) and renal (60 %) responses in phase I/II studies. However, the phase IIb PRONTO trial failed to meet its primary outcome, improvement in cardiac response (39.4 % in the NEOD001 group versus 47.6 % in the placebo group). In addition, the phase III VITAL trial was terminated prematurely after a futility analysis was conducted on the interim data. Interestingly, post-hoc analysis of the VITAL study showed improved survival in AL amyloidosis patients with Mayo stage IV disease, receiving NEOD001 plus standard of care (SOC) compared to the placebo plus SOC group. Based on these findings, a phase III randomized trial (AFFIRM-AL) is currently enrolling patients with newly diagnosed Mayo stage IV AL amyloidosis. The goal is to investigate the survival benefit observed in the VITAL trial. Another fibril-directed therapy, CAEL-101, a novel monoclonal antibody (mAb) has persistently shown improved outcomes in phase I and II studies and is currently being investigated in two randomized phase III trials.”

Mechanism of action of CAEL-101

“CAEL-101 is an IgG1k monoclonal antibody (mAb), a chimeric form of a murine antibody, 11-1F4, that is designed to target light chain amyloid fibrils. It binds to a conformational epitope at the N-terminal on misfolded light chains, consisting of the non-native cross- β-structure, irrespective of the kappa or lambda subtype, triggering the activation of macrophages. However, it does not bind to the native soluble kappa or lambda light chains in circulation. Rapid clearance of amyloid deposits by murine 11-1F4 was initially observed in mice models containing human AL amyloidomas. The process begins with the binding or opsonization of the amyloid fibrils by the antibody, leading to Fc receptor-mediated neutrophil activation. This phenome non initiates the enzymatic degradation of amyloid deposits by endo peptidases and free radicals derived from the neutrophils, ultimately removing AL amyloid deposits from the organs.”

I have covered and written about the CAEL-101 study results to date in other formats as well as in my initial review and case for FBIOP in my first post here on Substack. However, I will highlight certain small passages as new highlights or for the purpose of making it easier to follow along with my own thoughts (12. Discussion – Updated own reflections) below (for a deeper picture of yourself, if one is missing, I of course recommend diving into pages 6-8 of the review). I will also include some continued parts of the review that touch on Birtamimab in relation to CAEL-101 for the same purposes.

“In summary, the phase II trial also confirmed that CAEL-101 was safe and well tolerated up to the doses of 1000 mg/m 2 even in combination therapy with CyBorD +/ daratumumab. Most of the treatment-related adverse events were mild to moderate. Moreover, improved cardiac and renal responses were again noted at 12-month follow-up.”

CAEL-101 - Phase 3a-b

“Two international, multicenter, randomized phase III studies (CARES) involving CAEL-101 are currently in progress. The goal is to evaluate the efficacy and safety of CAEL-101 in combination with standard-of-care therapy (SoC), CyBorD versus placebo combined with CyBorD in newly diagnosed AL amyloidosis patients with Mayo stages IIb (Study 1: NCT04504825) and IIIa (Study 2: NCT04512235). The primary endpoint is the overall survival. The secondary outcomes include reduction in cardiac-related hospitalizations and improvement in cardiomyopathy, the 6-min walk test, and functional status. These trials have completed the enrolment phases. Notably, Study I was the first trial that included AL amyloidosis patients with severe cardiac involvement. Favorable results from these studies can transform the therapeutic approach of AL amyloidosis and improve patients’ survival and quality of life. In contrast to NEOD001, CAEL-101 has persistently shown improved organ responses in the phase I and II trials and is expected to have promising results in the phase III studies.”

Conclusion

“AL amyloidosis remains a therapeutically challenging disease. Improved hematologic responses with currently available anti-PCD therapies for AL amyloidosis do not translate well into organ responses. Therefore, organ dysfunction persists, conferring poor out comes, especially in patients with advanced cardiac involvement. This highlights an immense need for fibril-directed agents that reverse amyloid infiltration in the vital organs. The novel fibril-directed mono clonal antibody CAEL-101 appears to fulfill this need. The results from phase Ia/b and II studies demonstrated that CAEL-101 can potentially decrease amyloid burden, thus restoring organ function while maintaining a low toxicity profile. In phase Ia/Ib, 63 % of the patients with relapsed or refractory AL amyloidosis showed improved and sustained organ responses irrespective of the subtype of free light chain. More importantly, 67 % of the cardiac evaluable patients had a favorable response, as demonstrated by statistically significant improvement in GLS and NT-proBNP. Additionally, the median time to treatment response was 3 weeks after initiating therapy with CAEL-101, which is unprecedented compared to currently available anti-PCD agents, inducing responses at 10 months. As cardiac involvement is the main determinant of morbidity and mortality in AL amyloidosis, improved cardiac function will have a positive impact on the survival and quality of life of patients.”

“In summary, the simultaneous prevention of further amyloid formation and deposition using anti-PCD agents (suppression) and the eradication of abnormal light chain deposits from the organs by amyloid fibril-directed therapy (removal), such as CAEL-101, is a novel approach to treat AL amyloidosis. Besides improving hematological responses, this strategy will reverse organ impairment and allow full recovery in patients’ symptoms and functional status, which usually lag behind due to delayed organ function improvement. Based on the results of the phase I and II studies, CAEL-101 seems to be clinically efficacious. Additionally, faster response time to treatment and a low toxicity profile make it an effective agent to be used in frail patients with severe organ impairment who are in immediate need of treatment. Encouraging outcomes from phase III trials involving CAEL-101 and Dara-CyBorD have the potential to revolutionize the management of AL amyloidosis, offering new hope for this invariably fatal disease.”

“In addition, it is intriguing to postulate that CAEL-101 might be able to convert ASCT-ineligible patients to transplant eligibility if their initial preclusion stemmed from disease-related organ dysfunction.”

15 May - “Our new paper out now in Blood Reviews, on a potentially groundbreaking therapy for AL Amyloidosis, CAEL-101”

And just a few days later…

23 May – Prothena Announces Phase 3 AFFIRM-AL Clinical Trial for Birtamimab in Patients with AL Amyloidosis Did Not Meet Primary Endpoint

“Birtamimab did not meet the primary endpoint of time to all-cause mortality or the secondary endpoints”

“Birtamimab development will be discontinued, including stopping the open label extension of the AFFIRM-AL clinical trial”

24 May – “Everyone now looking forwards to the CAEL 101 results”

“We know antibody mediated amyloid removal works. See the images below in ATTR. Just need the correct antibody in AL - everyone now looking forwards to the CAEL 101 results AlexionPharmaUS”

3 June - Immix Biopharma confirms during KOL Event that NXC-201 will only target relapsed/refractory AL Amyloidosis

“Immix Biopharma Announces Primary Endpoint Met in positive NXC-201 Interim Results Presented at ASCO, Enabling Path to Best-in-Class Therapy for relapsed/refractory AL Amyloidosis”

In other contexts, than on Substack, I have discussed Immix and their CAR-T drug NXC-201, which was initially targeted as a second-line treatment for Relapsed/Refractory AL Amyloidosis. This is partly because there is no FDA approved drug for R/R AL Amyloidosis and that the current SoC for first-line treatment for AL Amyloidosis (dara-CyBorD) has only managed to achieve between 0–10% complete response in R/R.

During a Key Opinion Leader (KOL) event 3 June with lead investigator Heather Landau (Memorial Sloan Kettering Cancer Center), Shahzad Raza (Cleveland Clinic) and Jeffrey Zonder (Karmanos Cancer Center), they recommended that NXC-201 should only be used as a second-line treatment for R/R AL Amyloidosis, if FDA approval is possible in the future, and rather focus on other diseases in the future (Multiple Myeloma was mentioned if I remember correctly). This reasoning was supported by the representative from Immix, which should confirm that NXC-201 will not be a direct competitor for CAEL-101, which targets first-in-line treatment in combination with SoC (dara-CyBorD).

8. Helocyte

I have previously reported and written extensively about Helocytes Triplex, which presented 4 clinical studies and 8 have ongoing clinical studies in humans. As I mentioned earlier, the plan is to write a longer and more in-depth analysis here on substack in the future. However, I want to reveal now that Helocytes will continue to expand with two new studies and indications:

1) Triplex – Combo with Allogeneic CMV-Specific CD19-CAR T Cells After Matched Related Donor Hematopoietic Cell Transplant for the Treatment of Patients With High-Risk Acute Lymphoblastic Leukemia (ALL)

Early Phase 1

Estimated Study Start: 2025-08-23

NCT06735690

2) Triplex - Haploidentical Hematopoietic Stem Cell Transplant

Phase 1b

Estimated Study Start: 2026-05-08

NCT07020533

12 May – Ajit Limaye (you who know, you know…) seems to continue (you who know, you know…) informing about (you who know, you know…):

“Amazing summary of CMV vaccines in HSCT and SOT AT fredhutch Symposium on Infections in ICH by Ajit Limaye”

25 June – The Fourth International Consensus Guidelines on the Management of Cytomegalovirus in Solid Organ Transplantation

The highlights of this guidelines is detailed, comprehensive and very interesting from the perspective of Triplex's possible future. That Interesting that I will be returning to it for a broader and deeper approach in my future intended analysis of Helocyte - Triplex. Until then, I can recommend everyone to read this report at least once.

Despite my explanatory texts above that I will try to return to Helocytes Triplex in separate posts, I cannot resist sharing a new video from that is related to the post above (same professionals and guidelines).

Even though I will try to transcribe the text for the minute or so to the best of my ability, you almost have to listen to the tone, see their gaze and body language to get the full picture and meaning.

Listen specifically between 1:10:00-1:11:05:

CMV Management in Solid Organ Transplantation

Insights and Challenges from the New 4th Consensus Guidelines

- Watch CMV Stream 2025 for an in-depth discussion on challenging issues and open questions from the recently published 4th International Consensus Guidelines on the management of CMV in SOT

https://cmvstream.com/

Transcript:

-What would life be like if we had an effective CMV vaccine? Like a pre-transplant robust immunity, get through transplant with protections, would seem like a huge gamechanger, right?

-Transformative!

-Transformative!

-Yeah…

-Yeah…

-There have been so many attempts, more than 60 years of trying to develop a good CMV vaccine and we are still not there yet. There are a couple of trials underway, so we’re hoping that that night be helpful, but that would really be wonderful.

-Even if you got just even just a little bit more immunity.

-Some immunity, a little more help, and especially during those critical periods.

-Right…

-Yeah…

-Yeah...

-Even just pre transplant and then you know, can boost it later when you’re doing things that are a challenge.

-Creating active immunity rather than these passive immunity that we’re talking about.

-Correct.

-Yeah…

-Yeah…

-Right. Right.

9. Mustang Bio

14 May - Q1 Report

CAR T Therapies

“Our pipeline of CAR T therapies is being developed under exclusive licenses from several world class research institutions. Our strategy is to license these technologies, support preclinical and clinical research activities by our partners and transfer the underlying technology to our or our contract manufacturer’s cell processing facility in order to conduct our own clinical trials.

We are developing CAR T therapy for solid tumors in partnership with COH targeting IL13Rα2 (MB-101). In addition, we have partnered with Nationwide on the development of a herpes simplex virus type 1 (“HSV-1”) oncolytic virus (MB-108) in order to enhance the activity of MB-101 for the treatment of patients with high-grade malignant brain tumors. A Phase 1 clinical trial sponsored by COH for MB-101 (ClinicalTrials.gov Identifier: NCT02208362) has completed the treatment phase and patients continue to be assessed for long-term safety. A Phase 1 clinical trial sponsored by the University of Alabama at Birmingham (“UAB”) for MB-108 (ClinicalTrials.gov Identifier: NCT03657576) has also completed the treatment phase and patients continue to be assessed for long-term safety. In October 2023, we announced that the FDA accepted our IND application for the combination of MB-101 and MB-108 which is referred to as MB-109 – for the treatment of patients with IL13Rα2+ relapsed or refractory glioblastoma (“GBM”) and high-grade astrocytoma. Pursuant to termination of the lease for our cell processing center in Worcester, MA, we are exploring with COH and Nationwide the possibility of initiating this clinical trial as an investigator-sponsored single-institution study at COH in the first quarter of 2026. We are also developing a CAR T therapy for hematologic malignancies and autoimmune diseases in partnership with Fred Hutch targeting CD20 (MB 106). In May 2021, we announced that the U.S. Food and Drug Administration (“FDA”) accepted our IND Application for MB-106. As of March 1, 2025, 53 patients have been treated in an ongoing Phase 1 clinical trial sponsored by Fred Hutch (ClinicalTrials.gov Identifier: NCT03277729) and 20 patients have been treated in the Phase 1 clinical trial sponsored by us (ClinicalTrials.gov Identifier: NCT05360238). Each clinical trial has completed its respective treatment phase, and patients continue to be assessed for long-term safety. Pursuant to termination of the lease for our cell processing center in Worcester, MA, we are exploring with Fred Hutch the possibility of initiating a Phase 1 trial in autoimmune diseases as an investigator-sponsored single-institution study at Fred Hutch in the first quarter of 2026.

MB-109 (Combination of MB-101 CAR T Therapy with MB-108 Oncolytic Virus Therapy for Malignant Brain Tumors)

On November 7, 2024, we announced that the FDA granted Orphan Drug Designation to Mustang for MB-108, a herpes simplex virus type 1 (“HSV-1”) oncolytic virus, for the treatment of malignant glioma. The Orphan Drug Designation provides certain incentives, such as tax credits toward the cost of clinical trials upon approval and prescription drug user fee waivers. If a product receives Orphan Drug Status from the FDA, that product is entitled to seven years of market exclusivity for the disease in which it has Orphan Drug designation, which is independent from intellectual property protection. We are currently exploring with COH and Nationwide the possibility of conducting an investigator-sponsored single-institution trial under the COH IND to treat patients with IL13Rα2+ recurrent GBM and high-grade astrocytoma with MB-109 that could potentially be initiated in the first quarter of 2026. Because cell processing for MB-101 will revert back to COH – where the product continues to be manufactured today for other investigator-sponsored clinical trials being conducted by COH in malignant brain tumors (ClinicalTrials.gov Identifiers: NCT04003649, NCT04661384, NCT04510051), we believe that it is reasonable to assume that the FDA will not require a lead-in cohort, wherein patients would have to be treated with MB-101 alone prior to dual MB-108 administration. Should this, indeed, be the case, the first patient enrolled will receive the combination of MB-101 and MB-108, which will represent a considerable savings of time and money – as well as afford the potential benefit of both therapies to every patient treated on study.

MB-106 (CD20-targeted CAR T cell therapy for Autoimmune Diseases)

Currently, we are focused on the development of MB-106, in collaboration with Fred Hutch, for autoimmune diseases. We are in planning stages for a proof-of-concept investigator-sponsored clinical trial and actively evaluating potential indications in which MB-106 may be most effective and serve a patient population with high unmet need with a potential trial initiation in the first quarter of 2026. We have also previously been granted Regenerative Medicine Advanced Therapy (“RMAT”) designation by the FDA for the treatment of relapsed or refractory CD20-positive Waldenstrom macroglobulinemia and follicular lymphoma based on clinical data in both indications disclosed previously.”

(Mustang Annual Report 2024, P. 17-18)

1 July – Received FDA Orphan Drug Designation for MB-101

10. Avenue Therapeutics (New Deal)

15 May - Q1 Report

11. Cellvation, Oncogenuity, AEVITAS (Sold)

May – New Investor presentation (Cellvation)

Several new images, graphs and figures.

8 May - 4D Molecular Therapeutic Q1 update on 4D-175 (AEVITAS)

From 4D Molecular Therapeutic Q1

“$458 million in cash, cash equivalents, and marketable securities as of March 31, 2025, expected to fund planned operations into 2028”

But as described earlier, all focus now seems to be on 4D-150 for wet AMD and DME and 4D-710 for cystic fibrosis (CF) lung disease. But happily, 4DMT opened in Q1 so that doesn't necessarily mean that 4D-175 will be put on hold until 4D-150 or 4D-710, if possible, reaches the market:

”Paused significant additional capital allocation and investment, pending additional financing or partnerships, for 4D-175 for geographic atrophy, 4D-725 for alpha-1 antitrypsin deficiency lung disease, and 4D-310 for Fabry disease cardiomyopathy”

12. Discussion – Updated Own Reflections

I've received several questions regarding the political changes in the US and at the FDA, and how they might potentially impact Fortress Biotech. I believe that the macro news in the sector, as I shared above, suggests that these changes, marginally and compared to other companies in the sector, could have a positive impact on Fortress's future. Time is money, and money is time in this sector, especially for a small company (in terms of market capitalization). Add to that the fact that Fortress, through its subsidiaries and partners/deals, has a very diversified pipeline for its size, which, of course, increases the potential significance of saving both time and money. To mention a third point and complete the hat-trick, Fortress's history and business idea largely revolve around acquiring clinical assets that have already shown promise in humans. Take Dotinurad, for example, even though it doesn't directly relate to Rare Diseases, it's already BiC/SoC in large parts of Asia with overwhelmingly positive study results across the board. How will Urica/Crystalys's meetings with the "new" FDA differ from those we know they had with the "old" FDA before the two (different indications) planned pivotal Phase 3 studies?

Regarding the general "vaccine anxiety" that RFK Jr. has brought right inside the FDA's door like a wet dog, and concerning Helocyte and Triplex, I don't have the slightest bit of concern. I will also try to demonstrate this to you here on substack in the future. I'm halfway through my review, and during my work, I've continuously found that Helocyte and Triplex's prospects are far better than I could have anticipated. Transformational is the word.

Finally, regarding the "macro" environment, you might have been surprised that I didn't mention Trump and a campaigning or new (or re-elected) President's usual harsh words against the sector. I didn't bring it up as news partly because it's not new news, but also because it was so widely reported that I believe it would have been impossible to miss for those of you who have made it this far in my two posts (as proof of at least some interest in the sector). Words don't trump authorities and regulations (XBI closed up on the "news" of the day), and regardless, we're talking years to implement significant changes, if even possible.

I also didn't bring up the "PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION, DATED APRIL 14, 2025" from Checkpoint Therapeutics, where the twists and turns of the Sun acquisition process are transcribed, as it occurred before the timeframe for this update. Nevertheless, it's always interesting and educational to see how long these processes are, even when you've had a semi-established contact and done business with many of the same people involved (Rosenwald, Weiss), +1 in the CEO (now Checkpoint, formerly Journey). For those who doubted that Weiss is solely focused on TG Therapeutics (which would have been understandable), the document likely provided a wake-up call. I also hope that, with this document as proof, I won't have to engage in arguments with anyone who doubts that Fortress is not the one making decisions for its subsidiaries, even if they don't own 100% or, in some rare cases, lack people in operational management.

Now the Checkpoint and Sun deal is closed, which should have generated at least $28M initially for Fortress and significant long-term savings on Fortress's balance sheet. Despite the $28M, Q2 might be a bit "messy" to sort out in the report, as Checkpoint had some cash on hand plus warrants at the end. However, the savings will be crystal clear from Q3 onwards. From the news above, it was clear that Sun will initially invest $100M (in 1 of 2 new drugs) in the commercialization of UNLOXCYT to ensure its widespread success with their enormous global reach.

Journey Medical started selling EMROSI on Monday, March 24th, with 6 business days left in Q1. Sales? $2.07M. Although Journey explained during the conference call that the number itself was "boosted" (my words) due to front-loading (more like their words without remembering exactly what was said), they emphasized, both in figures and in writing and speech, the strong launch EMROSI has had, which is more significant since half of Q2 had already passed when Q1 was presented. Remember also the analysts' predictions of $0 in Q1 and $5M in Q2. A nice "head start" to have. However, I want to emphasize this again today: Journey themselves expect the real sales momentum to pick up somewhere around months 9-12 (November 2025 - February 2026). I also touched upon the uncertainty regarding increased competition for ACCUTANE and QBREXZA. Here I can confirm that so far, QBREXZA is holding up much better than I personally expected, while ACCUTANE is starting to perform somewhat worse.

The development with the longest-running direct (F-i-L) competitor Birtamimab and indirect (S-i-L) competitor NXC-201 is, of course, potentially very favorable if/when CAEL-101 receives its FDA approval. However, it should be said that the news of competitors was a base case where I agree with “anthonystaj” (49) early take and “BioRichesRags” (50) confirming post on X about Birtamimab.

We should be at most a couple of months away from the readout of the two P3 studies for CAEL-101. If the results are equally convincing in a larger patient group and with longer follow-up, it will be a matter of the heart (pun definitely intended…) to include CAEL-101 in the SoC today. It's important to re-emphasize and remember that CAEL-101 is not meant to replace but to complement by combining with today's SoC. This should mean a fast/efficient path to market with AstraZeneca/Alexion as owners.

That two new PRVs have been sold and the latest pushed to $160M, with a $154.6M average over the last five PRV sales, is also encouraging and significant ahead of CUTX-101's PDUFA in September. For relevance to my previous case review for FBIOP, I have only factored in a PRV sale of $129.8M, as I chose to be extra cautious with a 15% discount on the then-average of the last three PRV sales of $152.66M (the average of the last three PRV sales is now $156M).

The news that the "new" FDA will take action at the first sign of promise for Rare Diseases and plans to rapidly make available these promising rare disease drugs is, of course, also potentially fantastic news for CUTX-101. At the same time, it's important to remember that this year we've also seen some delays in PDUFA decisions.

I first "broke" the news about Novo Nordisk's investment and then Crystalys's background and management, which have not yet been confirmed. Therefore, I feel like I'm saving my boasting for the day it becomes official (or donning the dunce cap if I'm wrong). But if I'm right, it's an incredible sign of strength and strong backing that will now drive Dotinurad forward. However, I'll save the longer comments for my intended and entirely dedicated substack post on Dotinurad in the future, but, the continuous stream of new convincing study results from Asia strengthening the thesis in Gout and Hyperuricemia, and also indicating new indications in Hyperuricemia (CKD, CVD), is nothing short of fantastic.

Helocyte continues to expand Triplex's study scope to such an extent that it's difficult to keep track. It's fascinating how the market doesn't seem to grasp the value in this potential "gold mine", which is constantly searching for new discoveries. I both hope and believe that my future dedicated substack post about Helocyte will be an eye-opener for those who read it.

13. Summary & Position

I now want to pick up on the core point of my previous Substack post: the potential reintroduction of the preferred stock's accumulated dividend (which has now ticked up to 12 months and $2.3436 dividend per share, 31.04% yield per share today, but who's counting...).

If you add that news to the clear overall savings in the Q1 reports (I expected this to show up first in Q2), and you followed and bought into my reasoning from the previous post, you're probably also surprised/disappointed that the stock is trading at $7.55 at the time of writing (even though it's up 14.22% since the previous publication on May 5th, when the stock was at $6.61). This is despite the asymmetrical "on or off" aspect of an accumulated dividend that is still "off."

I recently addressed Fortress's own qoute from their latest Annual Report:

"...ability to pay cash dividends on our Series A Preferred Stock in the future requires us to have either net profits or positive net assets (total assets less total liabilities) over our capital, and that we have sufficient working capital in order to be able to pay our debts as they become due in the usual course of business."

On that point, with the sale of Checkpoint, we're at home plate. So why hasn't Fortress reinstated the dividend yet?

First, I want to point out that my review for the dividend in the previous post extends to the end of 2026, meaning we are 2 months in with 18 months remaining. For Fortress to feel confident in reinstating a sustainable dividend before then and over time, I believe 1 of the following 3 things needs to happen:

1. EMROSI sales are close to Fortress/Journey's expectations during Q2-Q4

2. CUTX-101 receives FDA approval with an accompanying PRV award

3. CAEL-101 P3 readout results are convincing

As I've pointed out before, I believe the chances of all three of these points coming to fruition are very high, and that at least one will is very, very likely. Should both points 2-3 in CUTX-101 and CAEL-101 fail, I believe point 1 will lead Fortress/Journey to seek a strategic partner (presumably a deal for EU commercialization) who will buy parts of Fortress's stake in Journey, thereby securing/reinstating the dividend and giving Fortress margins with new incentives to focus the pipeline (primarily Dotinurad and Triplex) or broaden it with new assets for diversification. Also, keep in mind that I haven't included the options for UNLOXCYT royalties, CVR from Sun, or other sales/savings from Mustang Bio and others.

Let's say all points 1-3 completely fail, and my possible scenarios above about other opportunities/options also blow up. Yes, then, of course, the odds of a sustainable dividend being reinstated during 2025-2026 decrease. But, very contradictory given the development, but logical if you read my last substack post, it could actually increase the chance that the preferred stock dividend is reinstated sooner (though, of course, not as sustainable) at least for Fortress to gain access to ATM for its common shares, which, according to the agreement, they cannot do as long as the preferred stock dividend is paused.

Call them options, life rafts, or whatever you want, but long-term, they don't stop there for probabilities for a reinstated dividend. Note that I haven't even mentioned the clinical assets that Fortress themselves believe have the greatest potential in Dotinurad and Triplex yet. So, let me then paint a new 3-point scenario that extends from today (1) and after 2026 (2, 3) that could still ensure a long-term sustainable dividend:

1. Helocyte enters into a partnership with an upfront payment or partial ownership for further development of Triplex in one or more indications

2. Helocyte's Triplex receives FDA approval for 1 (!) indication (8 ongoing indications now, 2 more planned)

3. Dotinurad receives FDA approval

Again, I hope I don't sound like a repeating talking parrot here, but, I currently assess that there are very good indications that all points 1-3 can occur (the need for point 1 is, of course, lower if any of the outcomes for the EMROSI, CUTX-101, CAEL-101 list succeed). In relation to point 3 and the history and present of the Fortress and Crystalys people, I would also not rule out an IPO of Crystalys, which could then secure the dividend financially even before a potential FDA approval. Same with Helocyte, although I don't think it's a priority today, an IPO can't be ruled out here either.

In summary, and to once again draw a parallel from the world of football (still the real, European one) in this post:

With the Checkpoint ball already kicked into the goal for a 1-0 lead, EMROSI with an open goal, CUTX-101 completely free in the penalty area, and CAEL-101 breaking free in the offensive half, and that with playing with the team's two best players (Dotinurad, Triplex) still on the bench, ready like an Ole Gunnar Solskjær (I am, after all, still from Scandinavia) in the 1998/1999 Champions League Final, it will be difficult not to win the game/title.